With the days growing shorter and kids heading back to school, fall is definitely in the air. The end of the growing season serves as a tangible reminder that nothing grows forever: not plants, not children—and not companies or product sales or economies.

This is a principle of the living world, and also a principle of systems of all kinds. In systems language, every reinforcing process eventually encounters a limit, or a balancing process. And yet, in the excitement of the growth, or boom, phase, we often seem to forget that “to everything there is a season.”

A Decade of Booms and Busts

In a Wall Street Journal article, “How I Got Burned by Beanie Babies,” Karen Blumenthal looks at lessons from the booms and busts of the past decade, including the housing bubble, the tech bubble, and, yes, the bubble that played out around a brand of stuffed animals called “Beanie Babies.” The wild-eyed speculation in each of these situations brought financial success to a few, and financial ruin to many more.

Blumenthal’s hope is that by understanding the patterns these rollercoaster rides tend to follow, we can “be more astute in reacting and adjusting our own behavior.” Here’s what she has observed:

- The biggest bubbles seem to occur during times of rapid and radical innovation. Because of the dramatic nature of the changes, we become susceptible to “bizarre rationalizations,” like the idea that home or oil prices could climb forever.

- Once booms get started, people jump on the bandwagon in droves, further boosting prices. As Blumenthal states, “Initial skepticism gives way to curiosity and then escalates into a kind of frenzy, a feeling that you may be the only person on the planet who isn’t part of the fun, and you’d better scramble to get in.”

- Even knowing that all booms eventually bust, people ignore warnings, thinking that something about this particular trend makes it different from all previous ones.

- Greed runs rampant. Blumenthal notes, “At some point, the bubble reaches a point that is so ridiculous that greed takes over and all common sense must be suspended to continue the myth.” She sheepishly admits that she once spent $50 on a $5 “Peace Beanie Baby,” falling prey to the illusion that she might one day finance her children’s college education with the little stuffed animals.

- Dangerous behavior ensues, as some people desperately try to “keep the party going.” This is the stage when unethical or patently unwise actions take place; according to Blumenthal, “It was only after the tech boom started to weaken that WorldCom Inc. began to cheat on its earnings.”

Blumenthal concludes that the only people who profit from boom cycles are those who sell on the way up and aren’t worried about trying to maximize their profits. She advises most people to invest for the long run: “The only way to survive financial busts is to hang on long enough to outrun them.

Limits to Growth

Knowledge of systems behavior can also help us avoid becoming caught up in the boom-bust dynamic. As Donella Meadows says in Thinking in Systems, “Whenever we see a growing entity, whether it be a population, a corporation, a bank account, a rumor, an epidemic, or sales of a new products, we look for the reinforcing loops that are driving it and for the balancing loops that will ultimately constrain it.” The “Limits to Growth” (also known as the “Limits to Success”) systems archetype offers a framework for acknowledging and exploring the constraints on unbridled growth.

But tools and guidelines will only get us so far. Escaping from the bubble mentality may necessitate a shift in the Western concepts that “bigger is better,” “more is better than less,” and “growth for growth’s sake.” Perhaps only by embracing the reality of limits will we be able to make the most of what we actually have.

Janice Molloy is content director of Pegasus Communications and managing editor of The Systems Thinker. This article originally appeared on the Leverage Points blog.

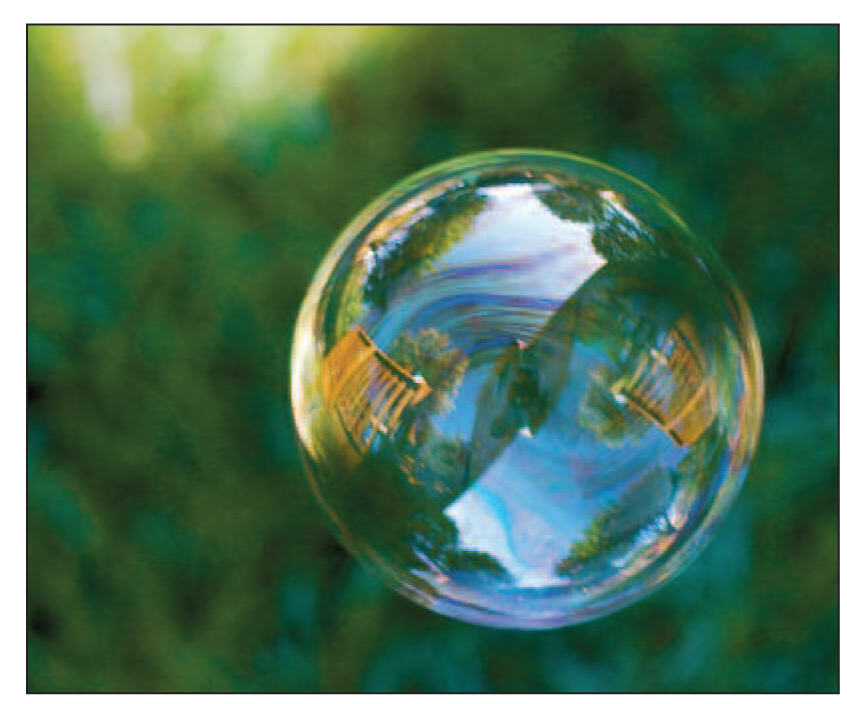

Bubble photo by Jeff Kubina/Creative Commons license (CC) BY-NC-ND