Ford and some other companies that have pushed (car) leasing hard ‘are making money hand over fist right now,’ says Randall McCathren, whose company, Bank Lease Consultants Inc., tracks industry trends. Yet some analysts and auto executives worry that the leasing business could make a dramatic U-turn and become a money-loser in two or three years. That’s an immediate concern, because the aggressive lease deals being written today could undermine profits several years down the road. By 1997, most analysts agree, the ever cyclical auto market will likely head south again — maybe sooner, if the Federal Reserve keeps hiking interest rates…. Moreover, these good-quality used cars may undermine new-car sales, thereby magnifying the downturn ” (“A High-Stakes Spin of the Wheel,” Business Week, December 19, 1995).

• • •

In the highly competitive auto industry, car manufacturers are under continual pressure to create more attractive deals. The most recent trend is to offer cut-rate leases on new cars, which helps in the short term by pumping up unit sales and total revenues. The long-term side-effects of cut-rate leases, however, are slowly beginning to emerge.

One problem facing many car manufacturers concerns the “residual values” of the leased cars. Residual values — the car’s anticipated wholesale value at the end of the lease — are set when a company writes a new lease. The process itself presents no inherent problems to the carmaker’s bottom line, as long as the actual market value of the car equals its anticipated residual value at the end of the lease. Unfortunately, the actual market price is falling short of expectations — which means losses for carmakers when it comes time to sell the previously leased cars. One example cited by Business Week is Nissan Motor Co.’s Infinity luxury brand. It “set an unrealistically high three-year residual on its Q45 model in the early ’90s. Last year, when the cars began coming off lease, Infinity had to sell them at losses ranging from $5,000 to $7,000 apiece, according to some analysts.”

In addition, according to Business Week, residual values are currently at an all-time high and may be poised to fall. This means that car manufacturers and independent lease companies may be facing tremendous losses as their cars come off lease.

Leases That Fail?

The struggles around residual values suggest that the car companies are caught in a “Fixes That Fail” structure. In “Fixes That Fail,” a problem symptom cries out for resolution. To alleviate it, a solution is quickly implemented that alleviates the symptom in the short term. Over the long term, however, the unintended consequences of the “fix” exacerbate the problem symptom and actually make the situation worse.

