Since the 1950s, accounting has increasingly become the “language” of business. The growing importance of accounting systems since that time has led to two unintended consequences: a tendency for organizations to define their purpose using accounting terms, and the tendency to define management’s job as achieving control over accounting-related results. These two developments have not only dehumanized organizational life, but in many large businesses they have also contributed to increased variation in bottom-line results.

Whenever a manager says something like, “Our goal is to make a profit,” he or she has just defined the organization’s purpose in accounting terms. Stating that profit is the goal of a business is like saying the purpose of life is breathing. Certainly people must breathe in order to stay alive, just as businesses must earn a profit in order to survive. But reducing life or business to such mundane necessities drains them of all human significance.

Unfortunately, since the 1950s large numbers of managers have done just that, defining their organizations’ purposes in terms of accounting results. This trend has also led to the use of accounting targets to control people’s work—a practice commonly referred to as “managing by results,” and one that was condemned by Dr. W. Edwards Deming as a surefire way to weaken a business system and to increase variation in performance.

Although recent advancements in accounting systems have improved our ability to measure results more accurately, they’ve done nothing to address the inherent shortcomings in the underlying philosophy. Activity-based cost management (ABC/ABM), business process reengineering, balanced score-cards, and other schemes for measuring vital signs all hold to the idea that business results are improved by manipulating independent quantitative targets. They define improvement as little more than moving faster on the same track—a view that would be appropriate if business were on the right track and we only needed to improve the status quo. Unfortunately, that is not the case (see “Tracing Accounting’s Influence since the 1950s” on p. 2).

The Accounting Worldview

Our current accounting practice is based on the Cartesian/Newtonian worldview, which originated in Western Europe in the late 15th century. Double entry bookkeeping and the systems of income and wealth measurement that have evolved from it are predicated on the belief that any result is the linear sum of infinitely divisible independent causes. It is not surprising, therefore, that 20th-century accounting depicts reality as though it were the summation of independent parts that interact with each other only through the influence of external forces. According to that system, the whole—defined as bottom-line results—is merely the linear sum of its parts. Therefore, a change in any part (cause) is automatically reflected as an equal, linear change in the whole (effect). For example, if profit equals revenue minus cost, then changing any cost by one unit presumably changes profit by the same amount.

The scientific community that gave us this mechanistic worldview has, of course, adopted a new position in the 20th century. Quantum physicists and evolutionary biologists now believe that reality is best described as a web of interconnected relationships that give rise to an evolving universe of objects that we perceive only partially with our limited senses.

