For more than 40 years, Barbie® has dominated the doll kingdom. Over a billion Barbie dolls (including relatives) have been sold since 1959, and Mattel currently sells 1.5 million dolls each week, in more than 140 countries.

But Barbie’s undisputed reign is under threat from a new family of would-be royalty—the Disney Princesses®. Snow White, Sleeping Beauty, Cinderella, and their friends have put aside their differences in a concerted attempt to win the hearts of three to seven-year-old girls. According to reports in the Economist (April 19th), total revenues of dolls and accessories have grown from $136 million in 2001 to $700 million last year, with hopes of over $1.3 billion for 2003. Sales of Princess dolls alone are running at 4 million units a year—a major incursion into Barbie’s 75 million.

In this article, we show how some of the tools of system dynamics can help us tackle important questions in business strategy by creating different scenarios of how the fashion doll market might develop over time and how Barbie might resist this attack on her supremacy. (Note that the figures shown in the diagrams below are meant to be illustrative of the process and do not reflect real business data.)

Because managers are expected to improve performance into the future, they need tools to help work out what to do, when, how much, and to generate what likely outcome. Such approaches must reliably use factual information and provide an integrated solution that takes into account all different aspects of the organization (that is, they don’t focus exclusively on marketing questions while ignoring implications for the supply chain). In addition, these tools must adapt continually to incorporate new and changing information, allow alternatives to be tested, and be easily explainable to anyone involved in the challenge—quite a tall order, but quite possible with system dynamics.

The exact story behind the battle makes a big difference to how both Barbie and the Princesses should react. Typically, consumer research tracks what people are doing, not the rate at which they are changing what they do. However, the reward for making the effort to discover consumers’ rates of change can be considerable: Understanding how the rates at which stocks of different groups of consumers are filling and emptying tells you where things are heading, not just where they are at any time. Thus, Barbie and her competitors would be well advised to develop advertising, promotion, pricing, and sales strategies that reflect the continually changing “flow rates” of children with different buying habits.

As you will see, Barbie’s battle gets pretty complex, but we can build up a clear picture of different future scenarios piece by piece. She has three battles to fight simultaneously:

- First, she must keep winning the hearts of the youngest children who are

- Second, she must keep the loyalty of existing owners and hope they do not relegate her to the cupboard to make room for those pesky Princesses; and

- Finally, Barbie must find a way to banish the Princesses from children’s bedrooms and playrooms so these characters won’t further threaten her status as “queen” of the doll market.

buying a fashion doll for the first time (or persuading their parents to do so!);

If Barbie (which we’ll use as a shorthand for Mattel, the company that owns her) does nothing, her dominant position could be eroded as these three battles go against her. So how should she use her limited resources? She only has so many sales and marketing people to defend her kingdom, only so much shelf space in stores where she can reach the children she’d like to make her loyal owners, and only so much cash to spend on advertising, promotion, and pricing. Let’s analyze some of the different scenarios that might take place as Disney ramps up its marketing of the Princess line of products and struggles to gain the hearts and minds of young consumers.

