Excess manufacturing capacity in most industries is suppressing new capital construction. Home equity second and third mortgages are vulnerable to deflation in home values and to a surge of unemployment. The present large trade imbalance that now contributes to a high unearned U.S. standard of living is sustained only by selling our assets. This in time will be followed by a reduced standard of living when interest and dividends must be paid in the form of goods to foreign owners of U.S. office buildings, farms, corporations, and bonds. Growing deficits have expanded government debt during past good economic times to such an extent that government actions are severely restricted during this economic downturn when financial demands on government arc increasing.

“Is such an array of forces merely a streak of bad luck — are they only multiple coincidences? Or are they connected below the surface in a powerful process of economic change?”

Is such an array of forces merely a streak of bad luck — are they only multiple coincidences? Or are they connected below the surface in a powerful process of economic change? I believe the current economic imbalances are connected and arise out of a mode of behavior called the economic long wave (popularly known as the Kondratief cycle).

The economic long wave is controversial, both as to its cause and even to its existence. Those who believe in its existence see it as a great rise and fall of economic activity with peaks and valleys some 45 to 60 years apart. It is considered the cause of the great depressions of the 1830s, 1890s and 1930s. The nature of the economic long wave remained unclear because there has in the past been no theory for how it could be generated. Instead, depressions have often been attributed to accidents or mismanagements. For example, the Great Depression of the 1930s has been blamed on mistaken policies of the Federal Reserve. Most economic theory has been based on equilibrium, or steady-state conditions that leave little room for even imagining an economy that can persist in major long-term fluctuations between booms and depressions.

The National Model

However, within the last few years, at least one comprehensive and coherent theory of the economic long wave has come into existence. It is the System Dynamics National Model developed in the System Dynamics Group of the MIT Sloan School of Management. The National Model is a computer simulation model based on the policies followed by banks, industries, markets, and government. The model is self-contained and, unlike the more common econometric models, operates without external driving inputs for controlling its behavior. In it we fad that ordinary and well-known policies of business, banking, and government can interact to produce all the important kinds of behavior observed in an economy. The model exhibits stagflation (simultaneously rising unemployment and inflation) as occurred in the 1970s but that had previously been considered by many to be impossible. The National Model also creates an economic long wave with a major rise and fall of economic activity having peaks some 50 years apart.

Development of the National Model is being supported by financial institutions, corporations, and private individuals whose motivations range from wanting a more unified viewpoint to assist in making their own decisions, to those who believe that an alternative and more comprehensive approach is needed by the country to gain better understanding of real-world economic behavior. In semiannual meetings these sponsors examine implications of the research and assist in keeping the work closely coupled with practical concerns in the actual economy.

One Driving Force in the Long Wave

The Long Wave

The National Model provides a new and more systemic perspective from which to interpret the economy. The model exhibits a wide range of behavior that is seen in the actual economy and sheds new light on the meaning of many things that have been puzzling and controversial. For example, real interest rates (bank interest minus inflation) drop to low or negative values before a long-wave peak, as they did in the 1970s, and then quickly rise to high values after the peak as they did in the late 1980s and as they did in the early 1930s. (Such interest behavior seems little affected by government policies but is deeply imbedded in borrowing and investment actions of the private sector.) Prices and wages rise to a maximum shortly after the peak of long-wave activity and fall during deflation after the peak, as they did almost sixty years ago and as they are now beginning to do again. In the early part of a long-wave expansion, as in the 1950s and 1960s, money is borrowed to build factories. At a peak, as during the 1980s, depreciation cash flows and new borrowing are used for speculation in land, for corporate acquisitions, and for bidding up prices in the equities markets beyond the underlying business realities.

Conditions during the 1980s closely paralleled those of the 1920s. Corporate mergers reached a peak in the late 1920s as they have recently. The price of agricultural land peaked in 1920 and again in 1980. Waves of speculation moved through the economy, with the run-up of price for agricultural land coming early, speculative peaks and collapses moving through other physical assets, and ending in the peak and fall of urban land prices and the Wall Street stock market. As the year 1929 unfolded, the stock market became progressively more volatile with growing swings before the downturn that started in October and continued into the 1930s.

