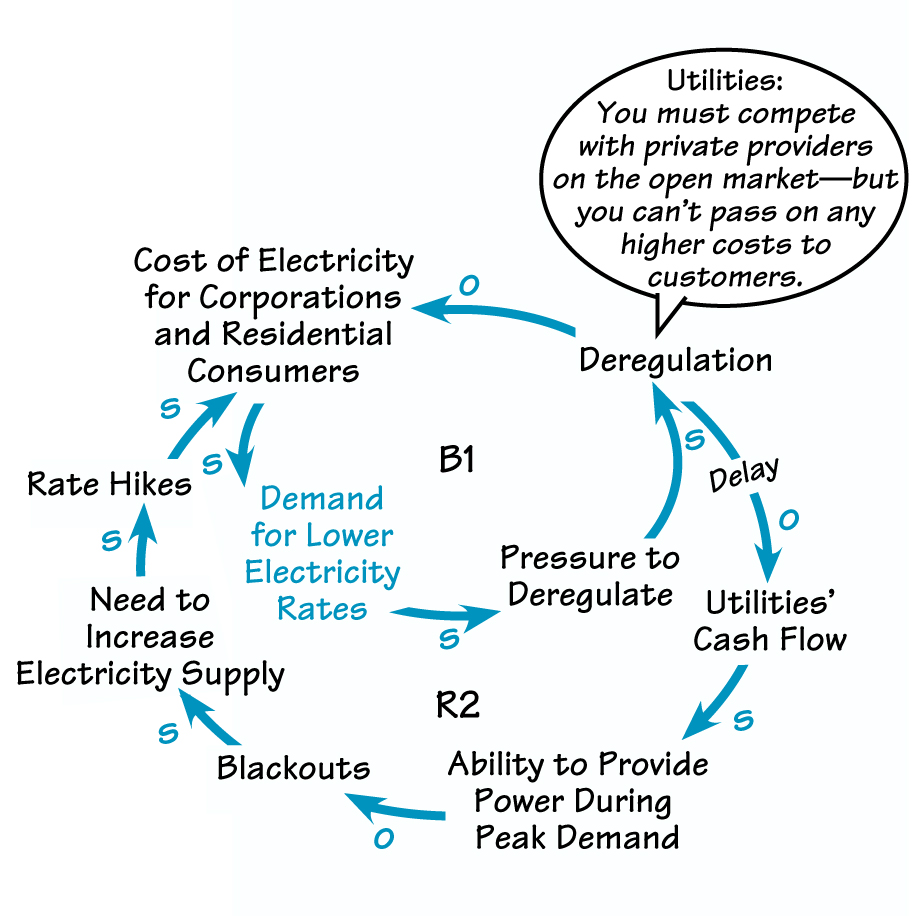

We’ve all heard the saying “Be careful about what you wish for; you just might get it.” In the case of the California power crunch, this pithy little phrase has particular meaning. Back in the early 1990s, Pete Wilson, California’s governor, decided to run for president. To woo California businesses—which were clamoring for cheaper electricity—he proposed a utilities deregulation plan that he had seen work in England (see B1 in “California’s Power Nightmare”). The plan won unanimous support in California’s senate, and Wilson signed it into law in 1996.

The deal looked like this:

- On the assumption that privatization would lower consumers’ electricity bills, the plan required California’s investor-owned utilities to sell some of their power-generating plants to other private companies and buy wholesale electric power on the open market.

- These same utilities couldn’t pass on any price increases to customers until at least March 31, 2002.

- Given the state’s tough environmental laws, California would not allow the building of any new power plants.

Deregulation Downers

Initially, results looked promising. The new market in wholesale power kicked in during April 1998. Cheap imported power gushed in from private energy suppliers in California and nearby states. Industrial users who had paid 7 cents a kilowatt now paid only 3 cents.

But everyone involved had forgotten two facts: (1) Energy prices can rise as well as fall, and (2) good times demand increased supplies. The California law didn’t include provisions for boosting capacity. As one observer said, the deregulation plan was “an accident waiting to happen.”

In summer 2000, that accident happened. Demand for power peaked as the weather turned especially hot and dry, and supplies decreased as the water reservoirs used by generators shrank. Prices skyrocketed.

The deregulation deal itself put the final fizzle on the situation. Because the utilities couldn’t pass higher costs on to their customers, their cash flow dried up. Banks avoided lending them money, and generators avoided selling them power. The strapped utilities couldn’t supply enough electricity to meet demand.

CALIFORNIA’S POWER NIGHTMARE

California’s utilities deregulation law lowered electrical costs for customers (B1). Because deregulation limited the utilities’ ability to pass cost increases on to consumers, over time, the utilities’ cash flow dried up. In response to the resulting black-outs, the state approved emergency rate hikes, leading to higher consumer costs (R2).

The solution? The state declared a “Stage 3” alert, which requires consumers to adopt strict energy-conservation measures and endure “rolling blackouts” (R2). The state also approved emergency rate hikes—ranging from 7 to 15 percent—to try to bail out California’s two largest utilities. In a recent move that would have made famed free-market author Ayn Rand shudder, a federal judge extended an order forcing an independent Texas power supplier to keep selling to California.

Lessons Learned?

As system dynamicist Donella Meadows explains, California—as well as the nearly two dozen additional states considering deregulation—can learn some things from this debacle:

- When restructuring an essential commodity, plan for the welfare of the whole system—not just the utilities or the big consumers.

- Rather than boosting supply, reduce demand (for example, through raising conservation awareness)—it’s cheaper and cleaner.

- Don’t try to control prices in just one part of the system—the impact affects all parts.

Kind of turns a lightbulb on over one’s head, doesn’t it?

Additional sources: “Electricity Restructuring and Faith in the Market” by Donella Meadows, The Daily News, January 21, 2001; “What Went Right?” by David Warsh, The Boston Globe, January 28, 2001.

Lauren Keller Johnson is a freelance writer and editor living in Lincoln, MA.