TEAM TIP

In a group, consider how the “global to local paradox” might play itself out in your organization. How do management’s goals and incentives differ from those of people on the local level? What are the unintended consequences of this gap? What changes could be made to bring the two perspectives closer together? How might you spread awareness of this paradox and its adverse effects? To take the discussion to a deeper level, you might create a causal loop diagram of the system, following the one shown in this article as a model.

These are two common pleas for help heard in organizations these days.

When reflecting on why certain systems behave the way they do, we regularly look for patterns of conflict among strategic resources within the organization. Strategic resources are those resources that management knows are important to the survival and long-term health of the organization. This conflict among strategic resources often seems to be due in great measure to what we call the “global to local paradox” of management practices.

Management and operations rarely communicate effectively because they are seeking opposite results from the same organization.

The global to local paradox reflects the impact of the difference in philosophy in various levels of the organization as to what to do with strategic resources. The global perspective refers to management’s goals and incentives, as defined by their role in getting the overall organization to achieve the goals and incentives of its shareholders. The local perspective refers to the goals and incentives that motivate people within the different areas to do what they do every day in performing the work of the organization.

The Paradox

The global to local paradox is the difference between management’s desire to continually grow global output at increasing rates for the shareholders over time versus operation’s need for local stability to maximize asset use, provide predictable returns from investor’s capital, and continually satisfy worker’s personal needs. Some implications of this unintended conflict are clear.

Management and operations rarely communicate effectively because they are seeking opposite results from the same organization. In response to shareholders’ demands, management pushes operations to take advantage of market opportunities and to grow output exponentially. This is what management gets paid to do. Operations strives to address growth within their capacity and cost constraints, mainly by boosting productivity. This is what they get paid to do. In essence, management is paid to focus on bringing tomorrow to reality, and operations is paid to focus on optimizing today’s reality.

Much focus in current management practice is placed on identifying and implementing methodologies for aligning the global and local goals toward satisfying shareholders. If the organization is not achieving its goals, it is assumed that something is not aligned. Since management’s goals and incentives tend to be identified more directly with those of shareholders, then, by definition, what we are really saying is that the local goals are not aligned with the global goal. This assumption leads to the conclusion that local goals need to be modified and shifted in the global, or shareholder, direction.

GLOBAL TO LOCAL PARADOX

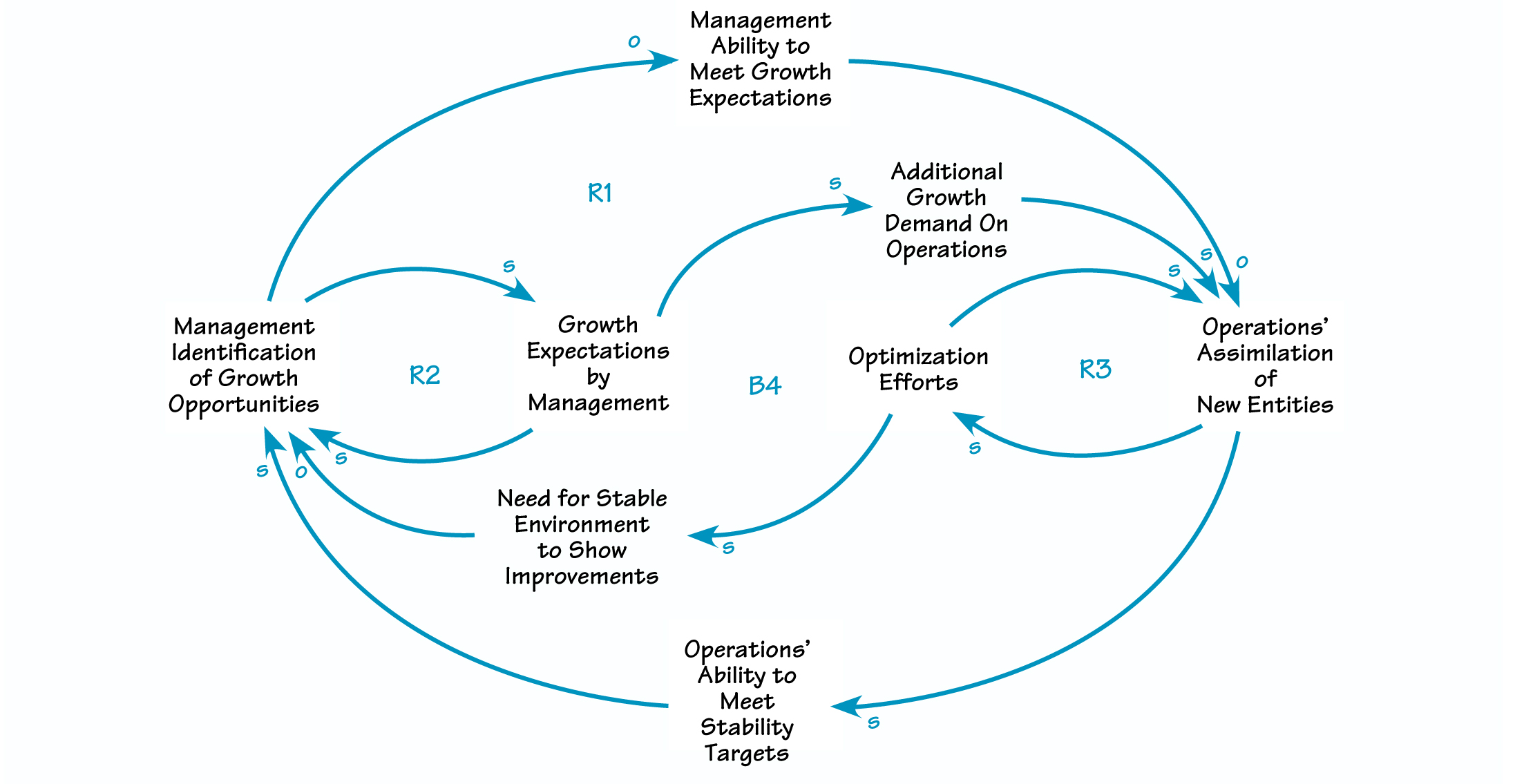

In this example of the “Accidental Adversaries” archetypal structure, managements’ focus on growth (the global perspective) unintentionally undermines operations’ ability to optimize performance (the local perspective). The solution is to map out the organizational dynamics to develop a sustainable set of expectations for the firm as a whole.

