If accountants (“those bean-counters”) are so dumb and we (“who really know this business”) are so smart, why do they run our companies? We complain that budget-mania closes off profitable ventures. We blame accountants when we scramble to meet performance goals. “It’s not our fault,” we say. “We have no choice but to wreak havoc on our company’s long-term well being; we must manage by the numbers. The enemy is out there.” Or is it?

There has been much grumbling in recent years about the outdated accounting systems that are straitjacketing most companies. Some innovators have implemented new systems — activity based accounting, non-financial performance measures, critical success factor analysis. But most reforms fall short because their underlying purpose remains the same — to provide financial control by “keeping score” in the game of business. This is like coaching a team by looking at the points on the scoreboard rather than the action on the field. If we want our accounting systems to foster a learning organization, their primary purpose should change radically. Instead of describing what already happened, they must enhance a group’s ability to explore, articulate and understand their reality.

The Language of Business

Accounting has long been called the “language of business.” Most of us think of language as a means for describing the world around us, just as accounting describes the status of an organization. But the power of language goes much further. It can serve as a medium through which we create new understandings and new realities as we begin to talk about them. In fact, we don’t talk about what we see; we see only what we can talk about.

“Managing ‘by the numbers’ is like trying to coach a team by looking at what is on the scoreboard rather than how the action is unfolding on the field”

Our perspectives on the world depend on the interaction of our nervous system and our language — both act as filters through which we perceive our world. In business terms, the language and information systems of an organization are not an objective means of describing an outside reality — they fundamentally structure the perceptions and actions of its members. To reshape the measurement and communication systems of a company is to reshape all potential interactions at the most fundamental level. Language (accounting) as articulation of reality is more primordial than strategy, structure, or corporate culture.

Management accounting systems both communicate and shape the goals of an organization. They form the critical communication channels that enable a decentralized enterprise to run as a coherent body. When they confront individuals with the global consequences of their actions, they can unite the organization to pursue a common goal. When they promote sub-optimization and defensive routines, they can blind the organization to the point of disintegration.

If accounting systems are to support the activities of the learning organization, we need to recognize that these systems are very much tied into our mental models — they dictate where our attention should be focused. In most organizations we don’t measure what is important, we measure what is measurable. How do we know, then, if organizational learning is occurring if we can’t measure it?

Double-Loop Accounting — Going “Meta”

