Have you been out on the links lately? If so, you’re not alone. In many ways, golf as a sport seems to be experiencing a “golden age.” Witness the tremendous personal and professional popularity of Tiger Woods and the record number of viewers who watch the sport on TV. Pros are earning bigger prizes than ever, too, and the number of women players is reaching new highs. Finally, golf-equipment manufacturers are offering more “skill enhancement” equipment, such as clubs with lighter and bigger heads, than ever before – attracting unprecedented numbers of newcomers to the sport.

What does all this mean for the companies that support golf, particularly the manufacturers and wholesalers that develop golf equipment and accessories? Given the recent positive trends – along with other advantages such as broader distribution channels and use of inexpensive overseas labor – golf-equipment manufacturers should be posting record earnings (see “The Growth of Golf “).

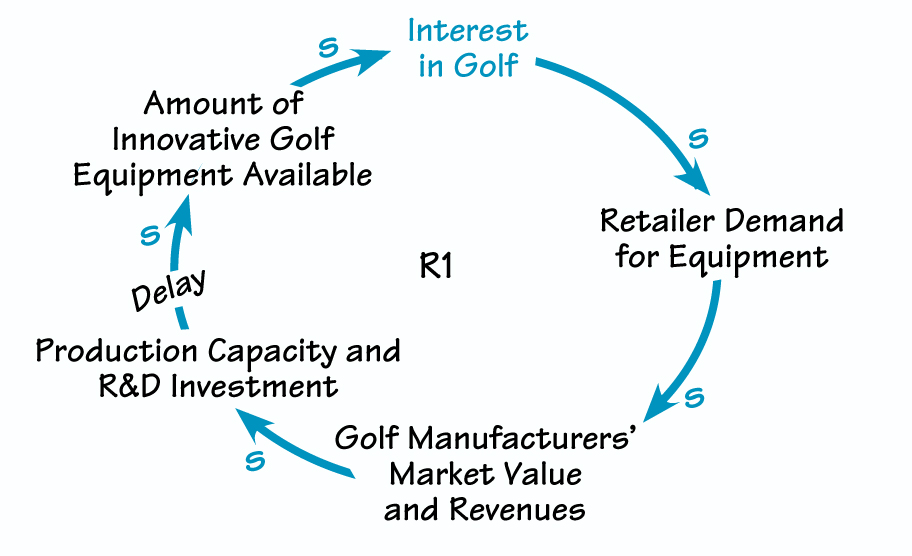

This figure shows the common mental model of how the golf business “growth engine” works. As interest in golf increases, retailer demand for golf equipment also rises. As the demand for equipment increases, the golf manufacturers who supply the products see an increase in their market value and revenues. Manufacturers are thus able to invest in R&D and production, and thereby deliver more innovative products to market. The increase in products enhanced by easy-to-use features and new, aesthetically pleasing designs then stimulates further interest in the game.

However, this model does not reflect the complete picture of the golf-industry marketplace. A quick financial “reality check” reveals a surprisingly different view. Let’s take a look at these “low-lights”:

- The world’s largest golf manufacturing company, Calloway Golf, lost 75 percent of its stock value from mid-1997 to late 1998. Calloway’s purchase of Odyssey Putter failed to bolster profit margins and revenue, and the company scheduled a staff reduction of 700 for the first quarter of 1999.

- Fortune Brands, owner of Titleist, Footjoy, and Cobra, has seen its stock-trading drop to near all-time lows. When Fortune purchased Cobra in 1997 for $700 million, observers gushed about a “third jewel in the crown.” Yet as with Calloway, the acquisition has not led to the expected boost in revenues.

- The industry has endured multiple mergers, and the new entities arising from this are struggling. For example, RAM merged with Tommy Armour to create a company called Tear Drop, whose stock price also lost more than 50 percent of its value from fall 1997 to fall 1998.

- Despite a $34 million capital infusion in July 1996, and assets totaling $30 million in July 1997, Lynx Golf, Inc. filed for Chapter 11 bankruptcy protection in July 1998.