TRACING ACCOUNTING’S INFLUENCE SINCE THE 1950S

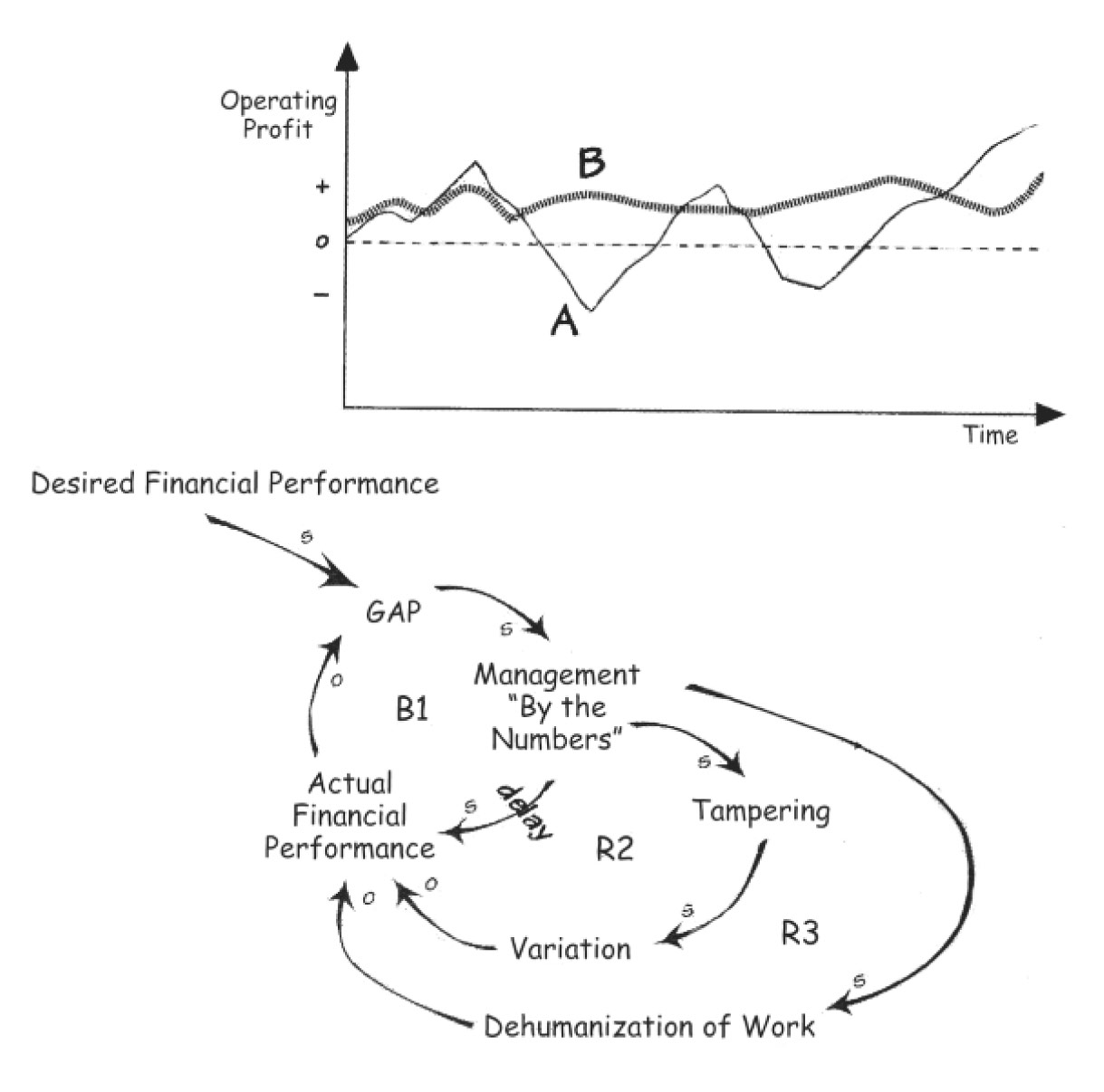

The behavior chart on the right shows two long-term trends: the performance of most companies over the past 40 years (A), and the performance trend that most companies would love to have, but few have been able to achieve (B). Clearly, B shows much less variation than A—and it probably reflects a higher average level of performance. But even if B’s average level of performance were somewhat lower than A’s, financial markets still might value B’s performance over A’s because of its smaller variation over time (less risk for a similar long-term return).

The pattern in track A seems to have become endemic in U.S. business after many companies (the A’s) began to focus strategically on accounting targets in the 1950s. Companies responded to a gap between their desired financial performance and the actual performance by focusing on accounting-driven management, which reduced the gap (loop B1). But it also created two important, yet unintended, side-effects. As managers increasingly used accounting to control results, they began tampering with fundamentals in order to bolster short-term performance. This tampering increased the variation of long-term results, which led to a decrease in financial performance (R2). In addition, the use of accounting-based management contributed to the dehumanization of work, which also eroded financial performance (R3).

Even though scientists no longer portray the universe as a giant clock, most executives operate as if organizations behave like machines. Mechanistic concepts such as “management by objective,” “managing by the numbers,” and “remote-control management” became even more prevalent in business after the 1950s—when large numbers of executives trained in accounting and finance rose to commanding positions in U.S. business. If our accountants and businesses were to adopt the new scientific worldview, they would probably begin to question their ability to describe organizational activity with a language that is based on the double-entry system of recording and measurement.

Accounting as Systemic Inquiry

It is tempting to consider what the last few decades of business would have been like if managers had viewed accounting as a tool that promotes inquiry about an organization’s purpose (see “Using Accounting to Promote Inquiry” on page 4). Managers with a more systemic perspective might have viewed the company’s purpose differently: to nurture their employees’ and suppliers’ capacity to serve customers. In such companies, profit—like breathing— would have been the natural condition of a healthy system, not an obsessive pursuit that drives the system to imbalance.