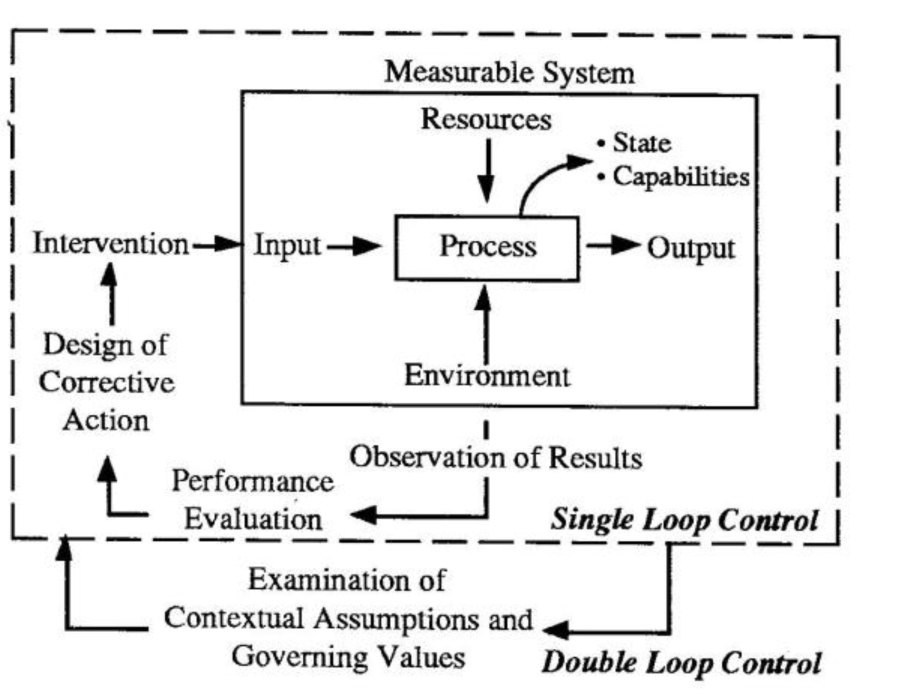

The concept of double-loop accounting is the analog of Chris Argyris and Donald Schon’s work on single-loop and double-loop learning. In single-loop learning, people respond to changes in their organizational environment by detecting errors and correcting them to maintain the current or desired status. Single-loop learning does not encourage any reflection or inquiry that may lead to a reframing of the situation — it focuses on analyzing and correcting the problem at hand. Double-loop learning, in contrast, involves surfacing and challenging deep-rooted assumptions and norms of an organization that may lead to a reformulation of the problem.

How did we get into this mess? (Or, the history of accounting)

How did control become interpreted as manipulation instead of detection and correction of error? How did accounting turn into scorekeeping instead of strategy-supporting? Why didn’t we think of accounting as a neural-linguistic system that enables a group to coordinate its perceptions, interpretations and actions in pursuit of a common goal? A historical reconstruction of the origins of accounting is both an answer to these questions and a first step toward changing the future.

In the middle ages, as overseas trade flourished, merchants began banding together and collectively buying ships to transport their goods. Because of the high-risk investment required, groups of traders pooled their resources to spread the risk (This is the same idea behind the stock market: spread the risk so shareholders can maintain low-risk portfolios even if their shares arc invested in high-risk companies).

Although the merchants owned the ship, the captain was solely responsible for managing their investment. The merchants needed some guarantees that their money would be spent wisely. They developed a series of control measures that have evolved into our complex system of modem financial accounting — the way companies communicate with their stakeholders through financial statements, earnings forecasts, quarterly reports, etc.

By the 19th century, the industrial revolution was pushing companies to grow larger and larger. Economies of scale and scope fostered organizations whose size exceeded the management capacity of existing methods. Managerial accounting systems, which allow companies to communicate internally, became necessary. These systems were intended to give the managers a yardstick for evaluating their performance, pinpoint problem areas or future possibilities, and communicate the status of their department to others. Though the purpose was much different from financial accounting systems, they borrowed many of the same policies and practices.

Financial accounting systems are designed for stewardship, control and external reporting. They are focused on gathering accurate information — providing snapshots of the business. Managerial accounting, however, is about understanding the dynamics of the business and how today’s actions impact the future. Both accounting systems are necessary for a productive economy. The problem is that we are using financial reports to inform our management.

Financial accountants are sort of like insurance company doctors — their job is to make sure that the company is not misrepresenting its “health” to those who pay the bills. They are ultimately concerned with costs. There is nothing wrong with insurance company doctors — there wouldn’t be health insurance without them — but we wouldn’t go to them for treatment. The relationship of openness and trust we develop with our personal physicians is vital for effective treatment. Similarly, there is nothing wrong with financial accountants — there wouldn’t be publicly held companies without them — but we shouldn’t let them run our companies. By putting financial accountants in charge of creating and maintaining managerial accounting systems, in effect we are letting our companies be run by the insurance company’s doctor.

Similarly, while single-loop accounting explains how things are being done, double-loop accounting explores why they are done that way. If we used single-loop accounting to evaluate a quality improvement program in our company, we would first set a goal (such as a 50% reduction in defects) and develop strategies for reaching that goal — training programs, more quality inspections, and dismissal threats for workers with high numbers of defects. We would then gather data to gauge our improvement (such as number of defects per 1000 parts), evaluate our progress, and implement corrective actions (see “Double-Loop Accounting” diagram).

Say at the end of the first year we get a report that says quality only increased 20%. A typical single-loop response might be, “It seems our workers still aren’t committed to quality. Our initial training programs didn’t go far enough. Let’s raise their awareness with slogans to educate them and fire some more people to show we’re serious.”

