Despite the booming economy, times are tough for many businesses, especially those in competitive industries. And when times get tough, many executives give in to the temptation to make their business look healthier than it really is—and thus earn their usual bonuses or gain other benefits. There are lots of ways—some legal and some illegal—to improve the look of the bottom line. Business Week refers to legal means of burnishing a company’s image as “aggressive accounting.” Examples include minimizing environmental liabilities, stretching out depreciation of inventory, making a big marketing push at quarter’s end to drum up sales, and other creative measures. The problem comes when executives pressure auditors to accept marginal accounting practices because “everyone’s doing it.” So, rather than insisting that their clients uphold higher standards, auditors sometimes “look the other way,” often missing warning signs that a company is playing fast and loose with the books—at times to the point of undermining its long-term health or even breaking the law.

“Unfortunately, auditors seem to have allowed more and more of their clients to undercut the trustworthiness of their reported numbers with aggressive…accounting for everything from restructuring or acquisition write-offs to the way sales are booked.”

– “Where Are the Accountants?” Business Week, October 5, 1998

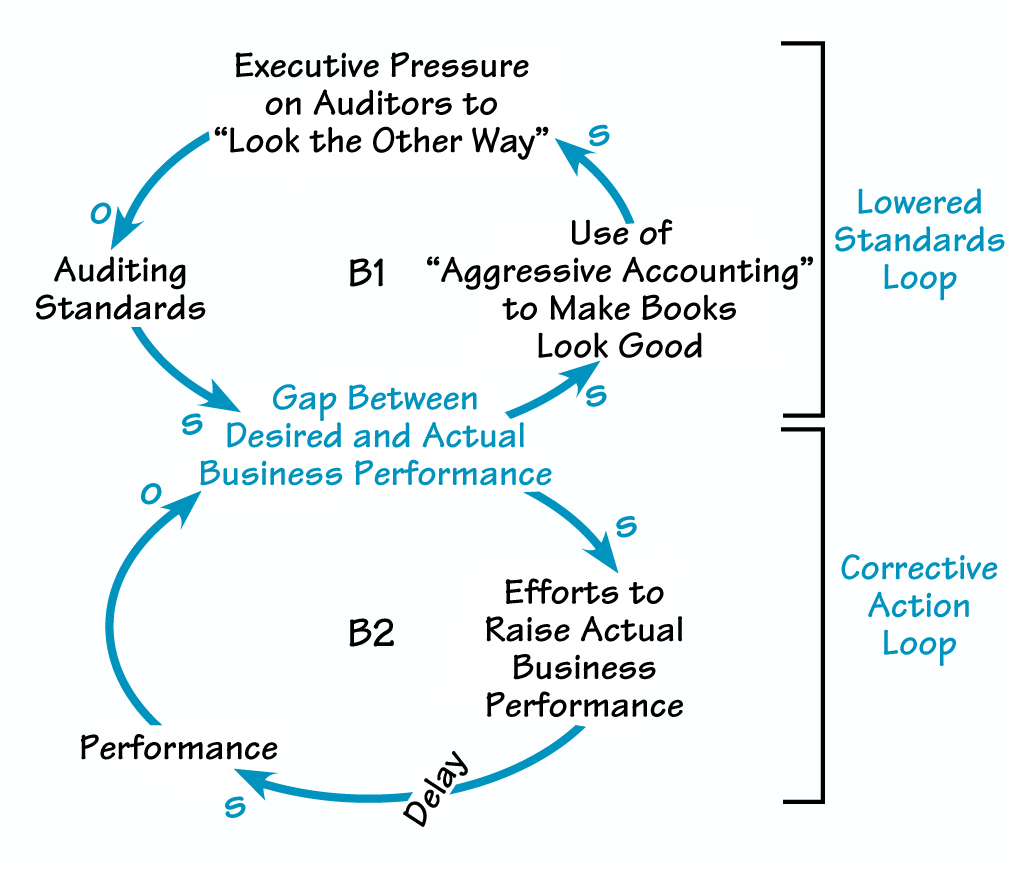

These activities indicate a systemic structure at work that may be forcing accounting standards down. The change begins with a few companies letting their accounting standards slip and spreads as businesses look to each other to set accounting standards. This situation can be seen as a classic example ofthe “Drifting Goals” archetype, in which a gap between desired and actual performance often prompts people to lower the goal rather than take true corrective action. The catch is that, by lowering the goal, we set in motion a dynamic that keeps pushing the goal even lower—until we no longer remember what our original standards were.

DRIFTING STANDARDS

By lowering our standards, we set in motion a figure-8 dynamic that keeps prompting us to lower our standards even further each time the gap between desired and actual performance widens.

A Closer Look at Drifting Goals

To see how this happens, let’s walk through the figure “Drifting Standards.” The upper loop shows the dynamic chosen by executives and auditors looking for the easy way out when the company’s performance falters (B1). As the gap between desired and actual performance widens, the company engages in aggressive accounting practices to make the books look good. This reliance on “iffy” practices prompts executives to pressure auditors to “look the other way,” which lowers auditing standards if accountants give in to the pressure. The lowering of standards in turn gives the false perception that the disturbing gap in company performance has actually narrowed.

Setting this loop in motion is dangerous because it takes away our incentive to initiate true corrective action. As we can see in B2, when we close the gap by lowering our standards, we may see less of a need to make efforts to raise our company’s actual performance. When these efforts decline, actual performance eventually declines, which once more opens the gap—prompting us to lower standards even further.

Many people enjoy painting accountants as the unassuming “number crunchers” of the business world. In the auditing arena, however, the eroding vigilance by auditors—along with an ever-growing temptation on the part of executives to “cook the books”—has sobering implications for everyone.