Two world-class companies that have adopted this view of accounting are the Swedish truck maker Scania and the auto maker Toyota. Both companies maintain excellent accounting systems, but neither sees management’s job as trying to control parts of the organization with accounting-driven targets. Instead, they focus their attention on the disciplined mastery of process or “pattern”—a source of meaning that undergirds and aligns all decisions and actions, like the underlying order that many evolutionary biologists and physicists see pervading the entire universe.

As a result of this different emphasis, both companies have enjoyed uninterrupted profitability, without layoffs, since at least 1960—a record unmatched by any competitor. Moreover, each company is generally acknowledged in its respective industry as the lowest cost producer of the highest quality products. But underlying each company’s high performance is a remarkable capacity to focus everyone’s attention on mastering a deeply shared pattern—at Scania, in product design, and at Toyota, in operations management.

Scania and Toyota

Scania is the world’s fifth-largest maker of heavy-duty trucks (U.S. Class 8). Based in Sweden for over 100 years, the company now generates over 95 percent of its revenue outside of Sweden—primarily in Western Europe, South America, and Asia. It is the only heavy truck maker that has chosen to grow from within, organically, rather than by mergers or diversification. Scania has never believed in financial “synergies” of acquisition, an attitude that has been vindicated by the recent financial setbacks suffered by Scania’s European competitors as a result of mergers. In contrast, Scania has focused its growth exclusively on the highly integrated production of custom-made heavy trucks, including manufacture of all critical components such as engines, gearboxes, axle assemblies, frames, and cabs.

The key to Scania’s high performance is a modular product design strategy begun in the late 1950s and put into full production by 1980. The goal of this system is to transcend the trade-off between meeting individual customer demands and achieving satisfactory profitability. Scania has been able to achieve both goals simultaneously by adhering to a modular design pattern that delivers “rich ends from simple means.” By enabling standardization and interchangeability of parts, they meet the widest possible customer requests with the least number of components. Designers can thus create a diverse array of products by varying only those features that affect the final result. For example, among the thousands of variants in cabs that appear on Scania trucks, there is only one windshield, one driver’s compartment and only three different door shapes.

Thanks in large part to this strategy, Scania has consistently generated far more profit than any of its competitors. For example, Volvo, Scania’s closest competitor in Europe, sold approximately the same number of vehicles in the 1980s but required about twice as many parts—so Scania earned about 1 billion Swedish kroner (approximately $140 million) more in operating income per year.

It is worth noting that Scania does not drive managers to meet cost targets by reducing their part number count. Many companies that employ ABC systems today view part number count as a “cost driver,” and they use it as a weapon to control design decisions. However, this approach merely tells managers what to do—it does not trigger inquiry into the best means for achieving the desired result. It is not surprising that managers focus on short-term “quick fixes” to satisfy accounting-based targets, rather than on long-term mastery of a robust discipline such as modular product design. As Scania’s history shows, achieving the lowest overall cost does not necessarily result from focusing people’s attention on cutting costs of individual parts.

Toyota, like Scania, set out over 30 years ago to bridge the apparent trade-off between meeting individual customer demands and achieving satisfactory company profitability. However, unlike Scania’s focus on product design, Toyota focused its attention on mastering a disciplined pattern of work that is known as the Toyota Production System (TPS). TPS has enabled Toyota to produce greater varieties of higher quality cars at lower cost than any other auto maker in the world. Using this system, Toyota has become the world benchmark for low cost—yet it does not use cost information to drive managers or workers. In fact, Toyota financial executives say that their company has never had, nor intends to have, a standard cost accounting system.

If our accountants and businesses were to adopt the new scientific worldview, they would probably begin to question their ability to describe organizational activity with a language that is based on the double-entry system of recording and measurement.

This is not to say that Toyota is not concerned about costs. The central message of the TPS has always been to identify and eliminate waste—whether in the form of time, resources, space, energy, human potential, or customer dissatisfaction. But Toyota’s strategy for eliminating waste—and reducing cost—is to instill in everyone in the organization (including suppliers) a deep dedication to mastering a disciplined approach to work.