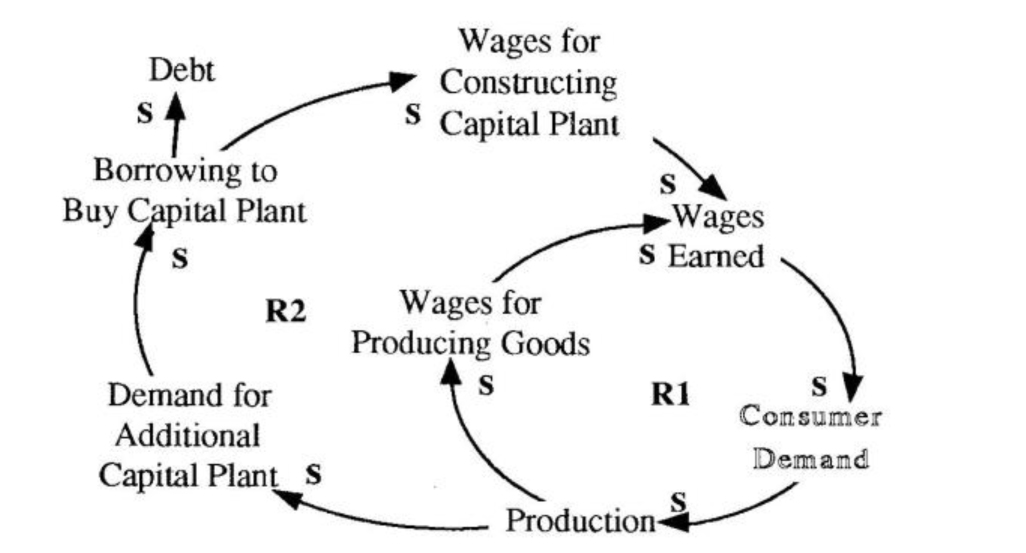

The central long-wave driving force is the over-building and under-building of physical capital investment — factories, machinery, offices, apartments, and homes. With this fluctuation of physical investment go other reinforcing changes in the economy. Construction of physical facilities increases employment and personal income that supports more purchasing and the apparent need for still more production facilities.

As an economy moves toward a peak and the need for more physical investment diminishes, government makes credit more freely available and introduces investment tax credits to sustain the boom, leading to still more excess physical investment. When prices begin to rise steeply during the late stages of an expansion, the inflation in price of physical assets (factories, homes, offices) encourages additional construction as an inflation hedge before prices rise still higher. The demand for more physical capital requires expansion of the capital-producing sectors of the economy for which they also need more capital plant. This “self-ordering” process adds still more to pressures for expansion and over-expansion. The result of all these forces is to encourage continuation of construction well beyond the level that is justified by long-term economic need. The excesses are now evident in over-capacity in many industries, in falling real estate values, and in agricultural difficulties of the last decade. But those stresses have only begun to clear out the accumulated economic imbalances. The larger corrections still lie ahead.

Since 1960, each short-term, three-to ten-year business cycle has been more severe than the preceding one. This appears to be consistent with activity at the peak and during the downturn of an economic long wave. The long wave affects the magnitude of business cycles. During a long-wave expansion, as in the 1950s and 1960s, a shortage of both physical plant and labor limits the overbuilding of inventories of goods and restrains excesses at the tops of business cycles. Also, during the long-wave expansion, there is an excess of consumer demand, which keeps the economy from sinking as far into recession.

However, conditions change after the expansion phase of the long wave. During a long-wave peak and downturn, the short-term business cycle grows in both its up and down swings, as has been the case since the 1980s. On the up side, excess physical capacity and labor allow overexpansion of business-cycle recoveries, while on the down side, demand is no longer strong so recessions are deeper. The strong business-cycle recovery that began in 1982 is consistent with being in a long-wave downturn and has proved to be more an indicator of economic vulnerability than of enduring strength. The trend of worsening business-cycle downturns can reasonably be expected to continue for at least one and probably two more recessions.

