Blockbuster Video lived up to its name in the 1980s, becoming the number one video rental company in the United States. But its star may be fading, according to a recent Wall Street Journal article (“Slower Forward: Blockbuster Faces Host of Video-Rental Rivals,” March 22, 1991). Increasing competition, a slowdown in VCR sales, and the increasing attractiveness of pay-per-view services may spell an end to Blockbuster’s record growth, the article warned.

Blockbuster is a company that created an industry. It took the concept of video rental stores national, opening more than 1500 stores over the last three years and chalking up annual revenues of $633 million. Fueled by new store revenues, Blockbuster’s annual net income grew from $5 million in 1987 to $60 million in 1990, while its stock climbed from $5 a share to over $12.

The company continues to pursue its aggressive growth plan. Company officials say that over the next three to four years they plan to open over 400 stores a year — one every 17 hours — and double their market share. The video rental market is expected to increase by $1.8 billion over that same time period. With an 11% market share, Blockbuster has plenty of room to grow — but not, perhaps, at the same breakneck speed.

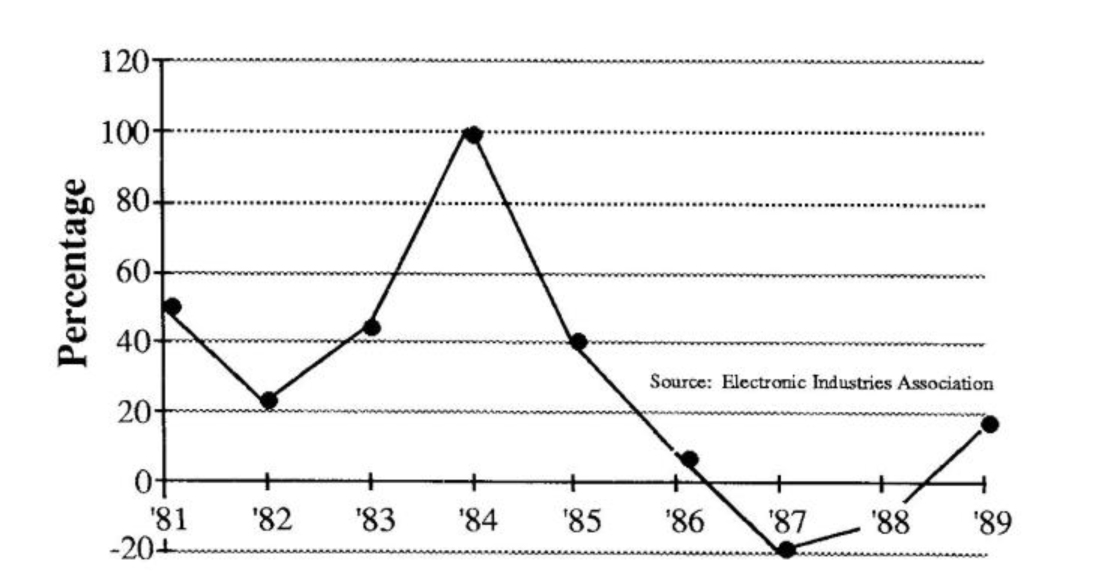

Annual Growth Rate Of VCR Sales

Since last year, according to the Journal article, Blockbuster’s year-over-year store revenue has slowed every quarter. And company officials recently announced that they expect first quarter earnings growth to be only 10-20%, far less than previous years’ rates of 75% and higher.

In the meantime, Blockbuster’s phenomenal success has attracted a slew of competitors, who have begun to saturate certain markets. At last count, the United States had 28,000 video stores. In the Pacific and Mid-Atlantic States, a given video store is likely to have six rivals within a three-mile radius.

Historically, the growth of the video rental industry has been closely tied to the spread of VCRs. Now that VCRs are in 70% of American house-holds, VCR sales are slowing, and so is the potential video rental market (see “Annual Growth Rate of VCR Sales” graph). A slowdown in VCR sales means that more competitors are chasing fewer new consumers entering the market.

As technology continues to advance, new services are also beginning to compete with video rental sales. The biggest contender, pay-per-view television, eliminates the single largest inconvenience of renting movies — leaving home. With pay-per-view, viewers select a movie from the available titles through their cable network system and are billed later. Although the current level of technology and pricing have slowed the acceptance of pay-per-view, the article noted that it continues to make inroads into the home entertainment market and could become the “ultimate cloud over Blockbuster.”

Discussion Questions

- The article noted that “everything Blockbuster is doing…assumes that Americans in large numbers arc going to continue to rent videotapes.” What structural basis is there for this viewpoint?

- VCR sales are an important factor in the video rental business. How likely is it that VCR sales will increase?

