The most successful organizations understand that the purpose of any business is to create value for customers, employees, and investors, and that the interests of these three groups are inextricably linked. Therefore, sustainable value cannot be created for one group unless it is created for all of them. The first focus should be on creating value for the customer, but this cannot be achieved unless the right employees are selected, developed, and rewarded, and unless investors receive consistently attractive returns.

What do we mean by value creation? For the customer, it entails making products and providing services that customers find consistently useful. In today’s economy, such value creation is based typically on product and process innovation and on understanding unique customer needs with ever-increasing speed and precision. But companies can innovate and deliver outstanding service only if they tap the commitment, energy, and imagination of their employees. Value must therefore be created for those employees in order to motivate and enable them. Value for employees includes being treated respectfully and being involved in decision-making. Employees also value meaningful work; excellent compensation opportunities; and continued training and development. Creating value for investors means delivering consistently high returns on their capital. This generally requires both strong revenue growth and attractive profit margins. These, in turn, can be achieved only if a company delivers sustained value for customers.

ZERO-SUM VERSUS WIN/WIN THINKING

If the purpose of business is value creation, it follows that the mission of any company should be defined in terms of its primary value-adding activities. Simply put, Honda should think of itself primarily as a maker and marketer of quality automobiles. McDonald’s should think of itself as providing meals of consistent quality throughout the world in a clean, friendly atmosphere, etc.

While this may seem obvious, many managers and strategists behave as though the day-to-day business of a firm is irrelevant. Hence, an oil company might buy a hotel chain, while a national chain of auto-mobile service centers is caught systematically charging customers for unnecessary repairs. What conception of business lies behind these actions? Typically it is a very narrow definition of purpose “to maximize the wealth of the share-holders,” or to achieve a set of short-term financial goals.

Managers are expected to address shareholder wealth, earnings growth, and return on assets, but the most successful firms understand that those measures should not be the primary targets of strategic management. Achieving attractive financial performance is the reward for having aimed at (and hit) the real target; i.e., maximizing the value created for the primary constituents of the firm.

Paradoxically, it is when an organization thinks of itself as a financial engine whose purpose is to generate attractive financial returns that the company is least likely to maximize those returns in the long run. Often, finance people end up shuffling a portfolio of assets in a self-destructive quest for “growth businesses” or “superior returns,” with no real understanding of the value-creation dynamics of the businesses they are acquiring and selling. Or, as with the automotive service chain, attempts to profit with-out delivering superior value end in lost business, long-term customer alienation, and corporate disgrace.

Redefining an Organization’s Self Interest

Why do managers so often choose not to focus on value creation and instead make decisions that systematically decrease the long-term value of their businesses? One reason may be that their training and education lead them to define their organizations’ interests too narrowly. This narrow view is powerfully reinforced by financial accounting systems that were well adapted to the industrial economy, but are inadequate in the information economy. The accounting and finance conventions of the industrial age are good at valuing tangible assets, but they largely ignore the value of harder-to-quantify assets like employee satisfaction, learning, R&D effectiveness, customer loyalty, etc. In the information age, those intangible assets are far more important than the bricks and mortar that traditional accounting systems were designed to measure. If management defines the organization’s self-interest (and consequently its goals) too narrowly — for example, to maximize this year’s or this quarter’s reported earnings — it will view that interest as being at odds with the interests of customers and employees. Given that perspective, in the short term every dollar spent on employee training is a dollar of lost profit. Every additional dollar squeezed out of a customer, even if it comes at the cost of poor service or price gouging, improves this quarter’s results.

