Last month, the National Bureau of Economic Research confirmed what most businesses have known for some time—the United States economy is in a recession. But debate continues over how severe the downturn will be, how long it will last, and what companies can do to survive in the tough economic climate. Some have argued that this recession, like most since World War II, will be short and mild, and the economy will bounce back quickly. Others have warned of impending doom that would rival, if not surpass, the Great Depression of the 1930s.

Which view should we follow as we head into the uncertainties of the 1990s? Can companies learn from the lessons of past recessions and position themselves to make the most of the current downturn? Or have we entered new, uncharted territory where well beaten paths lead to financial ruin? To answer these questions we need to look beyond current headlines about hank failures and volatile oil prices to the underlying forces that are shaping this recession — and the economic recovery that will follow.

Recessions and the Long Wave

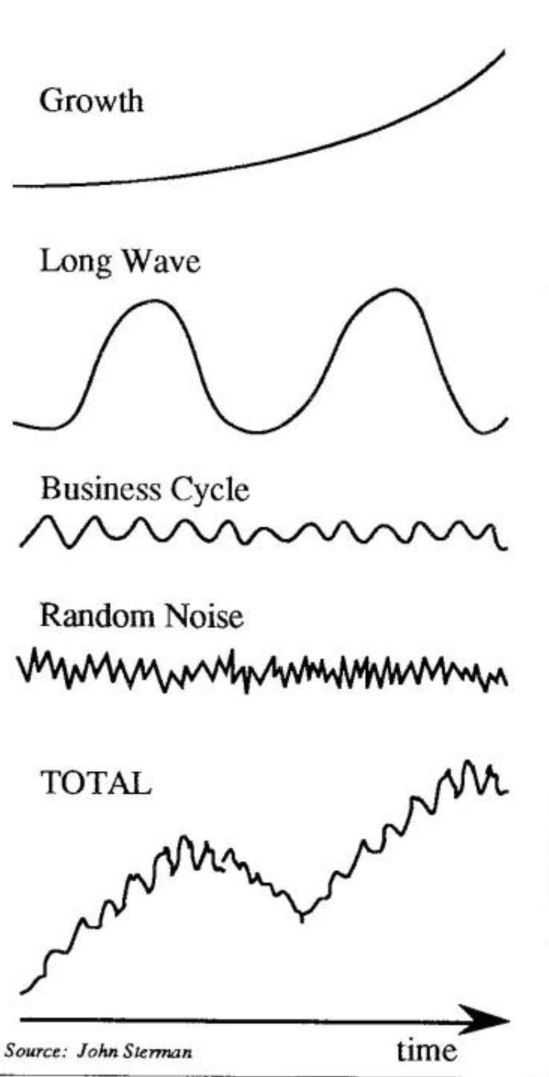

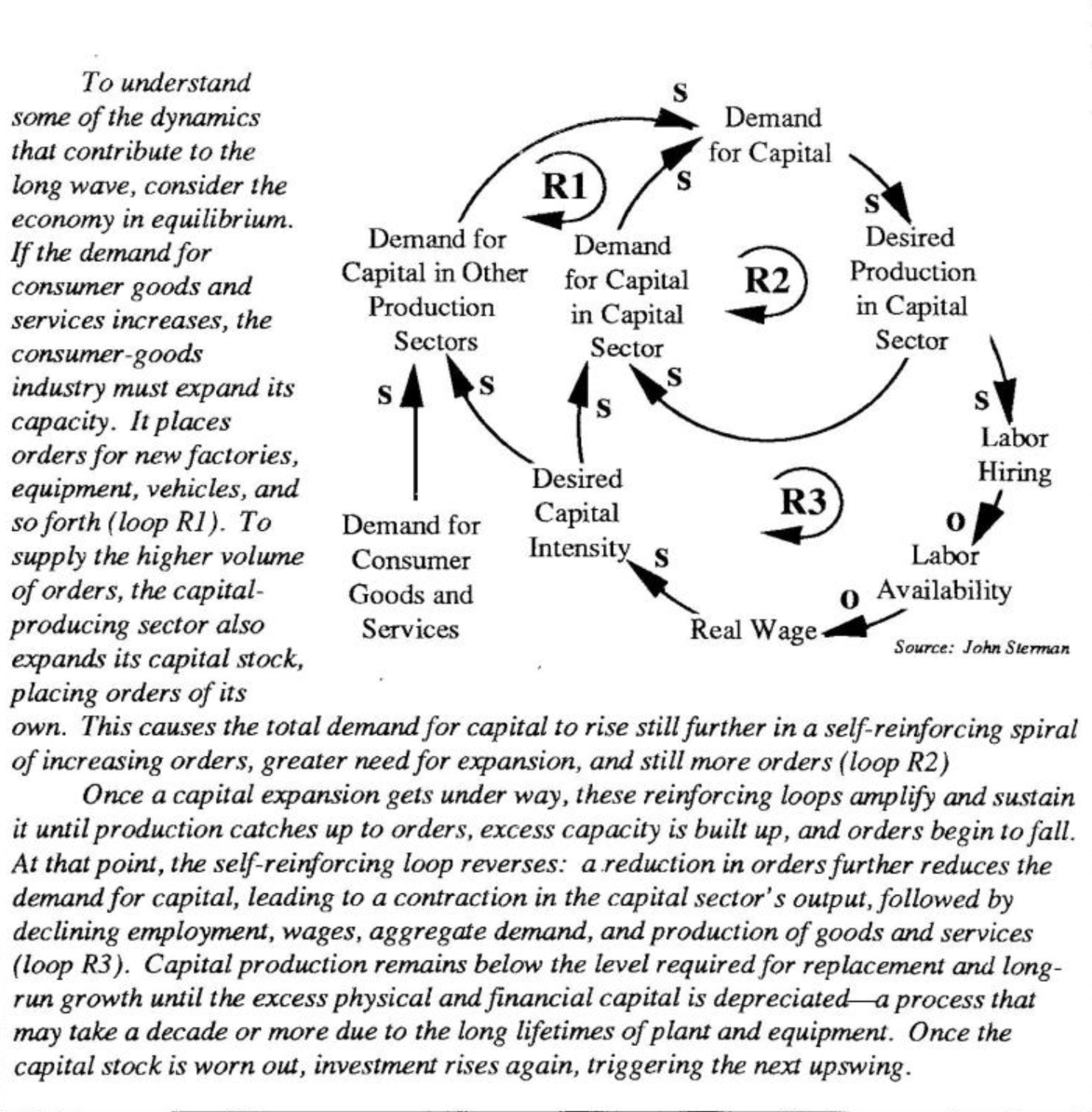

Recessions are part of the business cycle, and the business cycle, according to Professor John Sterman of the MIT Sloan School of Management, is one of several behavior patterns which produce the economy’s overall behavior (see “Economic Patterns” graph). Although the business cycle receives the most attention, it is in many ways the least important mode of behavior. It has a fairly small amplitude and averages four years in the United States, so its effects arc reversed quickly. The long wave, in contrast, has a much greater amplitude and a longer time-frame, making its effects more significant but less obvious. Both the business cycle and the long wave occur in the context of an even longer process, the life cycle of economic development — a high rate of average economic growth which began with the industrial revolution and has continued through the last 200 years.

The interaction of these forces produces the varied behavior of the economy: During an upswing of the long wave, a recession or downturn of the business cycle is generally short and mild, expansions are longer and more robust., and the rate of economic growth is well above average. During a peak or downturn of the long wave, recessions are more severe and the average rate of economic growth is greatly reduced.

Economic-Patterns

How the Long Wave Works

