TEAM TIP

When your team or organization seems trapped in a vicious cycle, work together to be sure that your interventions aren’t compounding the problem.

The daily headlines testify to the dire state of the U. S. economy: “Weak Dollar Feels New Stress,” “Housing, BankTroubles Deepen,” “Foreclosures Reach a New Record.” Rumblings about a recession have become a persistent beat. In a recent conversation about the downward spiral of the economy Wall Street Journal economics editor David Wessel and National Public Radio’s Steven Inskeep focused on the ripple effects caused by falling home prices and the tightening of credit (National Public Radio’s Morning Edition, March 11, 2008). The scenario they described was rife with reinforcing dynamics—and sobering news for businesses and consumers alike.

A Lack of Cash and Confidence

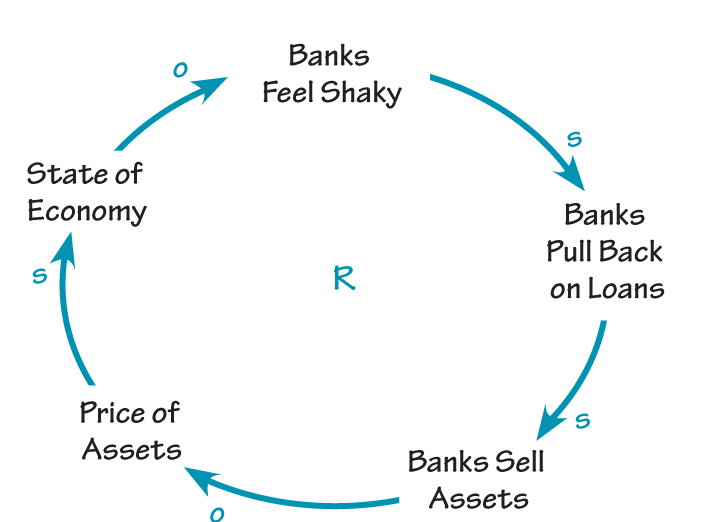

According to Wessel, “When banks are a little bit shaky and are trying to pull back on their loans and they sell assets, and then that pushes down the price of assets on the market and that makes the economy worse, and then the economy makes the price of assets worse, so the banks get a little more worried, and that makes the economy worse—we have what is sometimes called a positive feedback loop, and that is one of the things that is quite scary.” (See “A Downward Spiral.”)

A DOWNWARD SPIRAL

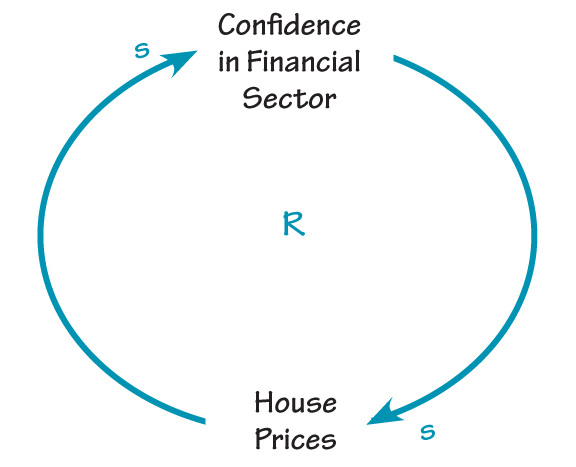

He believes the current financial crisis will end when the price of housing stops falling and when confidence returns to the financial sector. But as Inskeep pointed out, these two variables are also linked in a vicious cycle— people won’t start paying more for houses until confidence returns, and confidence won’t return until people start paying more for houses (see “Crisis of Confidence”). Compounding the problem is a credit crunch that is making it hard for even well-qualified borrowers to get mortgages.

The good news about a reinforcing process is that it can also work in the opposite direction. That’s what the Federal Reserve, White House, and Treasury have been aggressively trying to do by cutting interest rates and pumping money into the financial system. These actions have yet to have a beneficial effect, though. On an optimistic note, Wessel envisions a scenario in which “smart people with a lot of money” will start snapping up properties at a bargain rate—driving prices up and injecting the system with much-needed capital.

CRISIS OF CONFIDENCE

Worse Before Better

The other fact about vicious and virtuous cycles is that they eventually play themselves out. Unfortunately, these abstract dynamics create real hardship for many people. Each foreclosure represents the end of a dream for a homeowner or investor. If the U. S. falls—or, if some economists are correct, has fallen—into a recession, things are bound to get worse before they get better—yet another systems principle in action.

Janice Molloy is content director at Pegasus Communications and managing editor of The Systems Thinker.