Do you recall the first time you picked up a tennis racket? Perhaps it was an old wooden racket you found in your garage, or one a friend had out-grown. You weren’t really sure you had it “in you” to play — you didn’t even know if you would like the sport. But you tried playing a couple of games a week with the beat-up racket, picking up some of the basic moves and even sustaining a volley for a few rounds. After a month or so, however, you couldn’t seem to improve your play beyond a certain level.

If you were a little bit better, you might have been willing to invest in a new high-performance racket. But you decide that tennis is really not for you. Besides, another friend has just given you a pair of ski boots. They’re a little beat up and a bit tight at the toes, but then again you don’t know whether you’ll like skiing….

Growth and Underinvestment

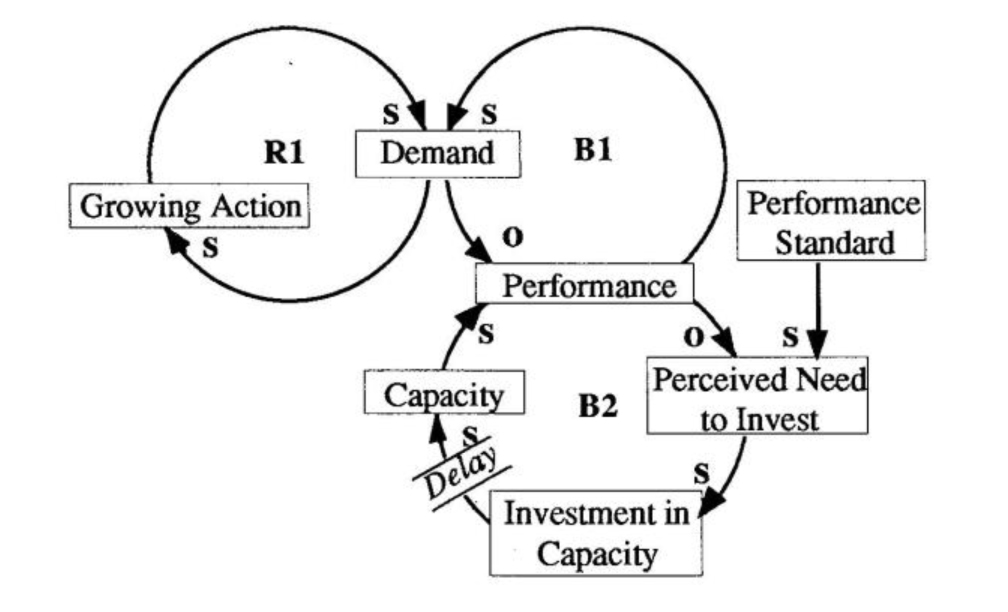

The above scenario is an example of the “Growth and Underinvestment” archetype at work. At its core is a reinforcing loop that drives the growth of a performance indicator and a balancing force which opposes that growth (loops RI and B1 in “Growth and Underinvestment Archetype”). An additional loop (B2) links performance to capacity investments, and shows how deteriorating performance can justify underinvesting in capacity needed to lift the limit to growth. This propensity to underinvest in the face of growth makes “Growth and Underinvestment” a special case of the “Limits to Success” archetype (see “Limits to Success: When the ‘Best of Times’ Becomes the ‘Worst of Times,— Toolbox, December 1990).

Growth and Underinvestment Archetype

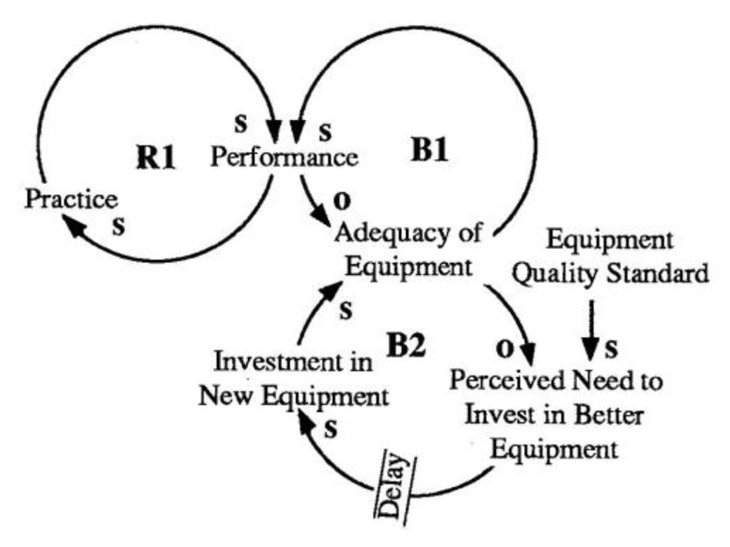

In the tennis example, the reinforcing process is practice, which improves performance (loop RI in “Practice Makes Perfect?”). Improvement slows, however, as you reach the point at which the equipment limits your ability (loop B1). If your decision to purchase better equipment is dependent on your past performance, you may fall victim to this archetype. Without investing in better equipment, your performance will likely plateau — or even decline as you become frustrated and spend less time practicing. The result then justifies your decision not to invest in a new racket.

