Your friends raved about the new restaurant in town — “Great food, great service, great price” — so you finally decided to go. By the time you got there, however, it had already become so popular that the average waiting time was over two hours. Your post-meal assessment: food and service were great, but the wait was too long.

Over the next several months you hear that the restaurant has hired a lot of food preparers and servers to reduce the wait time. You go back to the restaurant and are pleased to find that you don’t have to wait for a table. But your post-meal assessment is no better than before: great food and quick service, but they rushed you through the meal. The emphasis now appears to be on “quick,” not “relaxed,” dining. A few months later, you hear that service has gotten better, but the food quality has declined. You decide not to chance it a third time.

The restaurant, by trying to be “the best” in every aspect, has fallen into the trap of the “Attractiveness Principle.”

All Things to All People

The basic idea behind the “Attractiveness Principle” is that, in the long run, you can’t be all things to all people. If you offer “the best” on every competitive dimension, the market will swamp you with so much demand that you will eventually become less attractive in certain areas. The “Attractiveness Principle” structure is a derivative of the “Limits to Success” archetype (see “Limits to Success: When the ‘Best of Times’ Becomes the ‘Worst of Times,'” Vol. 1, No. 7). While “Limits to Success” focuses on capacity limits at a more aggregate level, the “Attractiveness Principle” focuses on the capacity levels of specific attributes and how they interact over time.

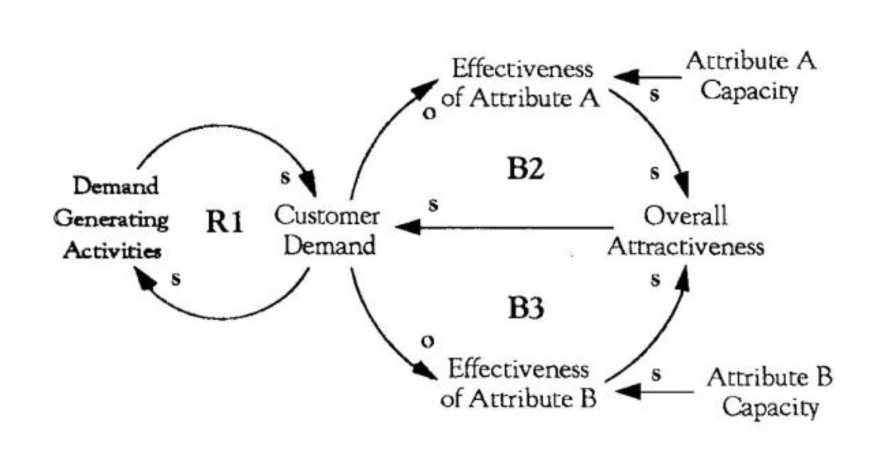

As in “Limits to Success,” demand-generating activities (e.g. marketing, word-of-mouth advertising) create a reinforcing cycle of increasing customer demand (loop RI in “Limits to Attractiveness”). Customer demand is also affected by overall product attractiveness (quality, uniqueness, delivery time). As demand increases, it starts to hit the limits of various attributes, thereby decreasing their effectiveness. That, in turn, lowers the overall attractiveness and thus the demand (B2 and/or B3).

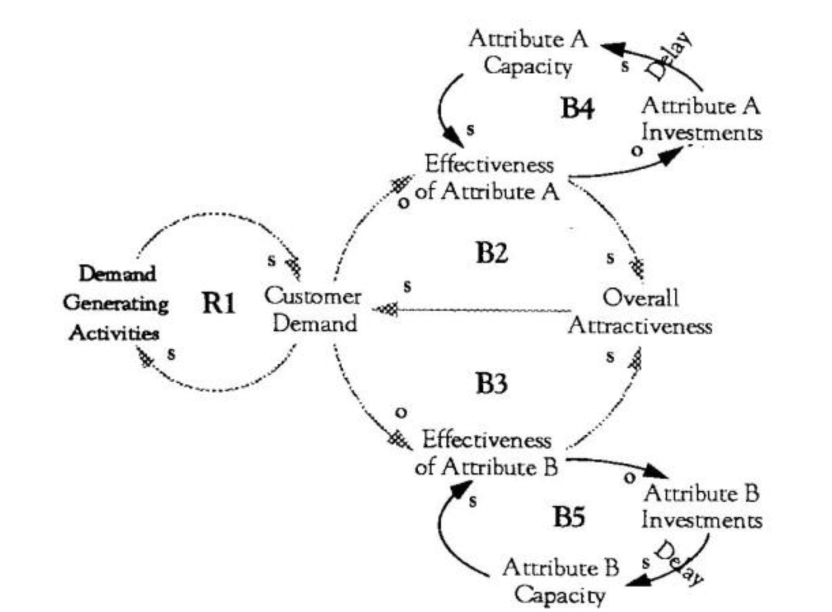

The tendency in this structure is to respond to the deteriorating effectiveness of one attribute by trying to pour more investments into it and restoring its effectiveness (loop B4 in “Attractiveness Principle Structure”). Each investment in a particular attribute, however, enhances overall attractiveness, which increases customer demand and puts additional strain on the system. Loops B2 and 114 trace out a figure-eight dynamic which produces a reinforcing spiral of increasing investments and increasing levels of demand.

The structure seduces you into responding to each capacity shortfall as an isolated problem, because the market response dictates which of your attributes is deteriorating at any point in time. The lesson of the structure is to recognize that being “all things to all people” is not a sustainable strategy and that you need to choose the set of attributes in which you want to be the most attractive.

