Did you ever go boating as a child? The image probably calls up a memory of a sun-filled day spent floating along a beautiful lake or river, lazily dangling your fingers in the water. However, the reality, at least for the beginning boater, is quite different. Learning how to paddle and steer are difficult enough, but one of the trickiest maneuvers for the beginner is to climb successfully from one boat to another. First your shipmates have to hold the boats steady. Then you balance yourself in the middle of your boat, and carefully—carefully—shift your weight from one boat to the other. It’s a scary moment, and the risks are high. One wrong move and… SPLASH! …everyone lands in the water.

Balancing Two Boats

Businesses face the same dilemma when they try to maintain two very different business lines or when they shift emphasis from one business or service to another. Examples of this dilemma can be found in organizations that move from offering differentiated products to being low-cost commodity providers, consulting firms that try to balance their consulting and training services, or settings in which there is more than one “engine of growth.”

BALANCING TWO BOATS

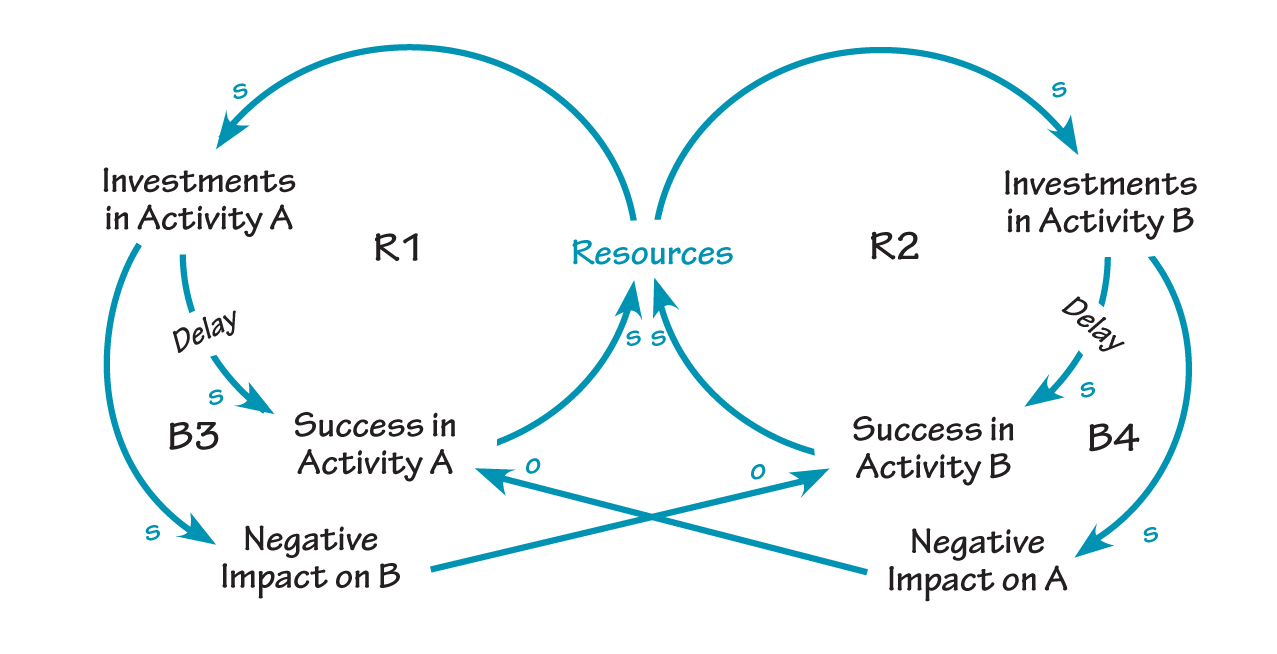

In a “Balancing Two Boats” dynamic, two reinforcing processes are linked via a shared resource (R1 and R2). Because of the different way that resource is used by the two parties, success in one strategy has unintended negative side-effects on the other area (B3 and B4).