What’s going on? If we analyze the situation from a systemic perspective, the forces behind the industry’s difficulties – and some insights into how these companies might recover – become markedly clear.

Questions for Reflection

- What could have caused market valuation to drop even though overall demand for golf equipment has been rising?

- Given the expanding customer base, we might expect demand for golf equipment to start rising exponentially. If equipment manufacturers wait until they’re certain that the unmet demand is “for real,” what might happen?

- If sales increase, how do the associated customer-service levels have to change if growth is to be sustained? As the customer base grows, the golf industry may become a commodity business. If this were to happen, what features would distinguish the various competitors?

- If production demands increase, how will management of internal staff need to change so as to attract and retain the best performers?

THE GROWTH OF GOLF

A Closer Look at the Golf-Equipment Business

To grasp why the golf-equipment industry is in trouble and spot possible leverage points for change, let’s take a closer look at the current system. One place to start is to explore how the golf industry’s plight might resemble a “Growth and Underinvestment” archetypal story (see “Underinvestment in the Golf Business”). Loop R1, as we saw above, represents the growth engine that is prompting the rise in retailer demand for golf equipment. Yet because most equipment manufacturers will wait until they’re sure that the unmet demand is “for real” before investing in R&D and production capacity, they fail to keep pace with the rise in demand. Even though some companies, in response to the jump in backlog, may hurry to boost production and R&D capacity (B3), these investments take time and money. The effects of any increase in capacity may not be felt for quite a while. In the meantime, backlogs have continued to worsen, frustrating customers and in turn reducing demand and eventually backlog (B2).

UNDERINVESTMENT IN THE GOLF BUSINESS

The tricky thing about this situation is that, when companies finally notice the eventual drop in demand and backlog, many of them respond by reducing investments in production capacity (and resorting to other cost-cutting measures, such as layoffs) at the exact moment when they should be boosting capacity. This dynamic can result in a steady downward slide for the company, as reductions in capacity prevent it from addressing the original source of backlog: the rise in demand.

What kinds of data would indicate that this dynamic is indeed happening in the golf industry? Check out these noteworthy trends:

- Product design and development. This function started out as a kind of cottage industry, featuring high levels of craftsmanship and tooling. Now, owing to recent technical advances, most golf clubs have very similar characteristics. And the associated product life cycle has shortened from three to four years to two to three years.

- Manufacturing and production. To decrease unit costs, a company has to produce large quantities of similar products. Therefore, forecasting accurate sales volumes becomes increasingly important. In addition, because most golf-equipment manufacturing is now performed overseas, product-development lead times have stretched to six to nine months. These factors have created delays in manufacturing and production. Last, with more production now automated, most golf clubs are no longer created by skilled artisans. Instead, different components are made by different companies, in different parts of the world, and the clubs are “assembled” by low-wage workers.

- Marketing and distribution. These functions have mandated payment of large sums of endorsement money to a few marquee players. In addition, the advancement of golf retail outlets has hurt “on-course” shop sales, blurring distribution channels. With the advent of the Internet, distribution channels are further “cannibalizing” each other.

- Order fulfillment and customer service. Product delivery times have deteriorated. Even though a set of golf clubs can be assembled in less than one day, orders for a customized set require six to eight weeks to deliver. And once standard club sets that are primarily sold in retail outlets are depleted, replenishment takes more than a month. Unfortunately, customer service staff are required to deliver the bad news about order-fulfillment delays to retail customers. The resulting strain leads to high turnover rates and low morale among customer service representatives. Last, internal information systems lack adequate tracking of orders, repair and warranty items, receivable balances, etc. – further eroding service quality.

Unintended Consequences and Financial Ramifications

How do the above conditions play out in the context of the “Growth and Underinvestment” systems archetype? The situation unfolds along these lines: As equipment manufacturers decide that backlogs are “for real,” many of them overproduce so as to compensate for the unmet demand. This effort requires manufacturing staff to work long hours. Once the inevitable drop in sales and corresponding build-up of inventory that are common to a “Growth and Underinvestment” situation begin, companies also heavily discount products to generate at least some revenue. This practice renders products obsolete and dampens prices even more.