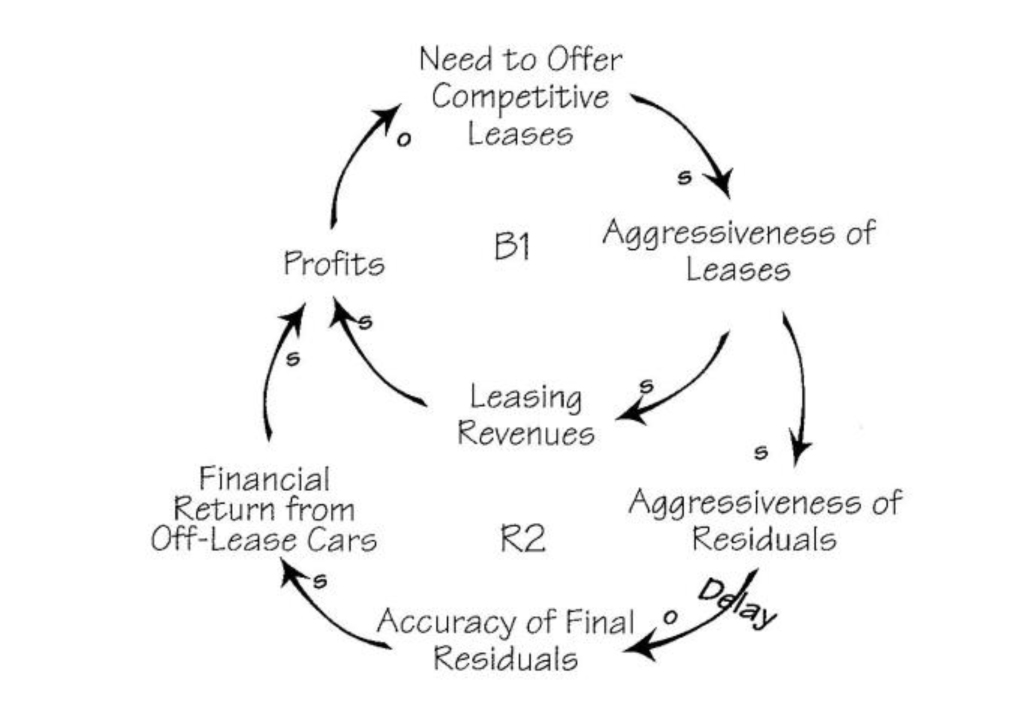

Leases That Fail

in order to remain competitive, car companies are establishing aggressive leases to attract more customers (B I ). Although these leases Increase revenues and profits In the short term. losses from aggressive residuals may undermine profitability and put further pressure on the companies to offer aggressive leases (R2).

In order to stay competitive, car companies are establishing aggressive leases to attract more customers (B1 in “Leases That Fail”), which increases revenues and profits in the short term. Losses from these aggressive residuals may undermine future profitability.

According to the Automotive I. Guide (ALG), which helps the industry set residual values, the average 1995 model car or truck will retain 57% of its sticker price two years from now. This figure is the highest since 1986 — and according to Business Week, ALG publisher Doug Aiken has been warning the car firms not to “get too far out on a limb with residual values.” This warning has not kept automakers from set-ting their residuals higher than those recommended by ALG in order to at-tract customers. For example, Business Week cited one independent auto lease company that estimated that the Honda Civic would be valued at 75% of its sticker price two years from now, compared with ALG’s estimate of 61%. As the aggressiveness of residual values increases, the likelihood of their accuracy decreases, which means lower profits in the long run (R2).

