The Chinese government has been working to avoid many of the economic problems experienced by other Asian nations. By controlling debt and making judicious expenditures and investments, the country’s leaders have been able to sustain a growth rate of over 6.7 percent— until recently.

To maintain this level of economic growth, Beijing has stepped up spending on infrastructure improvements. At first glance, it would seem that, through this modified “trickledown” strategy, the country’s leaders have found a way to overcome the troublesome dynamics often seen in the “Growth and Underinvestment” systems archetype (see “China’s Investment in Growth”).

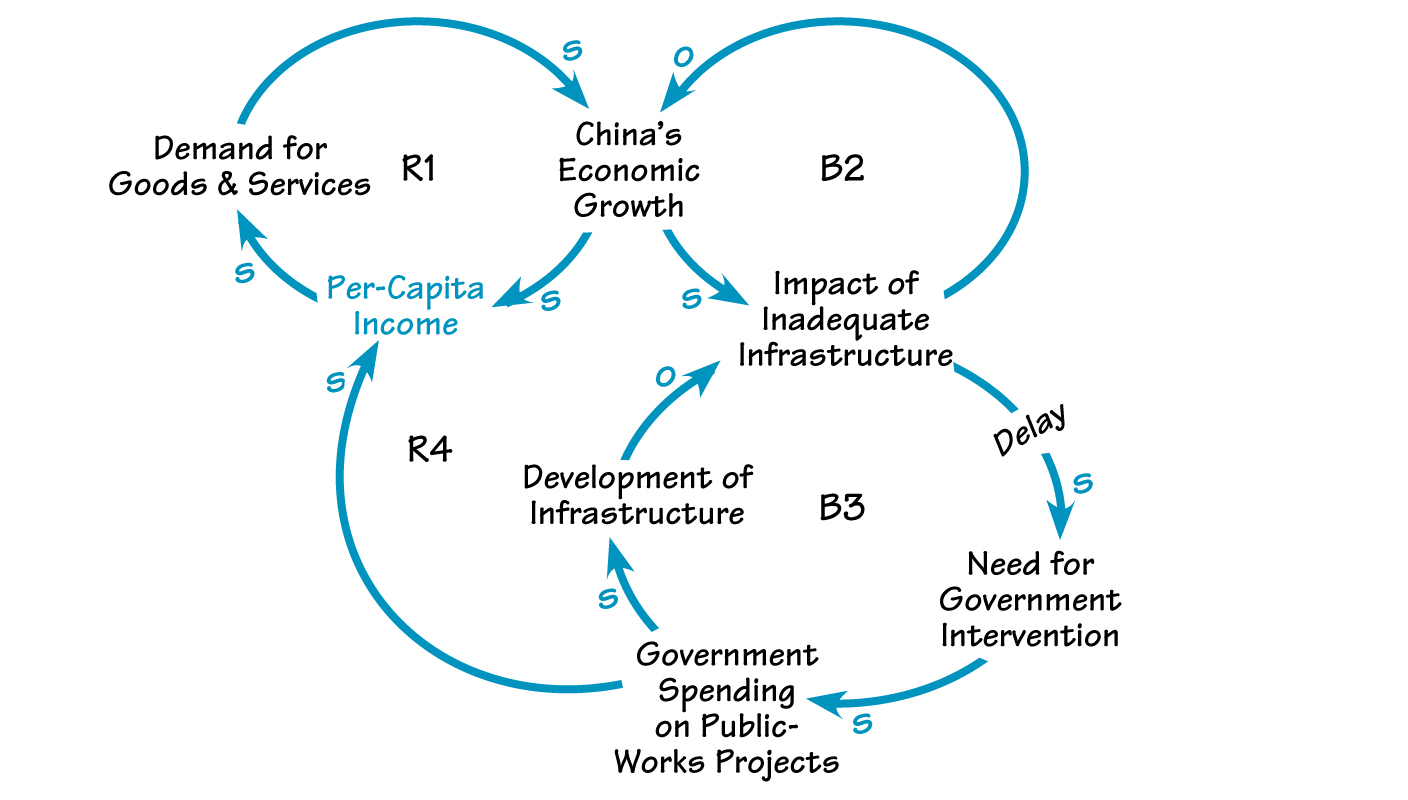

The government has set in motion a growth engine that they apparently hope will work as follows: As people’s income and ability to purchase goods and services increases, the country’s rate of economic growth rises, stimulating further spending (R1). Without ongoing investment in the infrastructure, the lack of adequate highways, airports, and electrical service could eventually serve as a brake on this growth (B2).

HEADLINESCHINA’S INVESTMENT IN GROWTH

As people’s income and purchasing power increase, the country’s rate of economic growth rises, stimulating further spending (R1). Without ongoing investment, an inadequate infrastructure could serve as a brake on growth (B2). To counteract these limits, the government has poured money into public-works projects (B3). Workers on these projects then have money to spend—further stimulating the country’s economy (R4).

To counteract these limiting factors, the government has poured billions of dollars into public-works projects (B3). Workers on these projects then have the money to spend on housing, television sets, and refrigerators—as well as to invest in new businesses back home—further stimulating the country’s economy (R4).

Growing Deflation

However, even as the government continues to use spending to stimulate the economy, there are indications of troubling trends. Retail prices fell by 3.2 percent in the first five months of this year compared to the same timeframe last year. According to Kynge, “Deflation is driving down corporate profits, triggering layoffs, and eroding consumer demand.”

The Chinese government seems to think that this unsettling news may indicate that not enough resources have been “trickling down” to consumers. To keep the country’s growth engine primed, some officials have proposed raising the wages of civil servants, in addition to guaranteeing minimum payments to the unemployed and pensioners. According to one official, “Giving money to the poor is an effective way to reflate. The poor have to spend just to get along. They don’t have the ability to put everything they get into the bank.”

China’s rising foreign debt may be a downside of this policy of growth through spending. Thus, it remains to be seen if the country has managed to invest its way out of the fate suffered by its financially strapped neighbors.

James B. Rieley is a senior manager with the Knowledge Services Business Solution Team of Arthur Andersen Business Consulting in London. Janice Molloy is managing editor of THE SYSTEMS THINKER.