Like many people, you’ve probably spent some time wandering the immense aisles of Toys “R” Us, gazing in awe at the endless array of dolls, games, and bicycles. Indeed, since the 1950s the successful retailer seems to have built its very empire on the expectation that customers would continue to be awed—and attracted— by its exclusive focus on toys.

But Toys “R” Us has apparently run smack into a limit that it never anticipated. As Rachel Beck points out, “Its reign as the leading U. S. toy retailer began to erode as the discount chains—Wal-Mart, Kmart, and Target—began adding more toys to their selling floors and offering them at cheaper prices.” In addition, “parents liked the convenience of stopping at the [competing] discount stores for groceries or garden supplies.” Perhaps increasingly busy in these hardworking, lean times and ripe for a bargain, customers began “quickly picking up that holiday gift or birthday present in [the discount store’s] fairly substantial toy department.” Even toy manufacturers are turning more and more to the discount chains because the chains are selling a broader collection of toys. All these changes have eroded Toys “R” Us’s market share, which fell for the first time last year—from 18.9 percent to 18.4 percent.

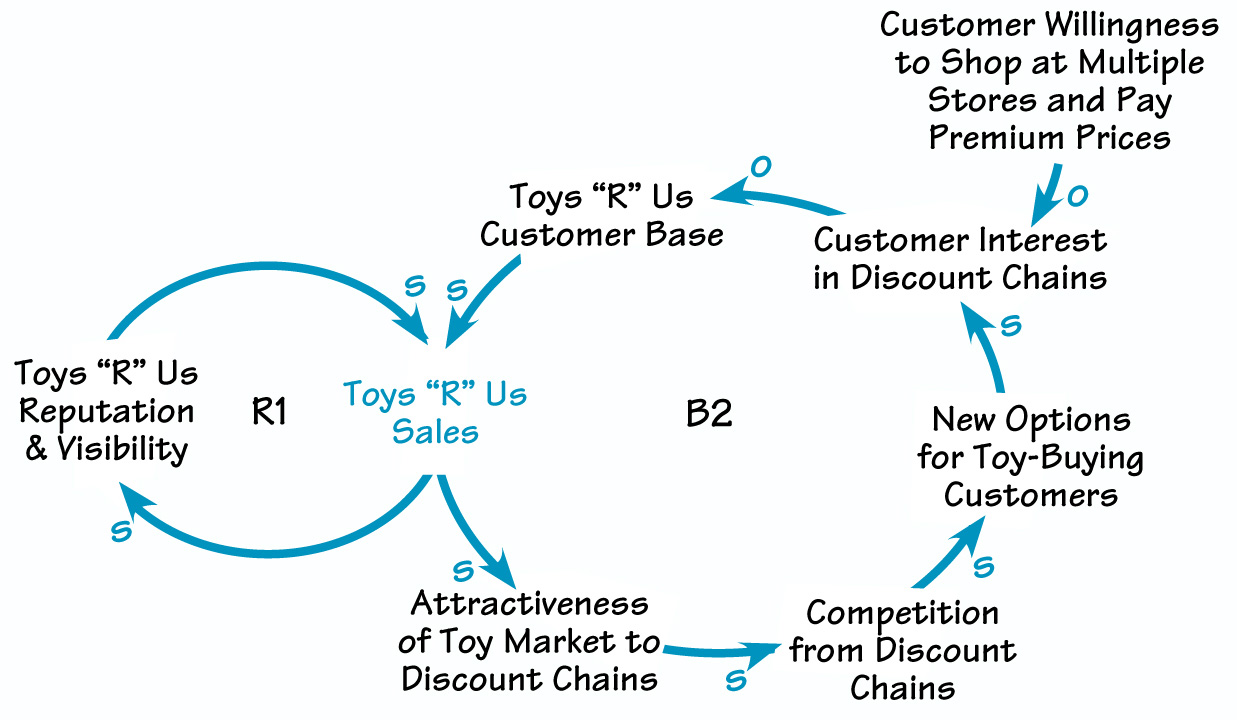

As Rachel Beck’s article indicates, Toys “R” Us’s current struggles stem from a complex mix of changes in the industry and in customer buying habits. However, within that mix we can spot the telltale signs of a “Limits to Success” systems archetype story at work (see “Limits ‘R’ Us’”).

Toys “R” Us has apparently run smack into a limit that it never anticipated.

In the diagram, loop R1 represents the growth engine that powered the rise of Toys “R” Us to the top spot in the toy-retailing industry. Yet, as often happens when a company begins to make a big splash in the market, Toys “R” Us’s success began to attract the attention of potential competitors—namely, discount chains who were eager to jump on the bandwagon. As competition from the discount chains stiffened, toy-buying customers reaped the benefits, enjoying a host of new purchasing options. Less and less willing to travel to different stores to shop, and increasingly resistant to paying premium prices for toys, some customers have begun abandoning Toys “R” Us in favor of the discount chains. Toys “R” Us’s customer base has consequently decreased, along with its market share (B2). In classic “Limits to Success” style, the company’s very success contained the seeds of danger to that same success.

LIMITS 'R' US

Customers’ decreasing willingness to shop at multiple stores and to pay premium prices for toys put limits on the growth of Toys “R” Us. When combined with new competition from the discount chains, this shift in buying habits may spell danger for the retailing empire.

How has Toys “R” Us responded to these troubles? As the article explains, the company has recently announced plans to close 59 stores and cut as many as 3,000 jobs. It has also slashed its inventory—a move that may hurt many of the large toy manufacturers. As we’ve seen, some of these manufacturers are already disenchanted with Toys “R” Us; loyal customers of the giant retailer can only hope that the company doesn’t start flirting with yet another archetype: “Fixes That Fail.”

Lauren Johnson is publications editor at Pegasus Communications.