The “Balancing Two Boats” dynamic is a variation of the “Success to the Successful” archetype: two reinforcing processes are linked together via a resource that two parties share, but use in different ways in order to be successful (R1 and R2 in “Balancing Two Boats”). For example, in the consulting setting, the resource is the consultants’ time, which either can be spent doing long-term consulting projects or short public workshops.

There are, however, important differences between “Success to the Successful” and “Balancing Two Boats.” A “Success to the Successful” structure exists when the allocation of the shared resource is based on the current success of one group over another (consulting vs. training). In “Balancing Two Boats,” on the other hand, the allocation between the two areas is made based on an assessment of market forces (such as increasing demand for public training). Whereas in “Success to the Successful” a fledgling business opportunity may not get adequate resources because it is unproven, in “Balancing Two Boats” a new business area is often funded in anticipation of changing market needs.

Keeping two boats afloat is a challenge, but if an organization maintains those businesses over time, it can discover the “optimal” allocation between the areas. When an organization must make a one-time shift from an old business to a new one, however, the optimal allocation is constantly changing. As in boating, the timing is crucial: If resources are shifted too abruptly from one business line to the other (before the investments in the new business yield results), the original business can go under too quickly, bringing the new business down with it.

A second challenge in managing “Balancing Two Boats” is learning how to avoid “crosscurrents,” the unintended negative effects of success in one strategy on the other area (loops B3 and B4). By the very fact that they are different businesses, the actions that make one area successful may have exactly the opposite effect on the other area (e.g., time spent in long-term consulting projects means less time to expose new people to the work, which may lead to fewer long-term projects over time).

The Healthcare Dilemma

One of the most visible examples of “Balancing Two Boats” is currently being played out in the healthcare industry where, due to external pressures from many sources, the system is shifting from fee-for-service to managed and capitated care.