With double-loop accounting we would go through a similar strategy development, data collection and evaluation process, but our analysis would go one step further. Rather than only questioning what was wrong with our implementation strategy, we would begin to question how our policies and structures might be actually impeding the employees’ quality efforts. We would begin to explore the governing structures of the organization that are behind the outcomes.

For example, say we took a tour of the shop floor and noticed “Quality is #1” signs posted everywhere. We talked with the workers and heard their frustration about taking blame for quality problems beyond their control. Talking further we learned that their individual bonuses depend on how many chips they produce above or below the plant’s average. We might begin to hypothesize that the problem is not with the workers’ commitment to quality but with the division’s management philosophy.

Double-loop accounting prompts us to “go meta” — to get below the surface and explore the philosophy underlying the unsuccessful actions. What leads the managers to believe that workers are not committed? How can they inquire into the workers’ claims of frustrating conditions? How can we synthesize managers’ and workers’ understandings (and misunderstandings) into a coherent picture that they can use to take effective action? In essence, double-loop accounting takes us beyond the simple reporting of numbers. It questions where those numbers came from, why they are important, and allows us to pinpoint leverage points for creating effective change.

Double-Loop Accounting in Practice

I have had the opportunity to participate in efforts to revamp the management accounting systems of two major automobile companies. These companies started general overhauls of their cost systems to gain a more accurate picture of actual costs. However, in their fascination with technological solutions, they placed little attention on creating levers for translating these reports into effective actions. The new activity-based costing system gave them a more accurate picture of current reality (single-loop accounting), but it did not help them to explore ways of articulating a common understanding and improve the system as a whole (double-loop accounting).

About a year ago, a plant manager, a department head, and I began an experiment at an engine plant: we designed and implemented a new performance management system based on double-loop accounting principles. In essence, we expanded the concerns of the measurement system to three areas: observation, common interpretation, and coordinated action. Instead of imposing a new reporting system from our “expert” perspective, we started by asking the workers what would help them better understand their impact on the department’s performance.

We helped workers design and produce “Daily Performance Reports.” These reports gave them immediate feedback on the performance L of the department — quality levels, scrap rates, tooling costs — in terms that they could understand. When they experimented with different procedures, they were able to see immediately how those procedures contributed to the productivity of the department. Although the “Daily Performance Reports” might be considered inaccurate from a general accounting perspective, they helped the employees gain ownership of the numbers and improve their systemic under-standing of how their actions contribute to the plant’s performance. The project is now being extended to several other departments in the engine plant.

Corporate Umpires

Three baseball umpires were discussing their views on balls and strikes. “I call ’em as I see ’em,” said the first, a realist. “I see ’em as I call ’em,” said the second, an idealist. “They ain’t nothin’ till call ’em,” said the third, an existentialist. Depending on which view we take, we probably see accountants as bean-counters, business controllers, or cultural architects.

Umpires and rules do a lot more than define strikes and balls, they allow the game itself to exist. Likewise, accounting and accountants do a lot more than define profitable divisions and products, they allow capitalism itself to exist in its present form. “Infield fly” rules determine strategy, game outcomes, and player contracts; profitability rules determine promotions, plant closings and workers’ lives.

Double-Loop Accounting

I see the task of management accounting as the design of a corporate nervous system. A system tailored to structure an informational environment where the organization can position itself for maximum strength and flexibility. A “good” accounting system should allow managers to interpret a complex reality in ways that open fruitful possibilities for action. It should lead managers to ask the right questions — as opposed to provide them with the wrong answers.

If we understand how the information and incentive mechanisms of an organization condition its ability to learn, we can begin to design new systems that nourish (not strangle) creativity and innovation. Rather than being impediments to innovation, accounting systems could become the very drivers toward the development of a learning organization.

Fred Kofman is an assistant professor of managerial accounting at the MIT Sloan School of Management. He is directing one of the pilot projects of the MIT Learning Center, which will explore ways to better coordinate the operations of a decentralized supply chain.