- What other factors can contribute to the growth of the video rental market? What factors may detract from its growth?

- Are there instances in your own organization or industry where similar S-shaped dynamics are occurring?

The adage “what goes up, must come down” holds true for many things. In the case of Blockbuster Video, the question is not if but when the current pace of growth will slow. To get a better idea of “when,” we need to map out the underlying structures that are responsible for its current growth.

In order for Blockbuster’s growth projections to materialize, two major assumptions must hold true: either the video rental industry will continue to grow at its previous rate or Blockbuster will grab market share by growing faster than the industry.

Industry Growth Assumption

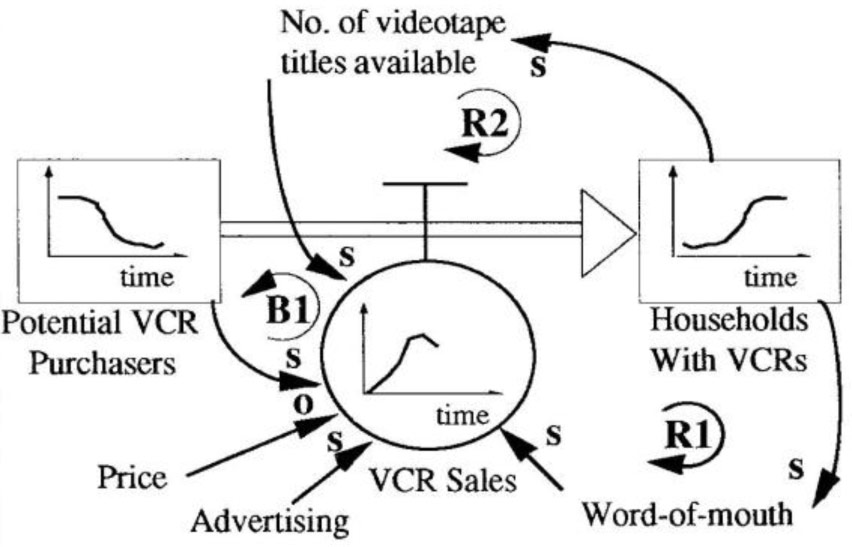

The industry can continue to grow in only two ways: either the number of households with VCR’s must continue to grow at historical rates or the number of tapes rented per household must increase substantially. As the graph on page 7 showed, the growth of VCR sales has been on a downward trend for the past several years. Since VCR’s are already in 70% of American households, it is unlikely that the sales rate will continue to increase. The word-of-mouth and the videotape availability reinforcing loops (R1 and R2 in the “VCR Diffusion” diagram) have pretty much played themselves out and the balancing effects of the declining pool of potential VCR purchasers have begun. As the law of diminishing returns suggests, getting VCR’s into the remaining 30% of American house-holds will be a much slower process than getting into the first 70%.

VCR Diffusion

Continued advertising will have decreasing effects since the number of people who have not purchased a VCR due to unawareness of the product and its benefits is growing smaller and smaller. Although dramatic cuts in price may spur sales in the short term, the penetration will eventually approach 100% and sales will fall off (except for replacement purchases). It is unlikely, however, that any major price cuts are in sight. Prices appear to have bottomed out at around $150.00 for a low-end unit.

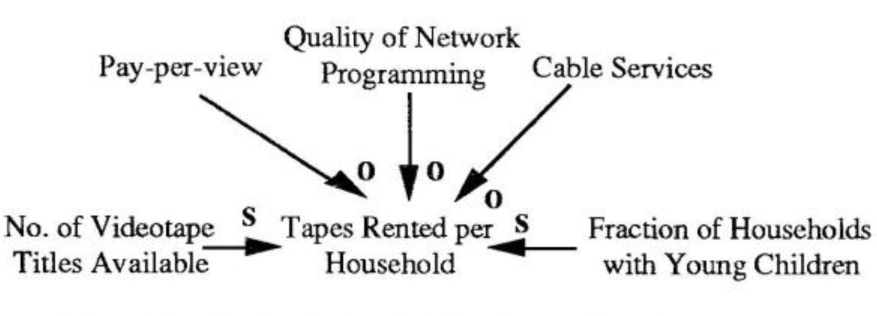

If industry growth is not going to come from increasing VCR sales, it must come from an increase in the number of tapes rented per household. There are a number of factors which can influence that number (see “Rental Tapes per Household” diagram). Increases in the number of videotape titles available and in the fraction of households with young children, for example, may boost the number of tapes rented per household. Further additions of titles are already producing diminishing returns, but demographic data with respect to family size and entertainment preferences may yield some basis for optimistic growth projections.