Losing New Owners

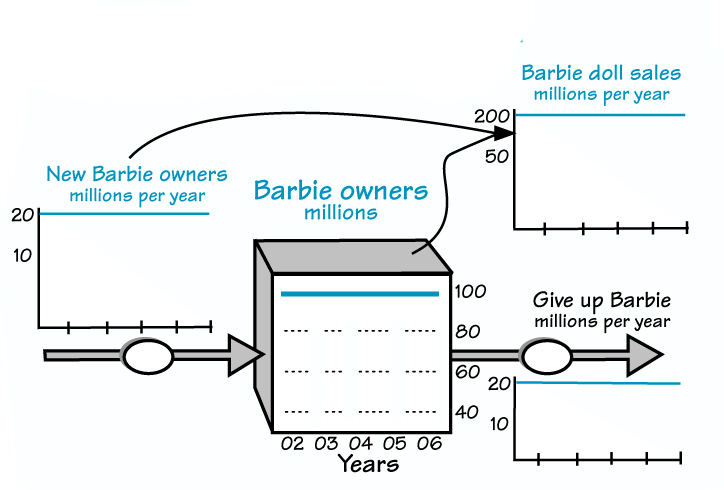

The first battle is for first-time doll owners. Let’s estimate that Barbie currently has some 100 million active owners. Before the appearance of the Princesses, the situation was relatively stable—we might guess that she was winning about 20 million new owners a year, but losing a similar number of older girls. Doll sales come from both first-time owners and from repeat purchase by girls who already own a Barbie.

BARBIE SALES BEFORE THE PRINCESSES’ INVASION

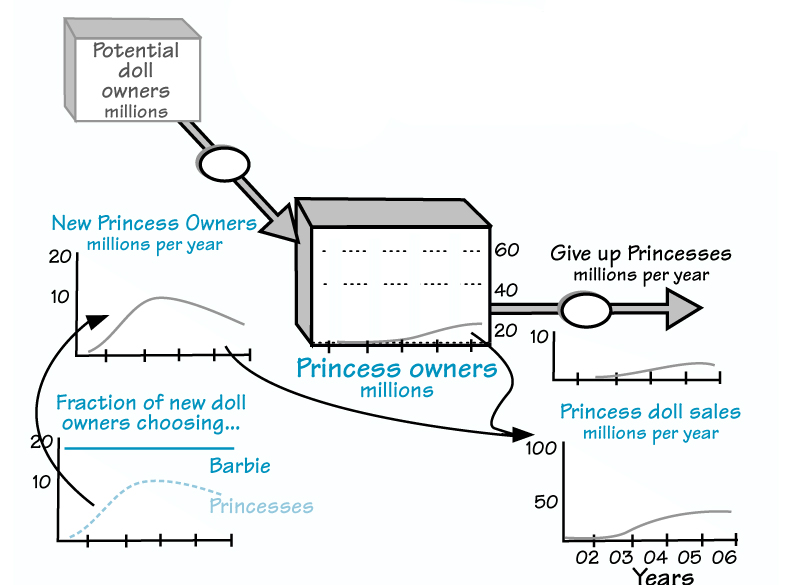

One scenario for this part of the Princesses’ incursion is that they quickly increase the fraction of little girls who choose them as their first doll, rather than Barbie. Later, though, the novelty wears off (Barbie hopes!), so after two or three years, the rate at which new children take Princesses into their hearts slows down. Even if this scenario comes to pass, the Princesses will have succeeded in taking sales that would otherwise be rightfully Barbie’s, without having to steal any of her existing loyal owners.

PRINCESSES CAPTURE AN INCREASING FRACTION owners millions OF NEW DOLL OWNERS

A couple of points to note:

- Girls are giving up owning Princesses only slowly in these early years, because relatively few have become old enough to tire of them.

- Sales of dolls reflect both first-time purchases and additional dolls bought by girls who already own one. With so many members of this extended royal family, these numbers could be even larger.