After examining a broad range of evidence from the last three decades, from the 1920s and 1930s, and to a lesser extent from the 1890s, one can conclude that the peak of the recent long-wave expansion occurred during the 1980s and that the best estimate of the low point in the long-term downturn will be in the mid-1990s. This means several more years of economic cross-currents and readjustments as the great imbalances in the economy are corrected.

Productivity and the Long Wave

Consider the first part of the rising phase of the long wave such as occurred from 1945-1965. In 1945, capital plant was inadequate everywhere in the economy; the capital-to-labor ratio was low; workers did not have enough capital equipment for efficient production; and productivity was low. At that time, high economic incentives for adding capital plant led to an aggressive increase in the capital-to-labor ratio. Each addition to capital plant substantially increased productivity. But in time, the most urgent needs for plant and equipment had been met.

In the second part of the rising phase of the long wave, which I believe lasted from about 1970 through the 1980s, return on investment declines because there is progressively less need for capital equipment in many industries. Unused capacity grows. Most workers have adequate capital equipment for efficient production. Additional capital plant yields less improvement in productivity because the most urgent needs for capital have already been met. By the time the late stages of expansion have been reached, the folklore has taken firm root that more capital plant is expected to increase productivity. In fact, however, capital plant has reached the point of diminishing returns. With the capital-to-labor ratio already at a high level, it becomes increasingly difficult to increase productivity by adding still more capital equipment. For any particular state of technology, each increase in the capital-to-labor ratio yields a progressively smaller increase in labor productivity.

Evidence of the declining need for new capital plant was seen in the merger mania of the 1980s. Governments made liberal credit available to encourage new physical construction, believing that more physical investment would increase productivity. But, with declining need and justification for such construction, much of the credit was used instead to acquire existing plant owned by other companies.

Faltering rise in productivity is to be expected in the late expansion stage and early downturn of the long wave. At the peak of a long wave, the capital plant for the current technology has been overbuilt. No more is needed of that particular kind of capital plant. But the existing capital plant is relatively new and is serving well, so the time has not yet arrived to replace it with the next wave of radically improved technology. The new replacement technology must wait for the old to be worn out, depreciated, and discarded.

International Consequences

The economic long wave is a world-wide phenomenon. Trade and money flows lock the world economies together into about the same timing of long-wave rise and fall. Excess production exists on an international basis. Every country is trying to solve its domestic economic weakness by exporting more than it imports, which is not possible. The total must balance. The solution must come from inside each country; individual internal balances must be reestablished.

Long-wave peaks and downturns are times of great international danger. World War I occurred at a peak of the long wave and World War II was a valley war in the long wave. Such peak and valley wars have occurred before. The political conditions at peaks and valleys are quite different. In a downturn, as internal economic difficulties become more acute, there is a tendency for governments to divert citizens from domestic economic disappointments by posing an external threat. Political attention is focused on military interventions, while the greatest threat to the future well-being of the country lies in the worsening domestic social and economic conditions.

When a military threat is perceived, massive resources are poured into weapons research and procurement. But as an economic threat emerges, the symptoms are denied, empty promises are made, and understanding is considered impossible. As a result, actions taken in the absence of understanding often make matters worse than they need to be.

Future Trends

I see the volatility of the stock market in recent years as an expected symptom of growing economic imbalances. As more and more people sense weakness in the underlying economic foundations, they become poised to jump quickly in either direction in response to smaller and smaller surprise events. The market has been going up only because the market was going up. How long the speculative mania will last is not predictable. But one can predict that a rising market based on hope alone is vulnerable. Those who stay in the market must be willing to live dangerously against increasingly unfavorable odds. The fundamentals of the economic long wave point to a downward trend for the next several years.

Jay W. Forrester, Germeshausen Professor Emeritus at the Massachusetts Institute of Technology and former director of the MIT System Dynamics Group, is the founder of the field of system dynamics. Since his retirement in 1989, Dr. Forrester has been working toward bringing system dynamics into junior and senior high schools as the basis for a new kind of education.