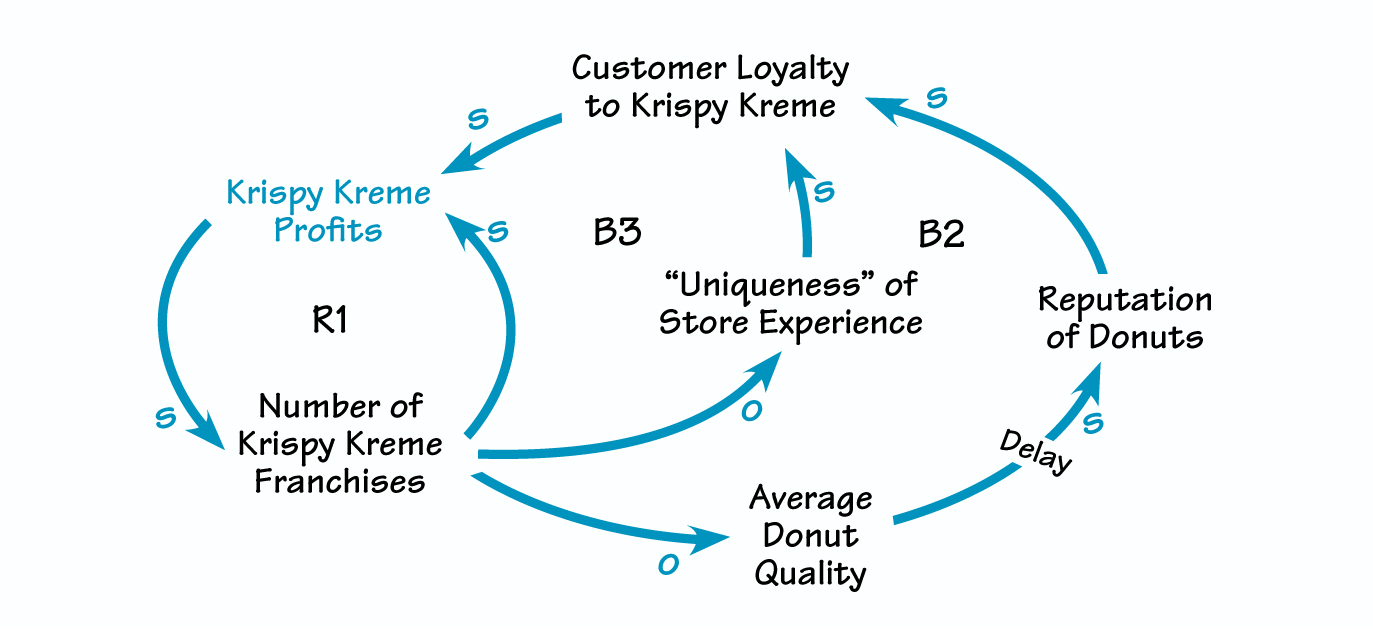

While never having tasted a Krispy Kreme donut (though the “pillowy” softness in the description was almost enough to motivate me to get in the car to drive south), I can imagine that the growth in the number of franchises is being driven by a “reinvestment” feedback loop. With high customer loyalty to this unique donut, each new franchise can generate additional profits, enabling the donut maker to invest in still more franchises (R1).

From the article, I see two potential limits that could slow the growth of the Krispy Kreme business. The first is donut quality. Each new franchise adds to the challenge of maintaining production of consistent and high-quality donuts. If the number of franchises grows faster than the company’s system for maintaining quality, its reputation for good donuts could fall, reducing customer loyalty (everyone goes back to Dunkin’ Donuts) and reducing profits (B2).

If the number of franchises grows faster than the company’s system for maintaining quality, its reputation for good donuts could fall reducing customer loyalty.

There would likely be a delay between the drop in donut quality (because of the increase in the number of stores) and the impact on reputation. Krispy Kreme is starting with a great reputation for donuts, so when the stores open, people are likely to flock in to try the donuts. Even if the donut quality doesn’t live up to its reputation, people will continue to come until word of mouth gradually brings reputation in line with the current quality. If this happens, the number of stores might actually “overshoot and collapse” as the initial success allows strong growth, then falling donut reputation and sales lead some stores to close. The leverage point here is to make sure that you do not grow the number of stores (volume and distribution complexity) faster than your capability to ensure quality

The second limit to growth is a little more subtle. One reason why customers in the southeast U. S. might be might so affectionate toward Krispy Kreme donuts is that they feel that it is a unique regional store and a unique purchasing experience. Each store has a “donut experience” (watching the donut production right in the shop). If Krispy Kreme goes national, it risks turning the Krispy Kreme store experience into something more common—just another national store—particularly if the new franchises don’t invest in the expensive “visible” donut production process (B3). The leverage here is understanding whether customer loyalty is based on the unique character of the stores. If so, and you are trying to expand, it is important to continue to invest the extra money in the new stores to maintain the “uniqueness” of the store experience.

The Limits to Uniqueness