A key principle underlying the TPS is the need to make visible to workers what is normal and what is abnormal in any work they do. That way a worker can stop and correct an abnormal situation the moment it occurs, and can take measures to prevent it from happening again. For example, on the production line, Toyota workers perform repetitive work according to a standard rhythm (called “takt time”) that dictates the rate at which product flows into final demand. Thus, if all work stations along the line are paced to work in 60-second cycles, then autos flow off an assembly line at the rate of 60 per hour. During the course of a day, workers rotate among three or four different stations in order to avoid monotony and to balance ergonomic requirements. But in any station the worker will perform exactly the same steps, the same way, in order to assure quality and safety. If something is abnormal, a worker sees it immediately and can stop the line to correct it.

Never are Toyota managers encouraged to “speed up” the line in order to achieve cost targets. If output falls behind schedule because workers have had to stop the line, the plant makes up the difference by going into overtime, not by changing the rhythm of work. Speeding up the line defeats the whole purpose of attaining a standard rhythm that will preserve quality and safety. This policy clearly enables Toyota to continuously improve its ability to produce exactly what customers want, precisely when they want it, at the lowest possible cost.

A New Vision for Accounting

The Scania and Toyota cases reveal what is possible when accounting is used in the service of an overall systemic approach to business. Both companies steadfastly define their purpose in terms of a holistic pattern that transcends financial results in order to assure both customer satisfaction and company survival. Functioning as a part of the larger system, every person and unit of the organization derives meaning from the organizational strategy. In a quantum sense, the whole in both companies is not defined by its parts; the parts derive their meaning from the whole.

Instead of rushing to intervene every time results fall short of a desired financial target, managers in Scania and Toyota trust that satisfactory results will occur if everyone continues to pursue mastery of their special customer-focused discipline. It is as though they believe the result is already there and that their job is to master the pattern that brings forth that result. This is a deeply quantum and systemic attitude that brings to mind Henry Miller’s saying: “The world is not to be put in order, the world is order incarnate. It is for us to put ourselves in unison with this order.”

USING ACCOUNTING TO PROMOTE INQUIRY

Here are some tips for how to use accounting as a tool to promote systemic inquiry:

- Resist the temptation to tamper. Use accounting to measure results, but not to drive the work that produces results.

- Help everyone in the company understand that profits (and cash flow!) are needed for corporate survival, but that they are not the raison d’être of business.

- Engage everyone in the search for a strategic focus that transcends accounting targets.

- Using the new strategic focus, define a basic “pattern” that underlies and connects relationships within your organization. For example, at Scania the phrase “rich ends from simple means” defines a fundamental underlying pattern.

- Look for the presence or absence of that pattern in all parts of the business. Explore ways in which existing uses of accounting information impede or enhance the pattern.

- Find ways to track measures of systemic well-being, as opposed to measures that control results. For example, Toyota’s plants track scrap rates and overtime, but they do not track costs of output.

- Consider ways in which accounting-based assumptions might be constraining management thinking in the company. For example, do people automatically favor “scale economy” solutions because they believe those produce the lowest costs? Or must every decision pass the “cost justification” test in order to be taken seriously?

- Explore ways to recognize and record the appreciation of intellectual capital in the company (not just the depreciation of assets).

Before managers attempt to go further in making accounting a positive force for systemic inquiry, they must first understand the place of variation in nature. A useful place to begin this journey would be to master the discipline of managing variation, as Toyota has done. At Toyota, this process began over 40 years ago, with their work on managing variation through statistical process control (SPC). Today, Toyota’s mastery of the concept has reached the point where virtually all processes are maintained in control without the explicit use of SPC. But Toyota reached this point only after years of disciplined attention to setting standards, mastering those standards, and developing fail-safe processes.

It is clear that we need to create new accounting systems for the 21st century—approaches that are compatible with organizational learning. Whatever those new forms may be, they will not preclude accounting’s important role as the primary source of after-the-fact results measurement. Even though life is not about breathing, it is still important to measure respiration rates from time to time.

However, accounting must go beyond providing measurements of results. By providing a means for exploring the assumptions and worldview that drive behavior in an organization, accounting can serve the larger organizational purpose of promoting inquiry into the relationships and patterns that give rise to the results we see.

H. Thomas Johnson is the Retzlaff Chair in Quality Management at Portland State University’s School of Business Administration (Portland, OR).

This story was co-presented with Anders Bröms at the 1995 Systems Thinking in Action™ Conference. The story about Scania was developed jointly with Anders Bröms and his colleagues at SAM Samarbetande Konsulter AB in Stockholm, Sweden.