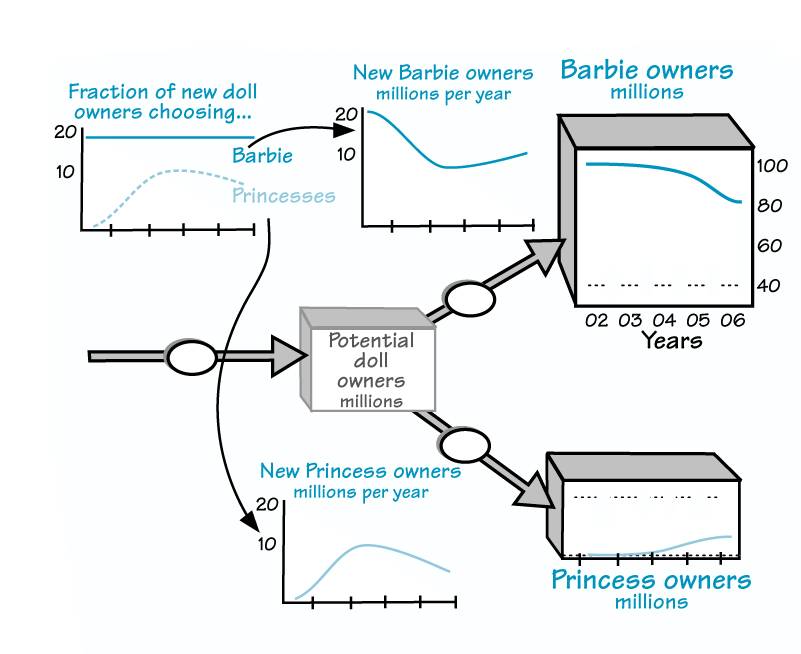

In this case, the number of Barbie’s loyal owners, then, would be cut by the same number as gained by the Princesses.

BARBIE’S LOSS OF NEW OWNERS TO THE PRINCESSES

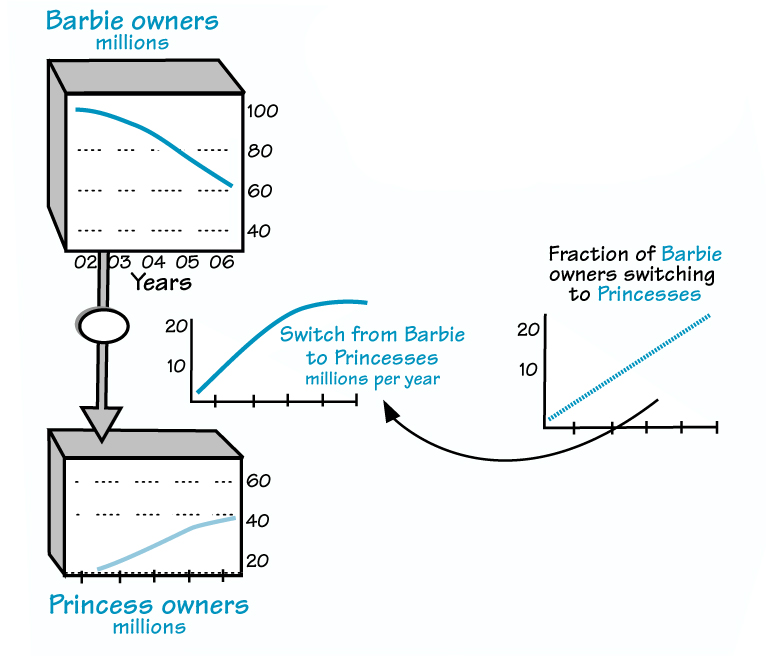

Losing Once Loyal Owners

Worse still for Barbie, though, would be if her existing owners were to start deserting her as well. Again, we don’t know how this trend might develop, but one scenario is that the fraction leaving her rises steadily through time.

We could speculate about all kinds of other scenarios; for example, Barbie could see a rapid early loss as the least loyal owners switch, followed by a slowdown as only her most loyal subjects remain.

Sharing the Kingdom

A RISING FRACTION OF BARBIE OWNERS SWITCH TO PRINCESSES

These are not the only dynamics of the Barbie-Princess battles that may develop over the coming years. Quite possibly, girls will want both Barbie and the Princesses (can you hear the sound of parents groaning?). In this case, the two doll companies will not only have to fight to win children and convert them to customers, but they also will be battling for the largest fraction of sales to this capricious group.