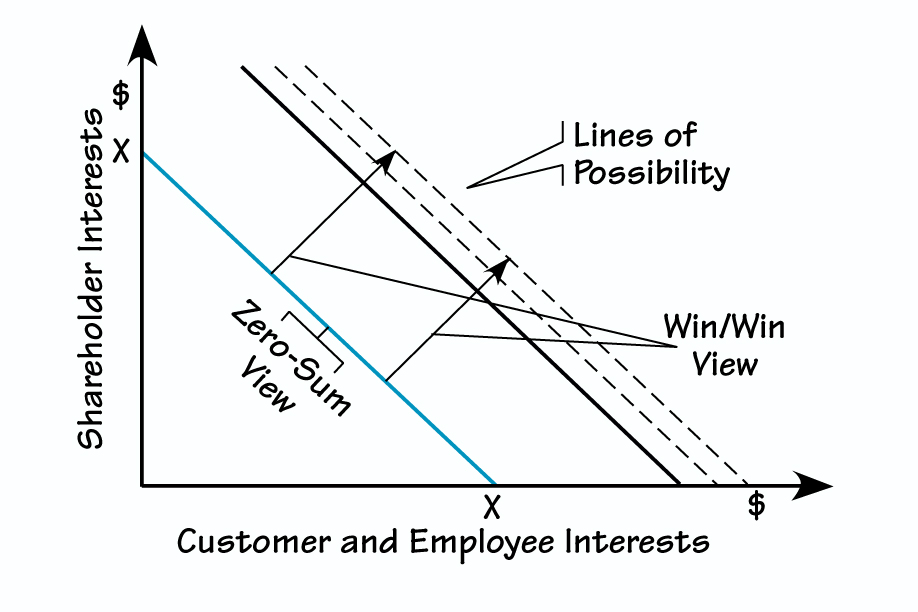

This approach is based on “win/lose” or “zero-sum” thinking: The underlying assumption is that there is a fixed pie of value to be divided up among customers, employees, and investors, so the interests of the three groups must be traded off against one another (see “Zero-Sum Versus Win/Win Thinking” on p. 1).

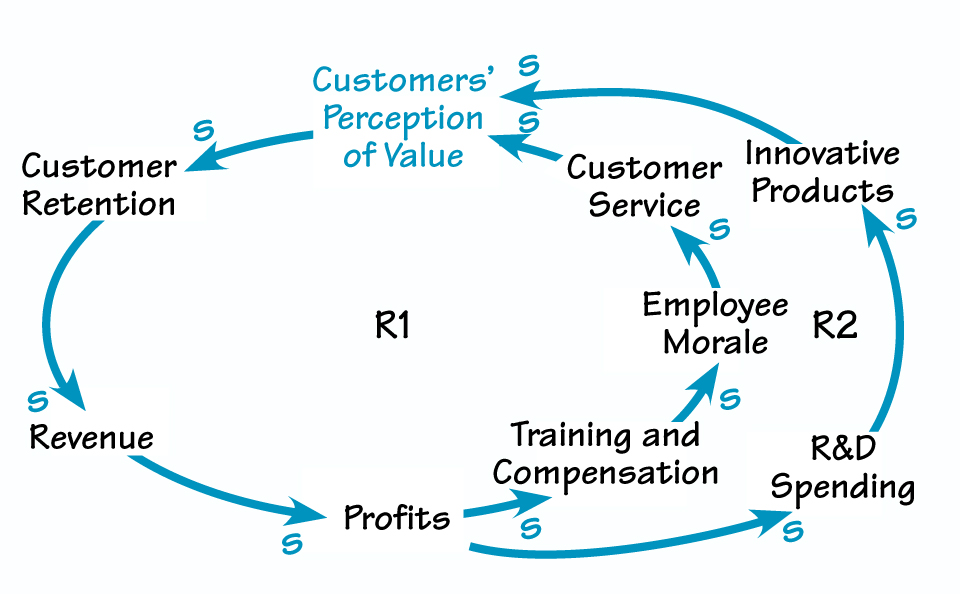

Companies that act on this myopic conception of self-interest may stumble into a downward spiral of poor decision-making that is difficult to reverse (see “When Customers Defect”). For example, as reduced employee training and compensation lead to low employee morale and poor performance, and as underfunded R&D allows a product line to age, customers can become dissatisfied and begin to defect. In situations where customers are “locked-in” owing to large investments in proprietary equipment or some other temporary monopoly effect, they may not defect immediately. Instead, they will become increasingly alienated and defect as soon as a technology shift, regulatory change, or competitive offering allows it. When customers finally do defect, profits shrink, tempting management to cut back even further on training, compensation, and R&D, thus accelerating the spiral of customer dissatisfaction and defection.