Legacy of the Past

Often in a “Growth and Underinvestment” situation, ghosts of past failures remain as a systemic legacy, influencing current decisions. A classic example is the story of a capital equipment manufacturer. The company’s CEO had seen an industry downturn in which the company had been saddled with too much capacity, so he was cautious about expanding. The company’s product was selling well, however, and a backlog began to pile up — three months’ worth of orders, then four, then five. The CEO continued to believe that it was just a temporary spurt. When the backlog grew to six months, he finally agreed to expand production capacity.

It took about a year and a half for the additional capacity to come online. In the meantime, demand trailed off as people found alternative sources. The company gradually worked off the backlog, and orders started to pick up again. After a couple of years they were in a similar backlog, but the CEO was even more reluctant to invest in new capacity because of what appeared to be a continual cycle of growing and falling demand.

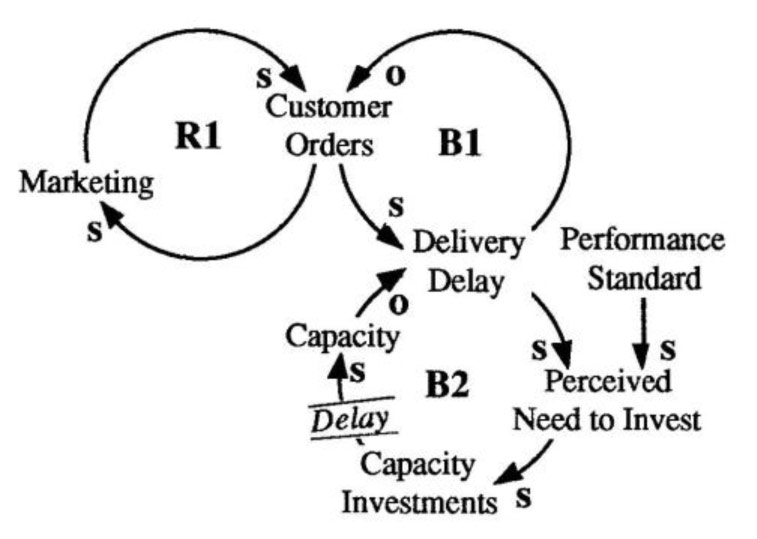

The “Growth and Underinvestment” archetype reveals that the company’s slow response may actually have created the cyclical demand. The reinforcing action of marketing activities, coupled with the balancing action of delivery delays, trace out a “Limits to Success” archetype, in which the limit is production capacity (loops RI and B1 in “Capacity Delays and Underinvestment”). As performance declined relative to performance standards, the perceived need to invest increased, until investments were finally made (loop B2).

Because of the delay in capacity coming online, however, delivery performance continued to decline for a while, hurting new orders. In the meantime, deliveries began to increase and the company crawled out of backlog. This led the CEO once again to question the need to invest in capacity, making him even more conservative the next time they were in a backlog situation.

Downward Spiral

If this dynamic continues through many cycles, customers are not likely to keep coming back. The result may be a downward spiral of cutting back on investments: the two balancing loops lock into a figure eight dynamic in which the effects of the reinforcing loop no longer have much impact on growth, while the combined balancing loops create a counter-reinforcing process of continual cutbacks. As demand goes down, delivery performance goes back up, creating less need for capacity investments. If capacity dips below the level needed to service incoming orders, performance will go down again, reducing demand even further. Perceived need to invest will be decreased, so investments will decrease, leading to even less capacity over time (as older equipment depreciates or is taken offline). Thankfully, the reverse situation can also be true: the two balancing loops can trace out a reinforcing loop that continues to expand demand and performance.

Practice Makes Perfect?

Breaking the Cycle

To determine whether a Growth and Underinvestment” structure is at work, start by looking for patterns of oscillations in customer demand. If you overlay that with capacity investments and find that they follow the same pattern, you’re probably in a “Growth and Underinvestment” situation.

Capacity Delays and Underinvestment

If a company waits until it receives signals from the marketplace to invest in capacity, it may be too late to prevent some fall-off in demand that will result because of the delay between investment decisions and capacity coming online. The key is to develop a way of assessing capacity needs relative to demands before the performance indicator starts to suffer.

Take some time early in the growth phase to determine what the limits may be, especially with respect to capacity. Studying the market response and characteristics of your target customers during an upswing can help you anticipate future capacity needs.

Also make sure internal systems are set up to deal with growth: if you have an aggressive growth strategy but a sluggish internal system for responding to performance shortfalls, then you might have created a structural inability to handle continued growth.

Most importantly, explore the assumptions driving your capacity investment decisions. Past performance may be a consideration, but it should not dominate your decisions. Instead, identify the marketplace factors that are driving growth. Otherwise you may end up with investment decisions that are too dependent on past experience and not on present (and future) needs.

“Growth and Underinvestment” and other archetypes can be found in The Fifth Discipline By Peter Senge (Doubleday).