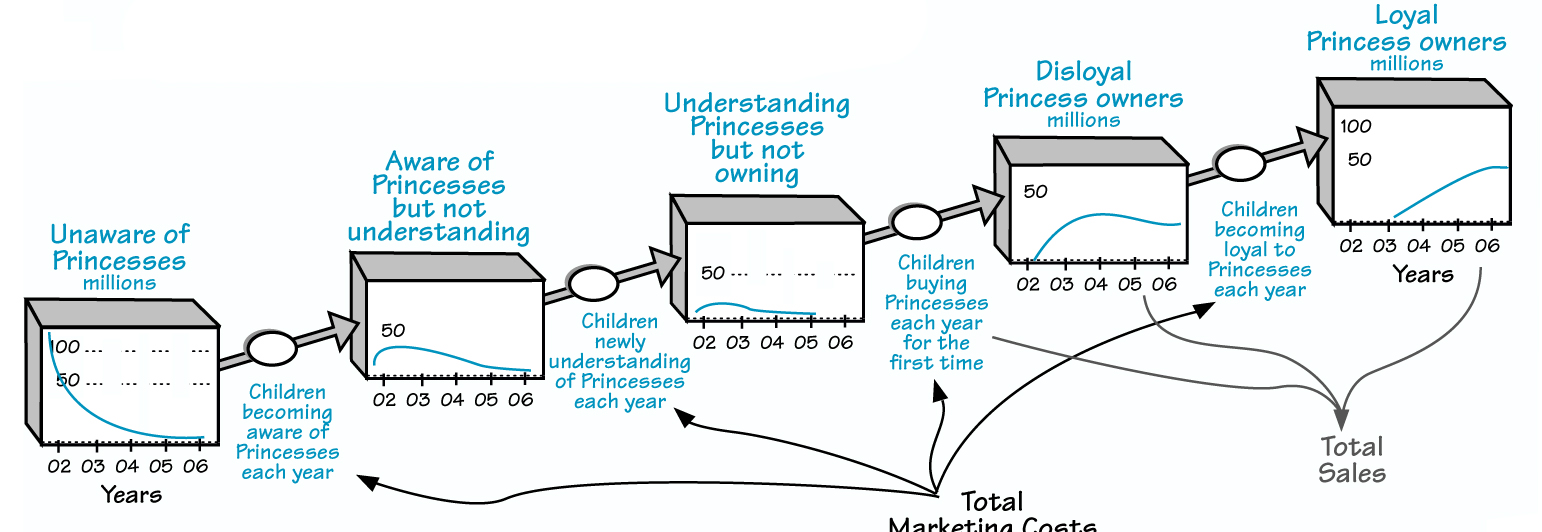

Children, like other customers, do not simply move overnight from being “not customers” to “customers”—they must travel through several stages as they choose which dolls to buy. Take the challenge facing the Princesses:

- First, small girls must be made aware of the Princesses’ existence.

- Next, Disney must explain what is special about these dolls—what exactly will a young child get from having them around?

- Only when these first two stages have been achieved will girls go to the next stage and actually ask their parents for a Princess doll.

- But these new owners are still a vulnerable group for the Princesses—they will only be reliable customers for the future if they can be persuaded to commit strongly to the Princesses alone and never consider switching to Barbie or sharing their favors. In short, the Princesses need loyal subjects!

THE CHOICE PIPELINE FOR PRINCESSES

This “choice pipeline” is a long, hard road, with no shortcuts. Pushing doll owners through the different stages will cost tens of millions in advertising, promotion, and distribution, and the Princesses will only enjoy actual sales from children in the last two groups. The end of this story is yet to be written!

The Royal Imperative

Barbie cannot yet fully know where her realm is most vulnerable. Given the questions about how successful the Princesses might be in capturing different shares of the market, she faces tough decisions about how much effort and expense to invest in the battle and on which fronts to fight. Should she focus those efforts on retaining her loyal subjects, on capturing the attention of the youngest first-time owners, or on boosting sales to those who already own her dolls? The different options are all exceedingly expensive, and all have very different implications for the path of her business empire.

What to do, how much, when, and with what likely outcomes are all complex decisions. System dynamics can provide answers to the questions that are simply not achievable by any other means. And, like many other market “rulers,” Barbie will need a high degree of secret intelligence and a clever understanding of this threat if she is to hold on to her crown in this battle royal.