On the other hand, improvements in the quality of network programming may cause tape rentals to decrease, since better options would exist on regular TV. More significantly, improvements in technology and price in pay-per-view systems and cable service will have a greater impact since they compete more directly with videotape rentals. As the Wall Street Journal article suggests, the prospect of pay-per-view swallowing up rental business looms large.

Market Share Assumption

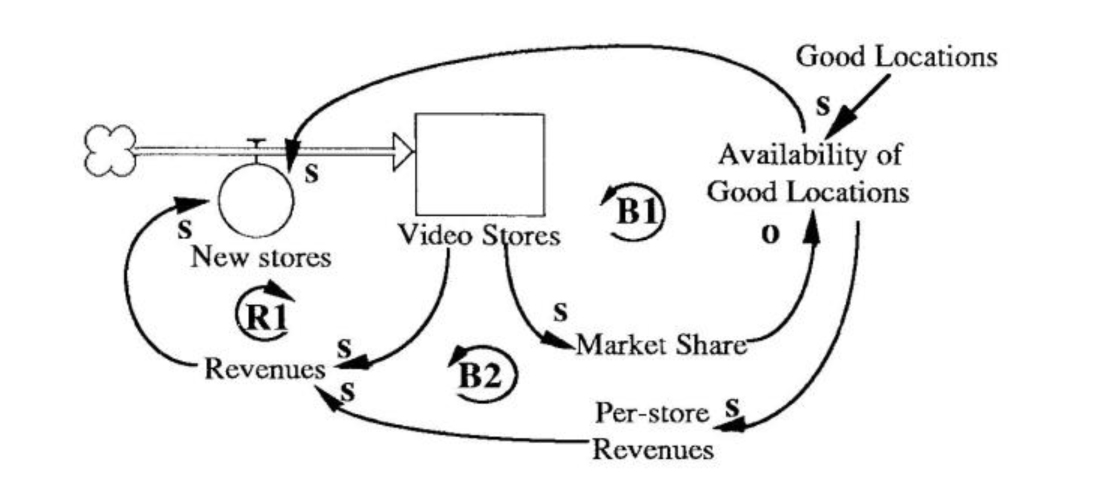

If the industry’s growth rate is slowing down, then grabbing market share is the only other way Blockbuster can sustain its growth rate. How realistic is it for them to expect to grow faster than their major competitors in an increasingly competitive environment? The law of diminishing returns again comes into play (see “Market Share and Availability of Good Locations” diagram).

In the first few years of the video rental industry, rapidly opening new stores increased the accumulation of video stows, which increased video store revenues and fueled further investments in opening new stores (loop R1). As the number of stores grew, market share grew. The best locations were gobbled up as competing firms jockeyed for position. Now, a shrinking pool of good locations will eventually curtail new store openings either directly (loop B I) or through lower per-store revenues (loop B2).

Market Share and Availability of Good Locations

Having only 11% of the market suggests that there is still plenty of room for Blockbuster to grow. Growing faster than the competition, however, is becoming more difficult. For example, Blockbuster was recently drawn into a price war in San Antonio where their price cuts from $3 to $2 were met with $1.50 and $.99 specials by their main competitor. If such price wars become more common or intensify (as usually happens in a maturing market), Blockbuster may lose its primary source of funds for new store expansion. In the long run, such wars are a losing battle for the stores — and for the customers, if the prices are too low for the stores to reinvest back into the business.

Identifying S-shaped Growth

Recognizing instances in your own organization where S-shaped growth and the law of diminishing returns are operating can help highlight potential barriers to continued growth. As with the video rental industry, there are usually multiple S-shaped growth structures interlinked. Sometimes one structure is driving the growth of another — such as personal computers and software sales — where a slowdown in one will lead to a decline in the other. Other times, the growth of one leads to its eventual substitution by another, such as the evolution from desktop to laptop and now notebook computers. Identifying the relevant structures can provide insight into what is driving the growth and where the eventual limits might be.

Rental Tapes Per Household

You can then use the S-shaped growth diagrams to help evaluate the underlying assumptions behind various growth strategies, as we did with Blockbuster Video. For example, new products are typically launched with a front-loaded marketing campaign designed to drum up a high level of interest. In many cases, the demand generated exceeds the company’s capacity to meet it. But marketing efforts continue unabated, further increasing demand. Capacity is slowly expanded, while the backlog of orders continues to grow — a condition that is often exacerbated by double and triple ordering. When the dust finally clears, the company is saddled with large inventories and excess capacity.

The challenge in launching a new product — or following any growth strategy — is to know where you are on the S-curve, so you can balance your marketing efforts and capacity expansions for a smooth landing