WHEN CUSTOMERS DEFECT

Expanding the Pie

Alternatively, if managers define their company’s interests broadly enough to include the interests of customers and employees, an equally powerful spiral of value creation can occur. Highly motivated, well-trained, properly rewarded employees deliver outstanding service, while effective R&D investments lead to products that enjoy a significant value-adding advantage and generate higher margins. Satisfied, loyal customers (and new customers responding to word-of-mouth referrals) drive revenue growth and profit ability for investors. Clearly, the undesirable reinforcing processes described in, “When Customers Defect” can work in reverse. This win/win scenario is illustrated in the figure “Zero-Sum Versus Win/Win Thinking.”

An “expanding the pie” approach to management requires that a company alter its thinking along several dimensions

Time horizons and perceived self-interest. The time horizon within which you evaluate a business decision dramatically influences your notion of self-interest. Considered at an instantaneous moment in time, virtually any transaction is a win/lose or zero-sum game. At the moment you spend a dollar on employee training, that dollar is in fact lost to the shareholder. Conversely, in a well-designed value-creation system, almost any transaction can become a win/win or positive-sum game, if it is managed within the context of an appropriately long time frame. For example, if a company’s rate of return on the dollar invested in employee training is 20 percent (in the form of higher productivity, increased sales effectiveness, etc.), then the shareholder hasn’t lost a dollar — he has gained a stream of future cash flows that represents an attractive return on investment.

