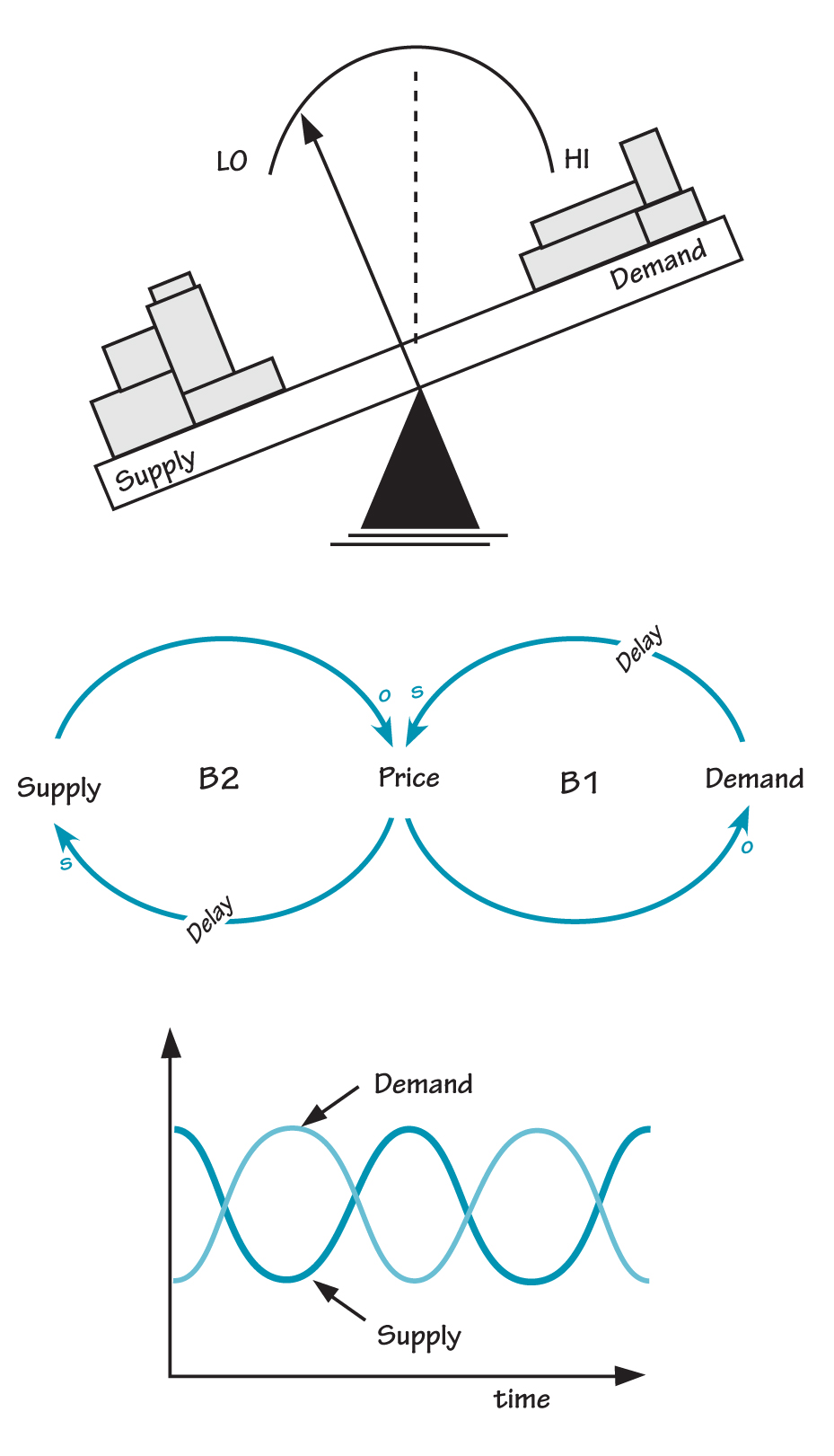

Most of us have played on a seesaw at one time or another and can recall the up and down motion as the momentum shifted from one end to the other. The more equal the weights of both people, the smoother the ride was. At a very basic level, a free market economy is a lot like a seesaw with supply at one end and demand on the other end. Prices indicate the imbalance between the two, like a needle positioned at the pivot point of the seesaw.

The goal of a seesaw ride is to always keep things in a state of imbalance (it would be pretty boring to sit on a perfectly balanced one). But the goal in the marketplace is exactly the opposite—to bring supply in balance with demand. Unfortunately, the supply and demand balancing process feels a lot more like a seesaw ride than a smooth adjustment to a stable equilibrium. As shown in the causal loop diagram, the dynamics of this adjustment process are produced by two balancing loops that try to stabilize on a particular price. But the process is complicated by the presence of significant delays.

Balancing Supply and Demand

FREE MARKET ECONOMY SEESAW

A free market economy is a lot like a seesaw with supply at one end and demand on the other. The dynamics that result from trying to balance supply and demand are produced by two balancing loops that try to stabilize on a particular price. Due to the presence of significant delays, a cycle of overshoot and collapse occurs.

Tracing through the loops, we see that if demand rises, price tends to go up (all else remaining the same), and as price goes up, demand tends to go down (Cabbage Patch dolls notwithstanding). If there is enough inventory or capacity in the system to absorb the increased demand, prices may not go up immediately. As demand outstrips supply, however, price will rise.

