Budgets are great for tracking money as it flows through a company. But when they are used for other purposes — long-range planning or gauging performance — they can distort reality and mislead managers. When budgets become an end in themselves, the company suffers, according to a recent article in Fortune magazine (“Why Budgets Are Bad For Business,” June 4, 1990). The result: managers end up managing the budget rather than managing the company.

Budget Loop

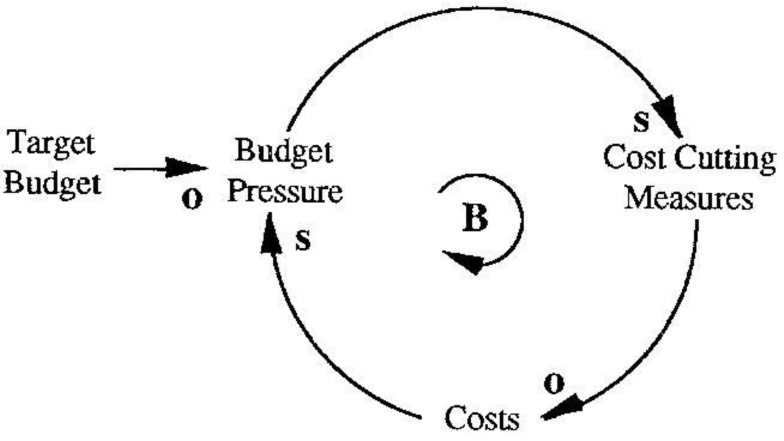

The Whole budgeting process is really a balancing loop that seeks to control costs at a desired or target level.

Budgets, the article contends, focus attention on short-term fluctuations in the bottom line, rather than on long-term planning and corporate development. They can only account for hard, quantitative data, not “soft” variables such as quality of service and customer satisfaction which can be crucial to the long-term health of a company.

In addition, what is good for the budget may be very bad for the company. Investing in R&D during a business downturn may seem suicidal from a budgetary standpoint, but it could be the key to the firm’s recovery once bad times pass.

Budgets often pit one part of the company against another. Each division tries to maximize its own bottom line, often to the detriment of the company as a whole. For example, a company may become overloaded with slow-moving inventory — often a sign that each department is pursuing its own agenda. At this point the finance department steps in, putting its priorities over everyone else’s by mandating across the board cuts in inventory. But, as the article explains, “[o]nly the hot items move out fast. The rest sits there.

When it’s all over, inventories are down 10%, the CFO declares victory — and the only items left are the ones nobody wants, so customer service goes to pot.”

The whole budgeting process is really a balancing loop that seeks to control costs at a desired or preset level. The key variables in this loop usually are the target budget (costs), the actual costs, and corrective actions taken to eliminate discrepancies (see “Budget Loop” diagram). As costs increase, budget pressure also increases, triggering cost-cutting measures and reducing costs in the hopes of meeting the target budget.

Discussion Questions

- Using the Budget Loop diagram, how would you include the various cost-cutting measures that were mentioned in the article or additional ones that have been taken in your own organization?

- The costs reductions that result from such actions are relatively easy to identify. What about some of the negative consequences mentioned in the article — how would you add them into the picture and tell a compelling story about the downside of focusing on costs to meet the budget?

- Where does Revenue come in, and how does it affect the picture?

- What are some high-leverage actions that can lessen the tendency to be ruled by budgets?

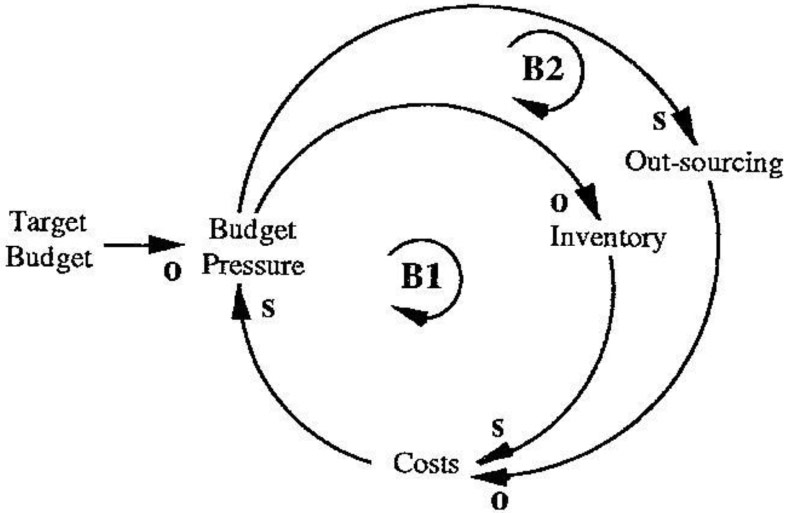

As managers we generally have no trouble coming up with cost-cutting alternatives — we live in the world of budget crunches and cost-cutting imperatives. The Cost-Cutting Measures diagram shows two typical measures that might be taken during a budget squeeze. Reducing inventories (loop B I) is one of the options discussed in the Fortune article. Out-sourcing more work and shutting down departments (loop B2) is another way to make a quick impact on the bottom line. Of course, many other measures could be taken — decreasing staff, cutting new programs, reducing R&D, slashing advertising and marketing, limiting training programs, etc. All of these measures have an immediate effect on costs.