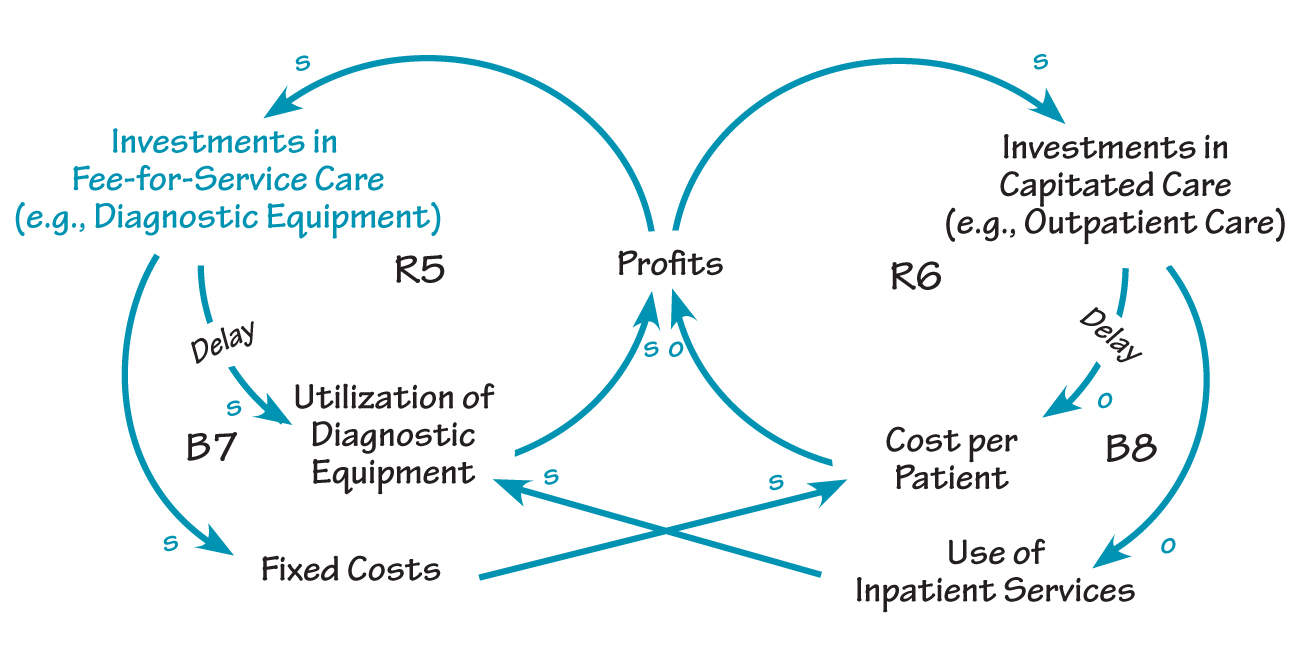

In the fee-for-service model, a doctor or hospital gets paid for each service provided. The incentive, therefore, is to offer the widest range of services in order to attract more patients. In the capitated business, however, hospitals receive a fixed monthly payment for each patient they are serving (the payment is typically lower than current expenditures), and the goal is to provide quality healthcare within that budget. The two models require entirely different strategies: investments in diagnostic machines, specialists, and extensive inpatient care improve the success of fee-for-service businesses (R5 in “Hospital Cross-Currents”), while investments in wellness programs and home care improve the success in the capitated market (R6).

In each case, however, the unintended side effects of those investments negatively impact the other business. For example, in the capitated market, shifting from inpatient to outpatient care is critical for managing costs. However, increasing utilization of outpatient care reduces the revenue from fee-for service activities, such as diagnostic tests (B8). Similarly, investments in diagnostic equipment are an important draw for patients in a fee-for-service hospital, but the overhead costs from those investments are so high that fixed capitated payments may not be high enough to enable the hospital to break even (B7).

Delays

HOSPITAL CROSS-CURRENTS

Investments in fee-for-service activities (diagnostic machines, specialists, inpatient care, etc.) increase profits from that business (R5), while use of wellness programs and outpatient services improves success in the capitated market (R6). However, each strategy has negative side-effects on the other. For example, shifting from inpatient to outpatient care reduces the revenue from fee-for-service activities (B8)

Understanding the timing and nature of the delays involved is an important part of managing a “Balancing Two Boats” dynamic. If there were no delays (i.e., a company could immediately switch from one business to another), the cross-currents would be reduced or nonexistent. In reality, investments in the new business have a delayed return, and there is an even longer delay before the market responds to the new capabilities.

In the meantime, the resources going to the new business will reduce the total available resources, and (most likely) the returns on the traditional business. It is easy to see how such a transition could produce a “trough” of lower success for the company overall as the old business diminishes and the new endeavor is too young to show results. If, in addition, your actions to promote each business are simultaneously hurting the other business, there is a strong possibility that neither will become successful and the boat will sink

Leverage

The leverage in the “Balancing Two Boats” dynamic lies in carefully choosing which investments to make and coordinating the timing of those investments to minimize the cross-currents. Try mapping out potential investments in order to highlight any possible cross-currents, and think strategically about possible ways to build the new business that will not damage your core business.

In one hospital setting, leaders instituted an across-the-board quality effort to reduce length of stay, which is an important part of managing costs in the capitated market. But the hospital was still largely a fee-for-service facility, so reducing stays—and all of the additional services that are provided during a hospital stay—was actually damaging its fee-for-service business. That impact on profits could potentially have limited the investment dollars available to prepare for capitation. In contrast, initiating process redesign efforts to reduce overall costs would have positive benefits in both fee-for-service and capitated markets.

The timing of the investments is also important, because it affects the amplitude of the cross-currents. For example, it does not particularly matter if an investment in a new business line hurts the traditional business if you are almost out of it. Sequencing possible activities, investments, or actions can therefore prevent or diminish the possible cross-currents. A system dynamics simulation model can provide a setting in which to experiment with the impact and timing of various strategies.

Jennifer Kemeny is an independent management consultant. She has a B. A. from Dartmouth College and has done doctoral work in the system dynamics department of the MIT Sloan School of Management.

Editorial support for this article was provided by Colleen Lannon.