Second-Order Consequences

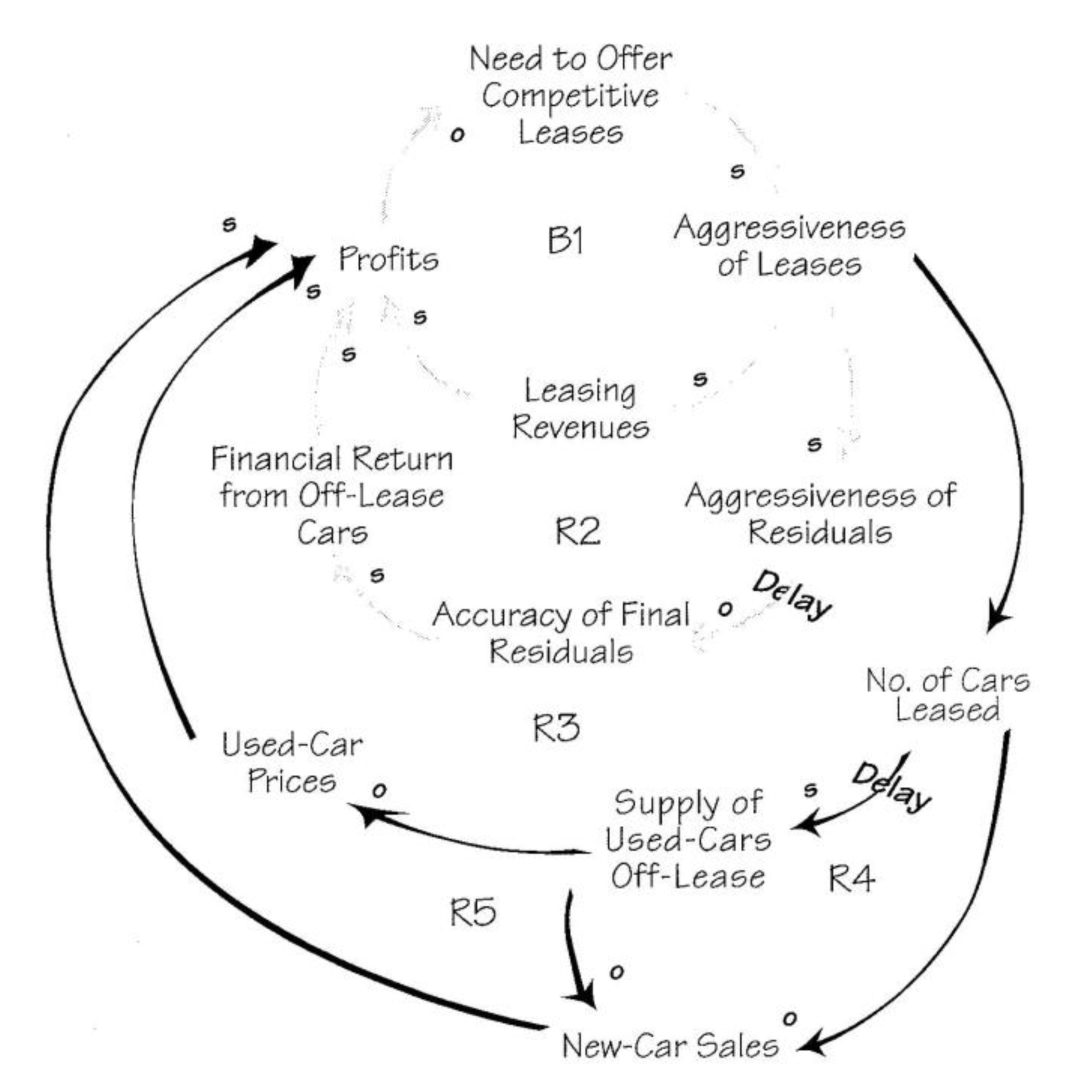

In addition to the residual values issue, the success of the leasing agreements may create problems for car companies further down the road. The key to profitability in car leasing lies in the market for used cars. As the leases become more aggressive and the offers more appealing, however, more people will respond to the leasing deals, increasing the total numbers of cars leased, and, after a delay, the resulting supply of used cars (see “Supply of Used Cars”). According to CNW Marketing/Research, when the expected downturn in the auto market comes, “The automakers will face an unprecedented situation: A record 2.7 million cars and light trucks will be coming off lease, up from 490,000 in 1993.” This increase in supply could dramatically affect used-car prices, and, over the long-term, the car companies’ profitability (R3).

In addition, as the numbers of cars leased increases, new-car sales can only decrease, further affecting car manufacturers’ profitability (R4). New-car sales are further depressed by the swelling supply of used cars (R5), and the fall in used-car prices due to expanding supply can also dampen new-car sales.

Supply of Used Cars

As more people respond to aggressive leasing deals, the total numbers of cars leased will increase, and, after a delay, the resulting sup-ply of used cars. This Increase In supply could dramatically affect used-car prices, and, over the long-term, the car companies’ profitability (R3). In addition, as the number of leased cars increases. New car sales can only decrease, further affecting the profitability of the car manufacturers (R4). New-car sales are further depressed by the swelling supply of used cars (R5) and the fall in used-car prices due to expanding supply can also dampen new-car sales.

Toward More Fundamental Solutions

To successfully manage a “Fixes That Fail” dynamic, we must rust acknowledge that the fix is merely alleviating a symptom. Then we must commit to solving the real problem now. That often means continuing to apply the fix while simultaneously working out a plan for a more fundamental solution.

For the car companies, this may mean continuing to offer aggressive lease deals to remain competitive in the short term while addressing the deeper underlying issues around product attractiveness and profitability. The car companies must also address the current situation of falling residual values and the impending glut of used cars. Some companies, for example, are working on exporting a portion of their used-car supply to create a new demand for them overseas. Others are developing programs to lease the used cars — or at the very least, reconditioning and adding extended warranties to enhance the sales of off-lease cars.

Despite those strategies, Business Week maintains that “the used-car market is probably too vast for individual companies to influence.” Given the additional complexity of this market, the decision to go so heavily into the leasing business may have far too many negatives in the long run to make it a worthwhile strategy. Car companies may want to reconsider their leasing programs in the context of the larger systemic consequences and see if there may be more effective ways to increase sales and profitability.

Kellie T. Wardman is publications director at Pegasus Communications and an editor of The Systems Thinker.