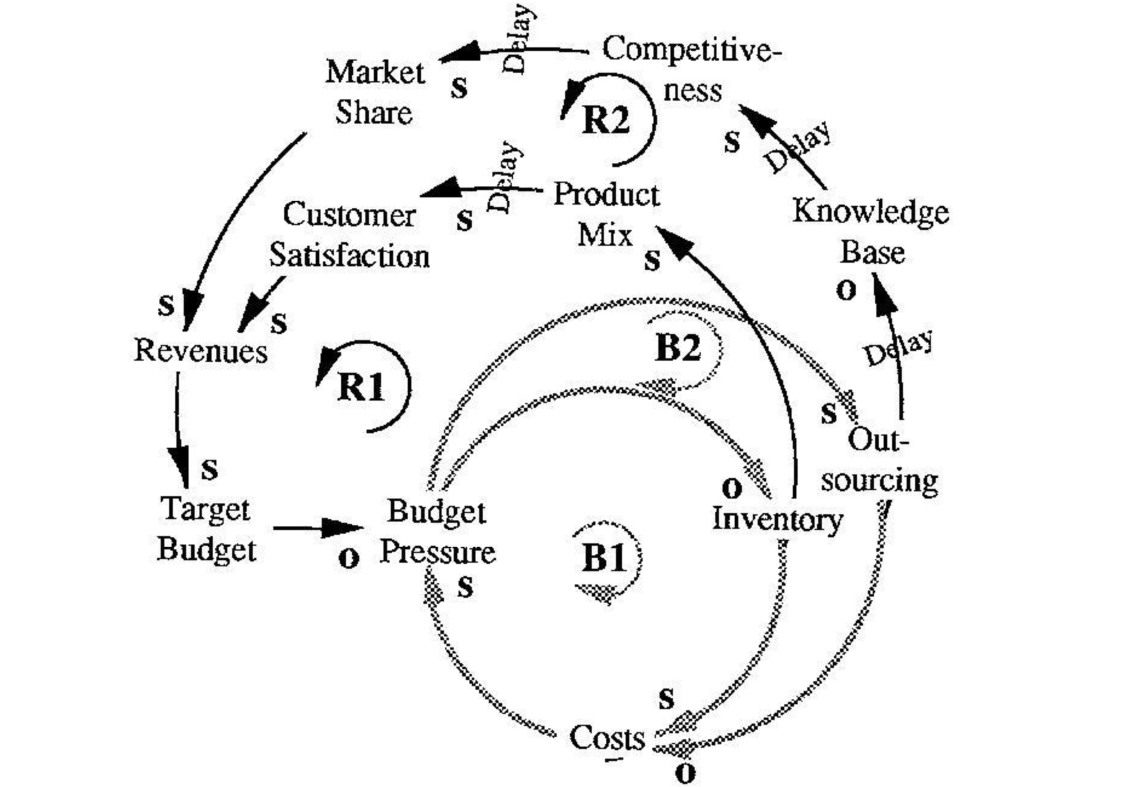

As the article suggests, cost-cutting also has negative consequences — especially when it is carried out with the single-minded purpose of meeting the budget The Cost-Cutting Side Effects diagram illustrates some of the harmful results of broad “slash and burn” programs. Reductions in inventory lead to poorer product mix, lower customer satisfaction, and lower revenues. Lower revenues in turn mean a lower target budget which increases the budget pressure to slash inventories even more (loop R1) since it worked so well the first time!

Cost-Cuffing Measures

Similarly, increased out-sourcing reduces the opportunity to accumulate knowledge about products and processes. This can erode competitiveness and market share, resulting in lower revenues. Again, this leads to a lower target budget and increases budget pressure — seducing us into more outsourcing because we’ve “discovered” how cost-effective it is to move work outside of the company (loop R2).

Cost-Cutting Side-Effects

Both of the above loops (RI and R2) are reinforcing loops — they aggravate the budget pressures that initiated their implementation in the first place. But the negative effects of these loops appear only gradually due to the significant delays in the system. For example, the erosion of knowledge about products and processes happens over a period of years (after many “successful” cycles of meeting the budget). The same holds true for deteriorating service quality that results from years of sparse training and development. Focusing only on the cost side of the business can lock a company into a “death spiral” as management relies more and more on the very “solutions” that are creating the reinforcing behavior.

There is a positive side to this story as well. These same reinforcing loops (RI and R2) can also produce a virtuous cycle of continued revenue growth (i.e., less out-sourcing can lead to greater product knowledge and increased competitiveness which will lead to higher revenues). But the payoff usually comes in the long term and often requires either holding the line or increasing investments in the short term — a hard sell in a time of budgetary crisis.

The article offers some suggestions for how to get out of the budget trap by basing corporate performance measures on standards other than budget targets. “The great budget game is the result of trying to control negative behavior, like spending too much, while largely ignoring positive behavior, like building the business,” says the author. Changing the game means shifting the emphasis from cutting costs to boosting profits—focusing on the reinforcing loops that will generate more revenues rather than seeking to control the short-term oriented budget loop. Asking the question “what investments must we make?” then becomes a more important question than “what can we afford to do?”

Cost reductions are often better handled as part of a long-term plan, rather than as part of yearly budgets. This tends to cut down on quick fixes that defer costs rather than eliminate them. Designing the corporate structure to prevent or minimize “turf wars” will also help ease some of the ill effects of budget plans. When divisions rely heavily on each other, they are less likely to foist work and costs onto other parts of the organization in order to improve their own bottom line.

Further Reading: Bruce G. Posner, “Squeeze Play: How the simplest cost-cutting programs can lead in the most unexpected directions,” Inc., July 1990.