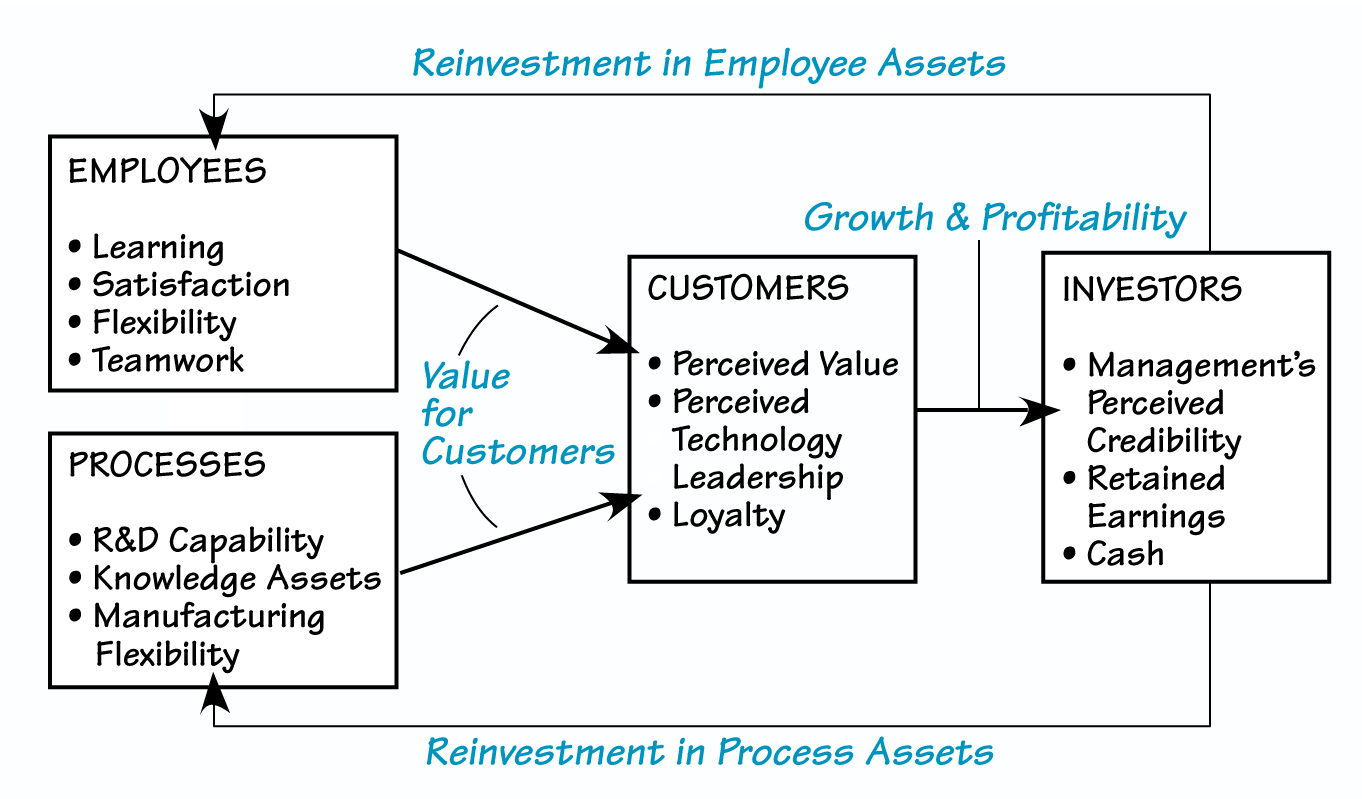

One way to build an understanding of these dynamics is to identify the key capabilities, resources, and relationships that are the basic ingredients of value creation for a particular firm, and to think of those ingredients as assets that either grow or diminish over time, depending upon how they are managed. It is useful to map a company’s key assets by building four “Strategic Balance Sheets” focused on customers, employees, processes, and investors (see “Balance Sheet Dynamics”). In building the balance sheets, managers must first decide which assets are the most important drivers of the company’s value-creation system. For example, employee learning and job satisfaction are two assets that could be tracked on the Employee Balance Sheet.

As managers identify the strategic assets that belong on the various balance sheets, they also must articulate the relationships among those assets. By tracing the dynamics through which customer, employee, and process assets accumulate, interact, and ultimately drive profitable growth, a company will be well on its way to managing the fundamentals of value creation and avoiding the pitfalls of managing by a set of narrow financial measures.

Expanding the pie between a company and its employees. In a true win/win dynamic, two or more parties aim first to create more total value, then concern themselves with distributional issues (who gets what share). When the parties focus first on dividing the “pie,” they are diverted from the innovative strategies that could have made everyone better off.

One way in which companies and employees can expand the pie is flexible work schedules. If an employee has the freedom to see to personal business (while completing all required work), the employee is better off, and the employer is likely to benefit from higher morale and the ability to attract and hold onto the best people.

A key element of win/win scenarios is that they are aimed more at creating opportunity than at minimizing costs. Outback Steakhouse has become a very successful, rapidly growing business by resisting the temptation to view a dollar of additional compensation to employees as a dollar of lost income to the shareholder. Outback has made its restaurant managers partners, attracting the best, most experienced people in the industry with a compensation system that more traditionally managed chains would view as ludicrously extravagant.

Outback’s general managers sign a five-year contract and invest $25,000 up front. In return, each manager receives 10 percent of her unit’s cash flow (earnings before interest, taxes, and depreciation) on top of a base salary of $45,000. In 1994, total manager compensation averaged $118,600. In addition, managers receive 4,000 shares of stock, which vest over the five-year contract period. All hourly employees participate in a stock ownership plan as well.

Another Outback innovation — not opening for lunch — generates benefits for investors, employees, and customers. Because they don’t compete for lunch business, restaurants can be located in less costly suburban locations instead of expensive business centers. The benefit to managers and employees is that they work only one shift per day. Outback also insists that managers work only five days per week to avoid burnout and high turnover. Finally, focusing on dinner allows the restaurants to maintain high levels of food quality

From its 1987 founding, Outback grew to 420 restaurants by the end of 1996 in a very crowded, competitive industry. Over the last five years, revenues have grown at a 55 percent annual rate, while earnings have increased 36.5 percent per year. For the year ending September 1997, Outback’s 20.9 percent return on equity placed it in the top 5 percent of restaurants (restaurant industry average ROE was 10.6 percent).

BALANCE SHEET DYNAMICS

Motivated, well-trained employees using state-of-the-art processes create outstanding customer value. Growth and profitability result, increasing investor wealth. Part of that wealth is reinvested in employees and processes, perpetuating a virtuous cycle. (Note: Each firm must identify its own strategic assets based on the company’s strategy, industry, environment, etc.)

