Spurred on by the vision of making a fast buck, many investors are treating the stock market like a casino. They put money into a hot company, only to pull it out a few days later and a few dollars richer. They then turn to the next company, make a quick killing, and move on.

Industry insiders refer to this turnover of investments as “churn.” And churn is on the rise throughout the business world, from newly hatched Internet companies to tried and true blue chips. According to Business Week, “Some 76% of the shares of the average U. S. company listed on the New York Stock Exchange turned over last year. That’s up from 46% in 1990 and only 12% in 1960.” Even more startling is the length of time that buyers keep stocks:, “The average share in Amazon.com Inc. is now held for seven trading days…Even Microsoft Corp. shareholders don’t hang around long: less than seven months, on average.”

PRESSURE FOR FAST PROFITS

The rising number of short-term investors puts pressure on management to take actions that will pay off in the near future. But such an approach can undermine the company’s long-term prospects.

Analysts attribute some of this, “get-rich-quick” mentality to the growing number of day traders, who seek to make a living by strategically buying and selling stock. Others blame mutual fund managers, who continually juggle their portfolios in order to compete with countless other investment vehicles. But regardless of the source, churn has become a major challenge for business leaders.

Fast Profits, Long-Term Problems

In the current market, lack of stockholder commitment may not be a serious issue. But the article cautions, “If the market stalls or declines, many observers believe that impatient shareholders will bolt, turning what would otherwise be a normal retreat into a full collapse.” Even when times are good, shareholders eager for return scan pressure a management team to focus on short-term results than on strategies for long-term success.

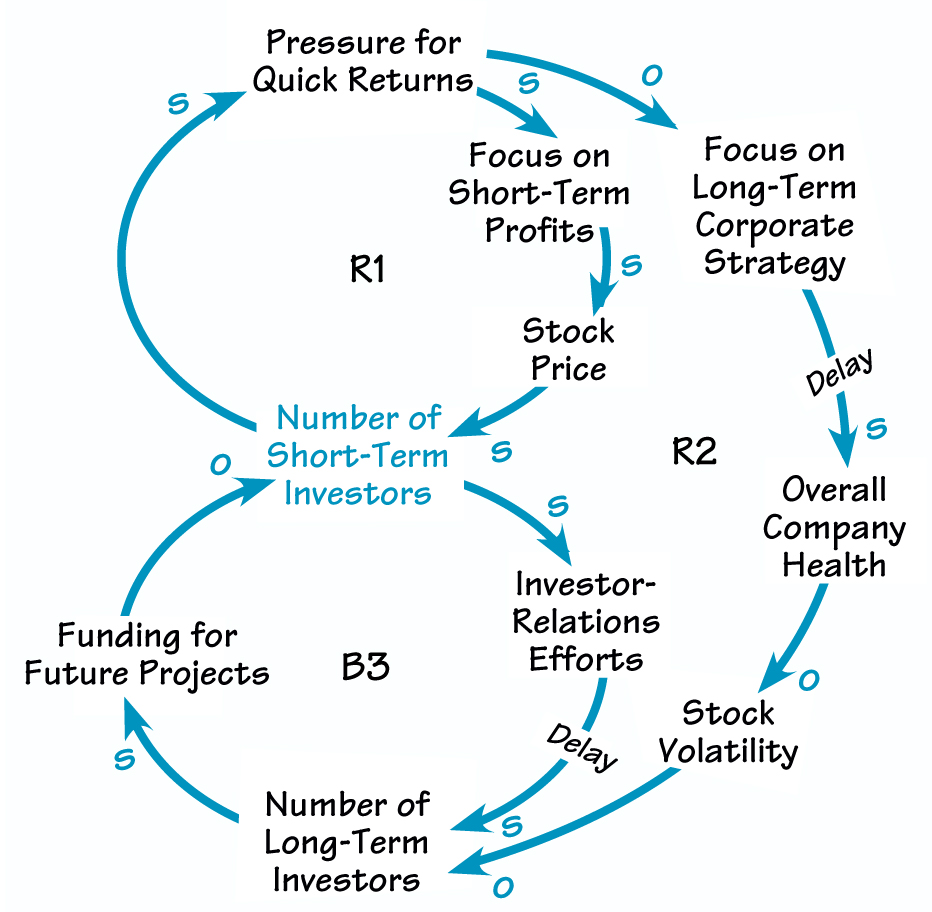

In “Pressure for Fast Profits,” the rising number of short-term investors puts pressure on management to take actions that will pay off in the near future in the form of higher stock prices (R1). But focusing on the present undermines the company’s overall health, making it more susceptible to fluctuations in stock prices and scaring off long-term investors. The organization in turn increases its focus on quick profits, which attracts larger numbers of short-term investors(R2).

However, longer-term stockholders are key to ensuring that a corporation has the funding it needs to invest in tomorrow’s products and services. Having a reliable source of capital is especially important for businesses that require a lot of R&D like pharmaceuticals or those that are in the process of restructuring. For that reason, several organizations have devoted resources to courting and keeping more patient investors (B3). In addition to boosting the strategic role of the investor relations function, other businesses have enlisted the services of, “matchmakers” to identify buyers interested in a longer timeframe.

When companies sacrifice future stability for current gains, they become vulnerable to the vagaries of the investor pool and risk a wholesale decline over the longer term. But by keeping in mind the organization’s vision, values, and long-term goals, managers can prevent their businesses from falling prey to the lure of fly-by-night stockholders.