As these unhappy events unfold, cash flow decreases, causing manufacturers to cut costs quickly, which usually translates into massive layoffs. Such cuts corrode morale even further, culminating in even lower levels of service quality. Also, any planned investments for research and development, production capacity, or staff training are all but eliminated, making it increasingly difficult for firms to rebound. Companies caught in this dynamic may find themselves struggling for their very survival.

Proposing a Systemic Makeover

As Barry Richmond has explained, many organizational problems stem from “straight-line thinking,” in which an emphasis on linear cause-and-effect on the part of the industry leaders themselves strangles the business (see “Closed-Loop Thinking,” V9N4). Straight-line thinking makes it difficult to see how our actions might actually be worsening our original problem through unintentional dynamic feedback.

To see how this works, notice how many of the unintended results in the discussion above compound each other. For example, mandating overtime to produce more golf clubs that later are left unsold eventually leads to layoffs of the production staff and “blow-out” sales. Unsold product “ages” and becomes obsolete, which in turn makes it hard to sell. Clearly, the failure of industry leaders to perceive these dynamic structures and to understand the role of delays is playing a major role in the industry’s declining profitability.

Now let’s contrast straight-line thinking with a more systemic perspective. In a “Growth and Under-investment” situation, companies respond to backlogs too slowly, creating new capacity just as frustrated customers abandon ship. Or, companies over-estimate how much capacity is needed because of the long backlog of orders. To avoid these traps, golf manufacturers should think first about how to invest to keep capacity ahead of demand, but without incurring too much risk. Rising demand is good, but companies need to keep in mind that it can spark a “Growth and Underinvestment” situation if demand exceeds capacity.

To sustain jumps in demand, companies need to provide an available product at an acceptable price, delivered in a timely manner. Manufacturers have to be able to respond quickly to fluctuations in sales volume and to the need for certain product changes. How can companies achieve this flexibility? One possibility is to redesign the entire golf club into interchangeable parts. For example, companies could design a steel shaft that fits more than one type of head, or a head that fits more than one type of shaft. Either design strategy would at least double the number of club combinations available from the same number of components. In this way, manufacturers could quickly satisfy shifts in preferences from the market.

Once a set of clubs is assembled, decomposing the club back into its original parts is costly. To leverage the investment in the component and allow for fast, flexible incorporation of component design improvements into the product line – manufacturers could avoid assembling components until they are ready to fulfill an actual order.

Clearly, this level of product customization would require a whole new information infrastructure. Detailed knowledge by salespeople about the golf-club component mix, and about what is and isn’t selling at what price, would be paramount. Real-time sales numbers and product-mix configurations would need to be available immediately to the manufacturing shop floor, which in turn would use the information to smooth out production-flow peaks and valleys. With an increase in information accuracy, quality of customer service would also improve. Also, any actions taken to address oscillations in the production flow would be much more timely. The manufacturer would be assembling only those products that had already been sold (in the case of customized sets of clubs), or that would soon be sold (to retail outlets).

These changes would help to align production flows with sales flows, thus addressing the inventory-backup problem that delay can cause in a “Growth and Underinvestment” situation. As a result, revenue streams might stabilize, which would allow for appropriate investments in staff development, production capacity, and product enhancements.

The Future of Golf

Golf, as a sport, has a long tradition of integrity and honor – a tradition that in turn depends heavily on the standards set in the golf industry. By taking a systemic view of how they operate, golf-equipment manufacturers have an opportunity to both support this vital, growing sport and pull themselves out of the sand trap in which they’re currently mired.

Dominic Bosque (dbosque@sonic.net) is a senior manager at CAST Management Consultants, a consulting firm that specializes in creating human, natural, and financial capital wealth through the application of system dynamics, computer simulation, and sustainability principles. Lauren Keller Johnson is publications editor at Pegasus Communications.