On the supply side of the seesaw, an increase in price provides a profit incentive for firms to produce more. Of course, it takes time for firms to expand. The length of the delay depends on how close they already are to full capacity and how quickly they can add additional capacity to produce more. Hiring new workers may only take a few days, while obtaining additional capital equipment or factory floor space may take months or even years. While firms are making supply adjustments, the gap between supply and demand widens and price goes even higher. The higher price spurs companies to increase their production plans even more.

As supply eventually expands and catches up with demand, price begins to fall. By this time, firms have over-expanded their production capacity and supply overshoots demand, causing price to fall. When the price falls low enough, the product becomes more attractive again and demand picks up, starting the cycle all over.

Airplanes on Seesaws

The supply and demand seesaw is played out in all but the most tightly regulated markets. A good example of this balancing act is described in a Forbes article entitled “Fasten seat belts, please” (April 2, 1990, pp. 84–85), about airplane leasing companies.

Leasing companies, which account for roughly 20% of all commercial jet aircraft currently on order, have enjoyed enormous profits during the latest boom in air travel. One carrier alone has put in an order to lease 500 planes. Based on leasing and buying rates in the industry, the total number of airplanes is expected to increase by 50% over the next five years. But in the meantime, air traffic growth has been slowing during the last three years. The leasing companies, however, do not seem too worried.

According to the article, “eight years of unbroken prosperity have created the illusion that many cyclical businesses aren’t cyclical any longer.” But, as one airline executive warned, “This is a cyclical business. Always has been, always will be. With a small change in load factor, the airlines can go from spilling cash to bleeding red ink like the Mississippi River going through the delta.”

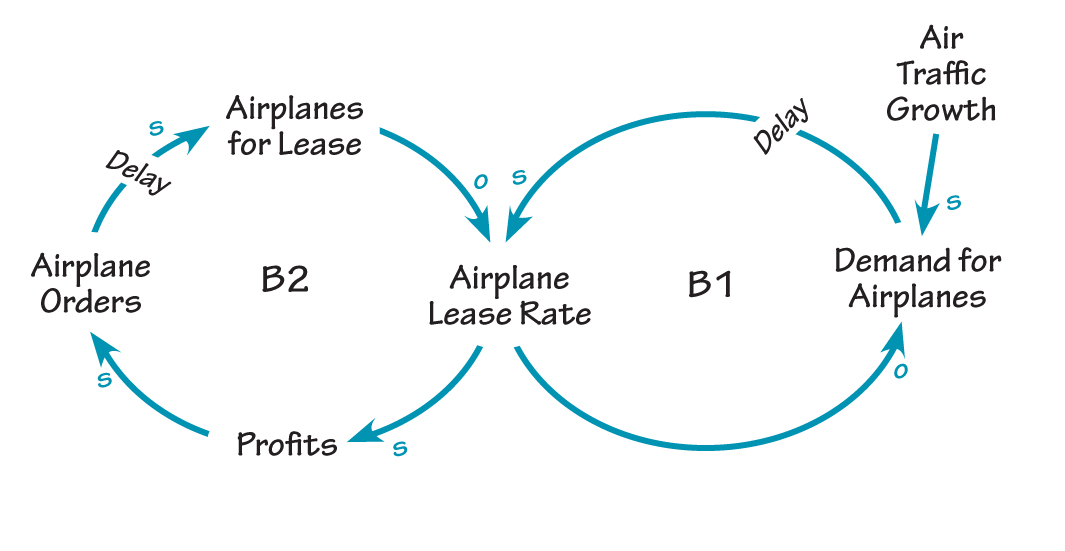

AIRPLANE LEASING SEESAW

A causal loop diagram of the airplane leasing industry shows the same seesaw structure at work.

If we draw out a causal loop diagram of this industry, we see the same supply and demand structure at work. An increase in air traffic growth over the past three years fueled a strong demand for airplanes. That in turn sparked an increase in airplane lease rates as airlines scrambled for additional airplanes. The high lease rates led to increased profits and a surge in airplane orders. Since airplanes take many months to build, the supply of leasable airplanes did not adjust right away, making lease rates go even higher. This led to higher profits which attracted more capital which was plowed into even more orders for airplanes.

As the supply catches up to demand, however, the airplane lease rates will fall (the slowing of air traffic growth will accelerate this process). With so many airplanes in the pipeline, the supply will begin to outstrip demand and drive lease rates down even further. This will put a squeeze on profits and force marginal firms out of business. Some orders will be canceled; others will be renegotiated.

All the pieces of the airline leasing industry seem to be operating within a seesaw structure. Although the extended period of air traffic growth has kept demand ahead of supply for several years, it has not changed the nature of the delays in the supply line. When the supply adjustments bring the seesaw back down, airline leasing companies could be in for a bumpy landing.

Summary

In this article, we focused on a variation of one of the basic feedback loop structures—the balancing loop—with delays. This structure is at once simple and complex: simple, because it seems to be an innocuous single loop structure that is easy to comprehend; complex because the resulting behavior is neither simple nor easily predictable. The delays in a typical system are rarely consistent or well-known in advance, and the cumulative effects are usually beyond the control of any one person or firm.

Daniel H. Kim and Colleen P. Lannon cofounded The Systems Thinker.