The Outback story illustrates one of the key characteristics of successful win/win thinking: The company’s strategy is based on a systemic view of the entire value-creation process, and it seeks to align the key elements of that process. For example, if the restaurants were in higher rent locations, they might be more tempted to open at lunch to cover that cost. If managers worked longer hours, turnover would be higher and the partnership model that motivates those managers would be unworkable. If the quality of the food dropped, the number of meals from repeat customers would decrease, putting pressure on margins and tempting the owners to cut compensation to restore profits, etc.

Expanding the pie between a company and its customers. As markets become increasingly competitive and one industry after another is forced to deliver greater value in the form of lower prices, higher quality, or both, companies in those industries respond to the mounting pressure with one of two broad approaches. Many firms focus narrowly on cost-cutting measures, playing an intensified win/lose game with their suppliers (pressuring them for cost concessions) and their employees (squeezing them to work longer hours for the same compensation or to do their own jobs plus the jobs of their laid-off former colleagues). This approach can yield some short-term profit increases, but it is not sustainable. You can only squeeze so hard for so long.

A smaller number of forward thinking firms innovate their way out of this zero-sum dilemma. For example, instead of focusing on individual transactions, such as the cost of a particular product, these firms examine the entire value-creation chain associated with their products (and their customers’ use of those products) and devise ways to make the entire system more effective. This increase in effectiveness often creates enough new value that the buyer’s total costs can be significantly reduced while the supplier’s margins can be maintained or even increased.

One example of this kind of value-chain innovation is the Custom Sterile program of Allegiance, Inc., a leading healthcare cost management and product distribution company. Under the Custom Sterile program, all of the supplies needed for a particular surgical procedure are collected, packaged together, and sterilized in advance at an Allegiance facility. This helps hospitals to standardize and optimize their use of surgical supplies, and creates dramatic savings compared to the traditional process, in which expensive nursing labor locates the supplies from storage facilities within the hospital, collects them, and sterilizes them for each operation.

The innovation is also good for Allegiance. Instead of having their margins relentlessly squeezed in a series of transaction-focused, commodity sales, the company has created a relationship-focused, high-value-added offering that justifies higher margins. This is the best kind of win/win outcome: using innovation to create a value (and margin) umbrella from which all parties can benefit.

NEW ROLES FOR LEADERS

- Engage the whole system. Only participation can save you.

- Keep expanding the system. Ask “Who else should be involved?”

- Create abundant information and circulate it through existing and new channels (dedicated Web sites or intranets).

- Develop simple reporting systems that can generate information quickly and broadcast it easily.

- Develop quality relationships as a top priority. Trust is the greatest asset. • Support collaboration. Competition destroys capacity.

- Demolish boundaries and territories. Push for openness everywhere.

- Focus on creating new, streamlined systems. There is no going back.

Competition and Customer Value

Another fallacy that has cropped up in much of the literature on strategy is that the purpose of business is to beat the competition. There is no question that competition, like profit, is an important dimension that companies must be aware of and manage to successfully create value in the long run. For example, a company typically creates value for customers and superior returns for investors by producing goods or services that are better than their competitors’ at meeting a set of clearly defined needs for a specific set of customers. So competition is a key variable in determining whether a product or service provides a differentiated benefit to the customer, and one that she is willing to pay a premium for. However, competition should never divert management from the primary task of creating those benefits by understanding and anticipating target customers’ needs, excelling in product and process innovation, providing outstanding service, etc

Thus, we need to think of competition not as a goal, but as part of the business environment — a key element of the context in which a firm seeks to create value. What then become critical are the alternative responses to competition undertaken by different firms, some of which are more likely to succeed than others, given the nature of the business environment. In the emerging information economy, the most successful responses to competition focus on two areas: (1) innovation that drives down the cost of products and services while increasing their quality and variety, and (2) building a deeper understanding of changing customer needs within increasingly specific market segments. Responses that are rooted in a win/lose frame-work, such as taking share from existing competitors in a zero-sum game, gaining power over customers (for example, by locking them into a proprietary computer operating system), or seeking to become the low-cost producer without simultaneously driving for world-class quality, are extremely dangerous. Many of them pit the interest of the company against the interest of the customer — a prescription for customer alienation and long-term disaster.