The long wave was first proposed in the early 1900s by a Russian economist named Nikolai Kondratief (see Global Citizen for a more complete history and description of the long wave theory). Since the 1970s, researchers at MIT have been using system dynamics to understand the structural forces that give rise to the long wave. The resulting computer model of the U.S. economy has correctly anticipated nearly all of the significant economic “surprises” that have occurred in the past two decades: deeper and deeper recessions, speculative “bubbles” in assets, persistent unemployment, and growing political conservatism, among others.

The long wave expansion is powered by many reinforcing processes that lead to high capacity utilization, low unemployment, rising real wages, low real interest rates, rising debt, increased investment, and rising optimism. Due to this growth, the economy slowly becomes overbuilt and imbalances appear. Excess capacity develops. Speculation replaces investment. Unemployment rises and real wages stagnate. Margins fall and price wars develop as firms battle for share in shrinking markets. Real interest rates soar with the decline in prices and inflation, and so do defaults.

These imbalances must be corrected. During past long wave downturns, the correction process resulted in depression, financial panic, deflation and default. Excess capacity, untenable debt, and inflated asset values were eventually eliminated, setting the stage for the next upward cycle. Although the MIT research on the long wave has focused on the U.S. economy, Sterman notes that similar dynamics appear in most industrialized economies.

The Dynamic Engines Driving The Long Wave

Past long wave downturns in the U.S. occurred in the 1830s and 1840s, the 1870s through the late 1890s, and in the 1920s and 1930s. The current long wave peaked around 1979, and will probably bottom out at the low point of the current recession, Sterman believes.

No “Great Depression”

This doesn’t mean we are heading into another Great Depression. “Many people believe that if there is a long wave, that means we will have a repeat of the Great Depression of the 1930s,” notes Sterman, “That’s not true. Each long wave downturn has been different, and the Great Depression represents one extreme.”

However, Sterman warns that the current recession “is going to be deeper and longer-lasting than most people think.” In the past, recessions have resulted from the temporary overbuilding of inventories, which can be worked off quickly. This time, it is not product inventories which are excessive, but the supply of condos and retail space, physical capacity, financial services and the government sector, and commercial debt. “These imbalances aren’t going to go away quickly,” says Sterman. “It takes years, for example, to work off excess real estate.”