Relative Overall Attractiveness

An important part of the attractiveness principle is understanding how one’s overall attractiveness is affected by the individual attributes. If the inter-relatedness among the attributes is perceived to be high, the attributes can be thought of as multiplicative. If the inter-relatedness is low, then they can be thought of as additive. If the attractiveness of a company’s product is a multiplicative function of its quality, service, price, availability, etc., then weaknesses in any one of the attributes has a negative effect on all of the attributes. For example, if my company ranks high on service and price but scores a zero on quality, our overall attractiveness would be perceived to be zero.

'Limits to Attractiveness'

On the other hand, if attractiveness is an additive function, then a relative strength in one attribute can help balance a weakness in another. For example, if my product’s price is substantially better than my competitor’s, customers may simply accept the fact that it does not have as many features as the competitor’s, or that our delivery times are much longer. High marks in one area offset low marks in others.

The distinction between additive attributes and multiplicative ones is not merely academic. Understanding the relative effect of each attribute on overall attractiveness can be used to plan capacity investments by helping to determine how much leeway you have in letting one attribute slide while working to strengthen others.

Optimize the Whole, Not the Parts

Focusing on overall relative attractiveness means focusing on optimizing the whole, not the parts. This means choices have to be made about where to deploy limited company resources.

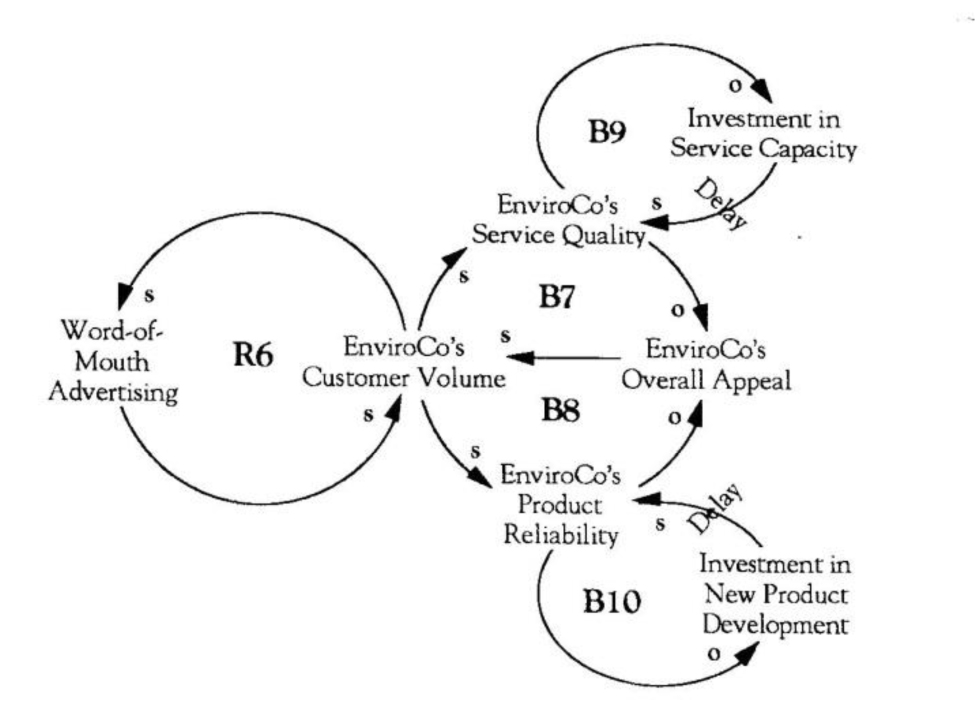

Suppose we start a company, EnviroCo, and want to establish it as the leader in industrial pollution control devices. Within 18 months of startup, it grabs a significant share of a highly-competitive and fragmented market niche. Word-of-mouth advertising among its customers pushes up demand so rapidly that the company soon finds itself forced to accommodate its own success. Promptness and quality of service become problems even though EnviroCo staff does its best to keep up with the high volume (loop B7 in “Fixing the Parts”). Management responds to the service problems by recruiting and training additional staff (B9), which helps bring the business back on track.

Attractiveness Principle Structure

The high customer volume also creates problems on the new product development side. The small R&D staff tries to respond to all the suggestions generated by enthusiastic customers, while still expanding their product line and sustaining their reliability standards.

Customers begin to notice deterioration in product reliability (B8), so management turns its attention to fixing the product development problems (B10). EnviroCo grows in fits and starts as it bumps along from one capacity limit to another. Over time, EnviroCo’s overall attractiveness is perceived to be about equal to everyone else in the industry because of its inconsistency in maintaining quality.

Fixing the Parts

Paradoxical as it may seem, trying to be the best at everything can actually result in a worse reputation than doing a few things well — as long as those few things are what is most important to the customer.

Choosing Competitive Dimension

In order to enhance each of the attributes you want to be strong in, you need to have a good understanding of the delays involved. You also need to manage the growth to be no faster than your ability to expand that attribute’s capacity to meet growing demand. In a company setting, for example, if service quality is one of the chosen attributes, it would be important to balance growth in demand with the ability to expand service capacity.

Russell Ackoff has a saying: “plan or be planned for.” The same can be said about an organization’s competitive emphasis — if you don’t choose the dimensions you want to known for, the market will choose them for you.