The most fundamental weakness of those win/lose responses to competition is that they divert management from the more important engines of value creation in the information economy: innovation, imagination, cooperation, and knowledge. Management’s time, creativity, energy, and imagination are among the scarcest organizational resources. At the same time, they are by far the resources that yield the highest returns. So it is important to recognize that all of the time, energy, and imagination expended on win/lose activities entails a high (sometimes fatal) opportunity cost. Managers are more likely to stay focused on the higher return, win/win levers if they aim not to beat the competition, per se, but to create more value than the competition — in other words, if they seek to achieve a “value-adding advantage.” And by doing so, they are likely to be more successful than their competitors in the long run.

Successful Value-Creation Strategies

Real value creation and long-term growth and profitability occurs when companies develop a continuous stream of products and services that offer unique and compelling benefits to a chosen set of customers. This means that to maintain industry leadership, a company must establish a sustainable process of value creation.

When investors buy stock in Motorola, or when customers enter into a partnership with that company, they are not basing their relationships on a particular product or set of products. Rather, both constituencies are expressing their belief that Motorola will continue to develop processes that allow it to take advantage of emerging technologies and changing market needs to create useful, profitable products and services. That ability to develop resources and effectively match them with opportunities is the core of any well-run organization’s value to customers, and the basis of its valuation by shareholders. That value creation process is, in turn, built on the capabilities and motivation of the company’s employees.

Some of the major themes that underlie successful value creation strategies in the information economy are:

- Product and process innovation

- Detailed, real-time understanding of changing needs of well-defined customer segments (frequently database enabled)

- Leveraging emerging technologies in existing markets (particularly information technology)

- Leveraging technology or regulatory changes to create new markets • Reconfiguring company and industry value chains

- Creating win/win partnerships with customers, employees, and suppliers

Pragmatic Idealism and Value Creation

By its very nature, the traditional win/lose approach to business contains a fragmented view of the interests of customers, employees, and investors. For managers who hold that fragmented view, efforts to create more value for customers or to improve employees’ transferable skills and compensation seem idealistic at best, and at worst, a naive policy that is doomed to failure. But as we have seen, the exact opposite is true. If value-focused behavior is idealistic, then the most pragmatic way to manage a company is with idealism. Such pragmatic idealism rejects the fragmented conception of “us versus them,” and embraces an integrated, systems view of business that recognizes the interdependence of all players in the value-creation process. Here is a pair of principles for managing with this systems view of business:

- Think first about creating the most value, then think about capturing part of that value as profit.

- Think of the value of a product or service as being what the customer would pay for that product or service if he had perfect information, such as knowledge of the total life-cycle costs and benefits associated with the purchase.

A great irony hovers over managers who reject these two principles. Many managers who view themselves as the heroic guardians of shareholder interests — the no-nonsense, tough-as-nails guys who run their businesses by the numbers, who pride themselves on their hyper-competitiveness, and who think that “organizational culture” and “shared values” are irrelevant fantasies concocted by out-of-touch academics — may be inadvertently running their companies into the ground and systematically destroying the wealth of their investors.

Thus, an organization can take one of two broad approaches to doing business. It can embrace the idea of pragmatic idealism, challenging itself to create value for customers, employees, and shareholders in a positive, win/win cycle. Or it can pursue a more narrowly defined (and illusory) self-interest by attempting to exploit the lack of perfect information held by the firm’s constituencies or by taking advantage of other inefficiencies in the market that allow the company to temporarily benefit at the expense of other parties and the economy as a whole. The latter approach is increasingly unworkable, even in the short run, owing to the nature of the emerging information economy.

In an environment of accelerating change — in which long-term partnerships and joint ventures must be built on mutual trust, in which employees must be committed to provide superior service and drive ongoing innovation, in which customers have access to more and more information — a course of pragmatic idealism and value creation is not only possible, it is increasingly the only viable approach.

For references and further reading, please see Creating Value: Linking the Interests of Customers, Employees, and Investors (Pegasus Communications, 1998).

Paul O’Malley (pomalley@PaulOMalley.com) is the principal of Paul O’Malley Associates (Newton, MA).