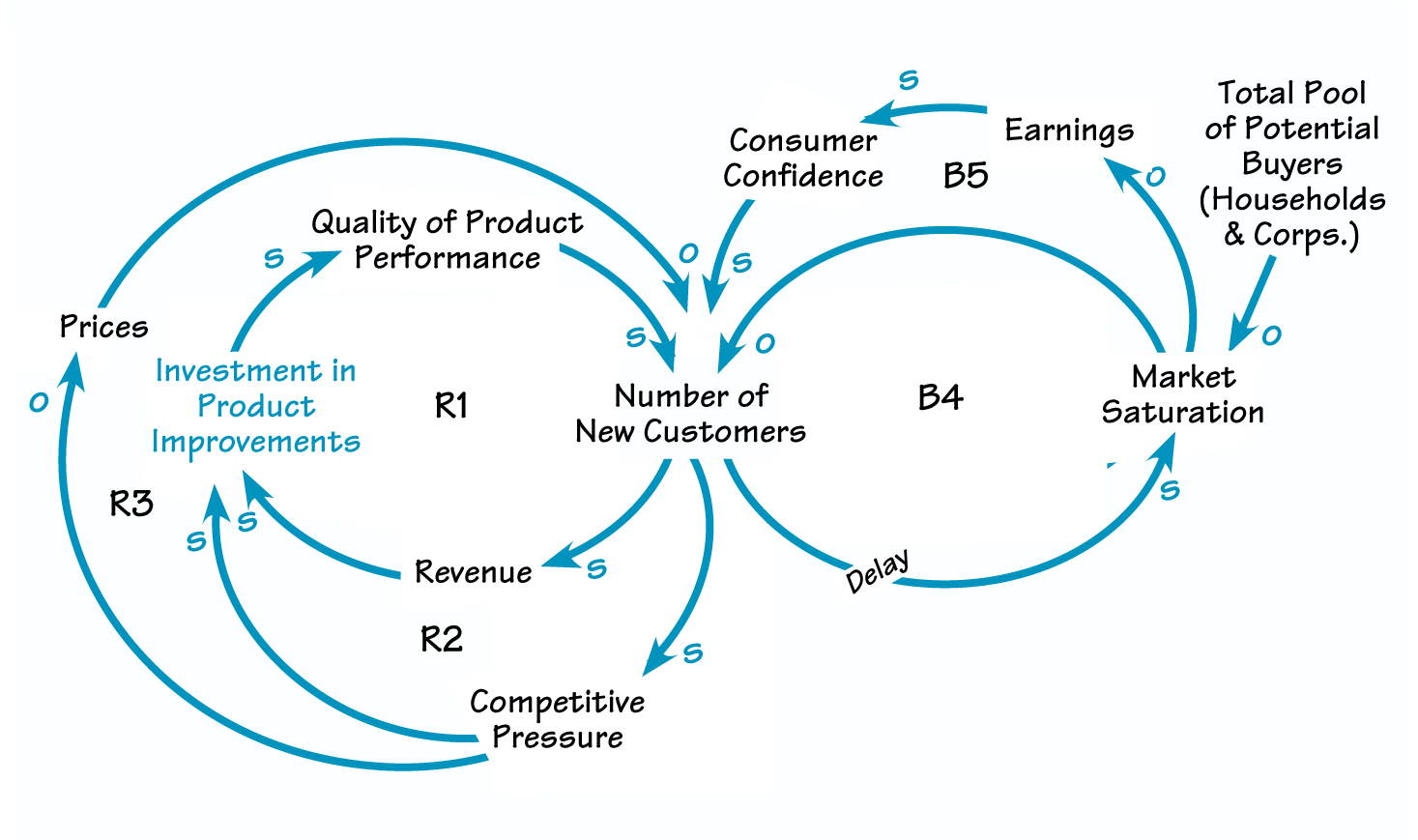

In the August “Systems Thinking Workout,” we introduced the question of whether the computer industry is beginning to experience market saturation. Julia Sager of Sager & Company submitted a causal loop diagram that depicts some of the variables at play in this scenario (see “Balancing the Computer Boom?”).

In Julia’s analysis, the growth engine kicks into high gear when PC makers beef up investment in product improvements, such as faster computing chips, new features, and so forth(R1). Such investment raises the quality of the performance of personal computers, which attracts more and more new customers. The flood of new business dramatically boosts revenues, letting PC companies invest even further in product enhancements. At the same time, as the number of customers soars, competitors take notice and jump into the fray, hoping to grab some of the action(R2). Stiffening competition prompts the original companies to invest even further in their products in order to keep drawing a steady stream of customers. While competitive pressure spurs additional investment, it also drives overall prices down (R3). As more and more companies offer products to customers, price becomes a distinguishing factor in buying decisions. And when prices begin to drop, new customers are once more tempted to buy.

As with any growth, the system will eventually encounter limits. In this case, one constraint is the total pool of potential buyers (whether households or companies). As the number of new customers climbs, the market gets increasingly saturated, which reduces the influx of new buyers (B4). With saturation, earnings per company also drop, eroding consumer confidence and further decreasing the number of new customers (B5).

BALANCING THE COMPUTER BOOM?

The growth engine can be seen in loops R1, R2, and R3. Competitive pressure further stimulates growth, by spurring additional investment (R2) and by driving prices down, which attracts more customers (R3). The constraint on the whole system is the total pool of potential buyers. As the number of customers increases, so does market saturation (B4), which eventually lowers the number of new customers (B5).

Looking for Leverage

Where might the leverage be in a situation of impending market saturation? A good first step is for companies to understand the inevitability of the “Limits to Success” phenomenon. This sounds simple but is often easy to ignore during boom times. Yet the total pool of potential customers is an unavoidable fact of life for any industry, and companies need to figure out ahead of time what they’re going to do when that constraint begins to make itself felt. Anticipating limits as well as finding ways to postpone their impact are the main leverage points for managing this archetypal structure.

In the case of the PC industry, as Robert Samuelson explained in the original article, market saturation doesn’t have to mean death. However, it does require a shift in strategy. For example, to delay the impact of saturating the U. S. market, American PC makers could look for untapped sources of new customers from overseas business. Or, they could shift their investment strategies to ancillary products and maintenance service for existing customers.

Different industries “mature” at different rates, and it’s still too early to say for sure whether the PC industry is hovering on the threshold of true market saturation. However, understanding the impact of limits on an initial growth surge is a vital strategy tool for any company.