Sterman also points out that the long wave does not happen in isolation, outside of our control. “It results from the everyday decision making process and actions throughout business and government.” Although the time is past to prevent the long wave downturn, he believes we still have the ability to choose between an uncontrolled “implosion” of the economy versus a more contained, controlled decline. What’s needed, says Sterman, are lower interest rates, early debt writeoffs, and solid leadership to maintain consumer confidence.

The Economic Circus

So how long will the recession last? No one knows for sure. One of the reasons this downturn is particularly difficult to calculate is the sheer magnitude of the government’s role in regulating the economy. In all previous long wave downturns the government was a much smaller actor — “a mouse among the animals in the economic circus,” as Sterman describes it. In the 1920s, the U.S. government controlled only one-tenth of the gross national product. It had little influence in the events leading up to the Depression and grew significantly in response to the crisis.

Now, with the government controlling one-third of the economy, it has become the elephant in the center ring. Government actions designed to prolong the current expansion have worsened many of the imbalances built up during the upswing of the long wave. The pressures continue to accumulate, not dissipate. In addition, the government — bloated with debt and burdened with enormous deficits — is now less able to respond to any new crisis.

The war in the Persian Gulf is another unknown factor. Although Sterman says its tough to say how it will affect the economy, he doubts that the war will bring the economy out of a recession the way World War II stimulated the post-Depression economy. The reason, he explains, is the timing of both wars in relation to the long wave. “World War II occurred just as the long wave had bottomed out, so that the excess capital and labor force were able to be used to meet the new military demand.” The Persian Gulf war, by contrast, is occurring in the downswing of the long wave, “when there are tremendous contractionary forces pushing down government spending.”

A Silver Lining

But Sterman notes there is a silver lining to the current economic outlook. “Keep in mind that the long wave is a cycle, and it will turn around. In the boom of the 1980s, a lot of people thought things would continue going up forever. If people now make the same mistake of thinking the economy will go down forever, they might miss some real opportunities.

“When the current imbalances are resolved, the stage will be set for the next long wave expansion, creating tremendous opportunity. Growth will resume at moderate rates. Real interest rates will decline. Unemployment will fall, though the new jobs will often be in new industries and require new skills. Debt will be rebuilt around a new set of financial institutions, a new set of managers, and newly-stiffened credit standards. A new ensemble of technologies will emerge, powering the growth of new firms.”

The Long Wave: Changing the Rules of the Game

- Intense technological innovation. All economies are organized around a fairly small number of core technologies. Radical new technologies, although superior, often are incompatible with the existing infrastructure. The airplane, for example, was a superior method of transportation, but it did not fit into an economy that was organized around rail transportation, steam, and coal. A window of opportunity opened up only after the bankruptcy of the railroad industry during the Great Depression.

Our current infrastructure is centered around oil, internal combustion, the automobile and aircraft, synthetic (oil-based) materials, electricity, telephone, radio, and television. As the recession intensifies and our current technological base weakens, new technologies will vie for a place in the foundation of the next long wave upswing, says Sterman. “It’s seems clear that the new ensemble of technologies will rely heavily on computers, biotechnology and more environmentally sound modes of transport, energy production, and materials use.”

- Regulatory backlash. Economic historians have identified three great merger waves: 1870-1902, the 1920s, and the 1980s. All three occurred during a long wave downturn. In the past, every merger wave has been followed by a regulatory backlash, resulting in measures such as the Sherman Antitrust Act of 1890, the Glass Steagall Act, and the creation of the Securities and Exchange Commission.The regulatory backlash in the current long wave is already building, says Sterman. Insider trading and securities law violations prosecuted by the government increased significantly in the 1980s, and the backlash will spread rapidly to other areas.

Some industries which were deregulated during the downturn will be candidates for reregulation and new industries and technologies will be brought under regulation as the government seeks to redress past imbalances. Possible candidates: double hull requirements for oil tankers, limits on caller ID and other new information technologies, and tougher Food and Drug Administration approval processes.

- Changing treatment of debt. The pressures of the long wave downturn change the relationships between borrower and lender. As prices fall and the impossibility of repayment becomes clear, the political pressure from massive foreclosures and defaults will lead to relaxation of bankruptcy laws, as it did during the depressions of 1837-43, 1873-78, and the 1890s. The S&L bailout is the largest bank holiday to date; it likely will not be the last.

And the great pendulum of the U.S. economy will once again begin its upward march.

Portions of this article were adapted from “A Long Wave Perspective on the Economy in the 1990? by John D. Sterman which appeared in the July 1990 issue of The Bank Credit Analyst. For more information on the long wave and the National Economic Model, contact John D. Sterman, 552-562, MIT Sloan School of Management, 50 Memorial Drive, Cam-bridge, MA 02139, (617) 253-1559.