In response, management places growth and flexibility demands on operations, requiring much faster turnaround times and internal growth rates than the typical productivity gains operations can deliver from optimization efforts. To solve the problem, management searches for additional capacity, internally or externally. Operations, in turn, is subjected to a constant stream of criticism regarding their inability to keep up the pace. This conflict not only stresses the relationship among the individuals in the firm, but also reduces the potential for achieving results — people spend more and more energy defending themselves from attack. We see this pathology in newspapers everyday.

What Is The Systemic Under-standing of This Paradox?

This paradox is an example of the “Accidental Adversaries” archetypal structure. In “Global to Local Paradox,” the virtuous cycle (loop R1) shows management’s focus on growth. As the organization grows, shareholders exert more and more pressure on management for returns, pushing them to find new opportunities. Over time, increasing the return on investment becomes increasingly difficult, as fewer opportunities are large enough to fill the new expectations. The company either must make more, smaller acquisitions or initiate a major transformation.

While management is looking for a steady ramp up in growth over time (loop R2), additions to internal capacity influence the operations area, or local perspective, in step changes. Each new acquisition presents the same challenge to the people doing the work inside the firm: They must determine which elements from the new acquisition stay and which go, and then they must figure out the best way to optimize the new mix. Operations research literature indicates that this constant adoption of new elements in a world that is trying to optimize creates tremendous tension for the folks doing the work on a daily basis.

Moreover, operations is judged on their ability to keep costs down and optimize the existing asset base. However, to truly do their job well, they need a stable environment in which to focus on optimizing the resources under their control. There is a physical limit to what they can get done at any point in time. This local perspective is seen in loop R3, as operations pushes hard on optimization efforts to achieve their goals. The essence of the global to local paradox is shown in the diagram in the variables:, “Growth Expectations by Management” versus “Optimization Efforts” by the operations team.

What Can We Do?

The most challenging issue facing the people living this conflict is that it crosses the strategic and operational interests of the organization. The folks doing the work do not often have all of the information that those running or financing the firm have. They are paid to look at very different pieces of the organization and rely on very different mental models in evaluating what to do next.

So, what can we do to mitigate the effects of the paradox? As with most systemic issues, awareness that the conflict exists is the best place to start. Developing a systemic view of the conflict with a more detailed causal loop diagram or in some cases stock and flow model is fundamental. This causal map facilitates study of the archetypal pattern of behavior and unravels the roots of the underlying behavior this paradox creates. In addition, the causal map invites the organization to investigate the diverse motivations across functional lines in the organization, which create potential internal conflict (see “Breaking Down the Functional Blinders: A Systemic View of the Organizational Map,” The Systems Thinker, Vol. 10, No. 10, p. 6-7).

In some cases, when the group wishes to test the cause-effect relationships in their map, they build a dynamic business simulator. What is critical is to make explicit the linkages among the key resources, expectations, and incentives that each group holds to be important in a way that shows respect and rigor around each view. One way to do so is to involve the entire team in developing the computer model. Engaging shareholders, management, and operations in discussions around the results of the systemic understanding of the causal map is a highly leveraged method for building communication bridges across the paradox.

Practically, there will be issues that the senior management team cannot share explicitly with a broader audience during these sessions, such as the intent to acquire or sell specific assets. Yet the discussion of what effects such actions may have on the ability to achieve stated goals should be included. By understanding what motivates groups at the local level, management can better understand the effectiveness of the incentives they have put in place in generating desired behavior from the different areas of the firm.

In one case, a large capital equipment manufacturer’s sales were rebounding from a cyclical downturn, yet the firm was not generating the expected improvements in profit.

Systems tools expose many fundamental, unquestioned assumptions.

Management thought the marketing group was doing a fantastic job, while the assembly group was letting the firm down through late deliveries and financial penalties. Looking at the dynamics and incentives in detail, it soon became clear that management had set up the conditions for this underperformance to happen. Marketing was being paid based only on orders placed and did not have to worry about the firm’s ability to deliver on time. The marketing director commented “I know how to fix this, but you pay me to accelerate sales, so I will stick to selling as much as I can.”

Though obvious now, by changing the incentive so that marketing was paid based on orders delivered on time, management ensured that the marketing and assembly groups now worked closely together to sell only those units that could be delivered on time. By relinquishing a bit of market share, they were able to maximize profit and invest in additional capacity. Referring to the diagram, changing the marketing incentive released pressure on the “Additional Growth Demand on Operations” variable, slowing down the need for operations to expedite orders. To do so, management had to realign its “Growth Expectations” with the existing internal capacity.

Finally, systems tools expose many fundamental, unquestioned assumptions around the philosophy of “This is the way things are done here.” In working together, shareholders, management, and operations can minimize the effects of the global to local paradox and develop and achieve a sustainable set of expectations and results for the firm.